The Mega Backdoor Roth is a strategy that could allow you to contribute an extra $37,000 to your Roth IRA every year!

Before we dive into the details, some background info is required first…

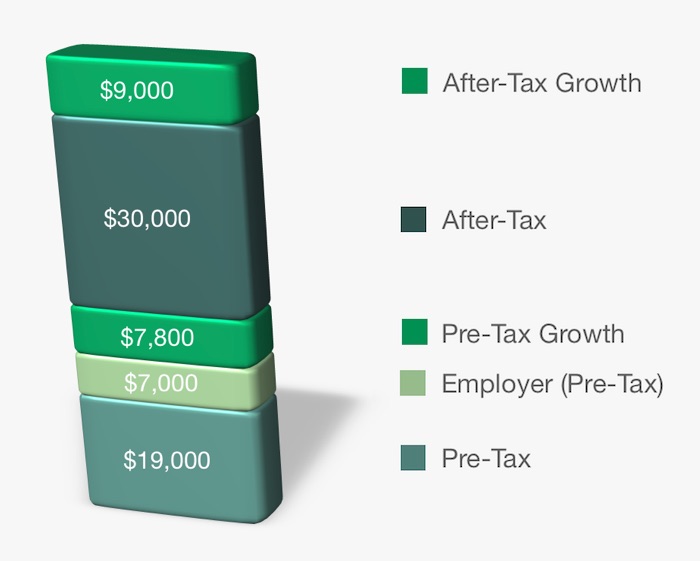

When contributing to a 401(k), there are three different types of contributions that you can make:

Pre-Tax Contributions

For a normal 401(k), the amount that automatically gets contributed from your paycheck is a pre-tax contribution.

Pre-tax contributions are tax-free going in and they grow tax free but you have to pay tax on the money when you withdraw it.

The limit on the amount of pre-tax 401(k) contributions you can make in 2019 is $19,000.

Note: If your employer matches a portion of your contributions, these employer contributions are also pre-tax but they do not affect the $19,000 annual personal limit.

If you plan to retire early, it makes sense to take advantage of as many pre-tax contributions as you can (click here to learn why).

Roth Contributions

If you have a Roth 401(k) instead, the contributions you make are considered Roth contributions.

Roth contributions are made with after-tax money (i.e. you paid tax on the money before putting it into the Roth) but the contributions are allowed to grow tax free and all principal and earnings can be withdrawn tax free when you reach standard retirement age.

After-Tax Contributions

The least-known type of contribution you can make is an after-tax contribution.

After-tax contributions are made with money you’ve already paid tax on (like Roth contributions) and can grow tax-free but the growth will be taxed upon withdrawal.

Depending on how much your employer contributes to your retirement account, you could potentially contribute up to $37,000 extra into your 401(k) every year with after-tax contributions.

The total 401(k) contribution limit for 2019 is $56,000 so to figure out how much in after-tax contributions you could make, simply subtract your personal pre-tax/Roth contributions and your employer contributions from $56,000.

For example, if someone maxes out their 401(k) in 2019 and their employer contributes $7,000, their after-tax contribution limit would be $56,000 – $19,000 – $7,000 = $30,000.

Now that we’ve established the type of contributions you can make to your 401(k), you may be wondering what this has to do with the Mega Backdoor Roth IRA strategy?

Let’s dive in…

Moving Money from Your 401(k) to Your IRA

The IRS has stated that when transferring money from you 401(k) into your IRAs, you are able to divert the pre-tax portion of your 401(k) (and all the investment growth) to your Traditional IRA and the after-tax portion to your Roth IRA, without paying any tax.

This is a big deal for people who can make in-service distributions (i.e. 401(k)-to-IRA transfers while still employed) or those of us who plan to leave our full-time employer soon because this allows us to dramatically boost our Roth IRA contributions!

Suboptimal Example

Assume that you read my article on front-loading and on January 1st, 2019 you decide to max out your pre-tax 401(k) contributions, you convince your employer to contribute $7,000 immediately, and you max out your after-tax contributions as well.

Here’s what your 401(k) would look like on January 1st:

Next, assume you just leave it there and when you eventually leave your job, you find that the market has increased your 401(k) balance by 30%!

Here’s what your 401(k) would look like:

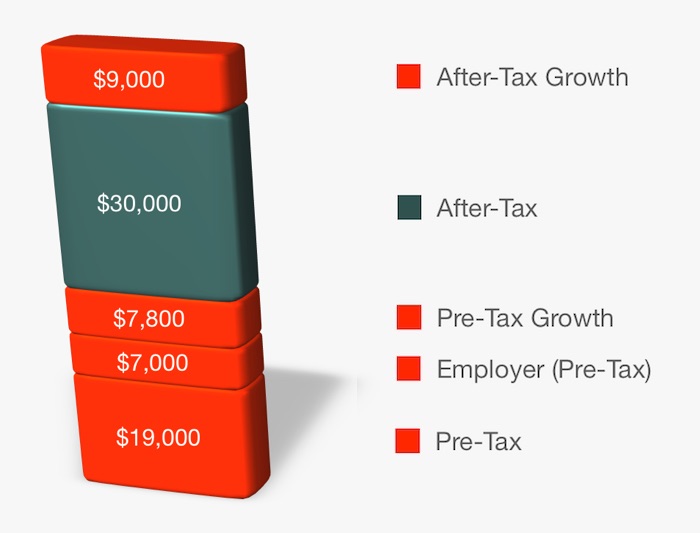

Since all pre-tax contributions and all growth within the 401(k) will be taxed, here’s the money that would be subject to tax once you decide to tap into the account:

As you can see, you don’t really have tax-free gains on the after-tax contributions, you have tax-deferred gains instead (because you eventually have to pay tax on the money).

Let’s take a look at a better way to handle after-tax contributions…

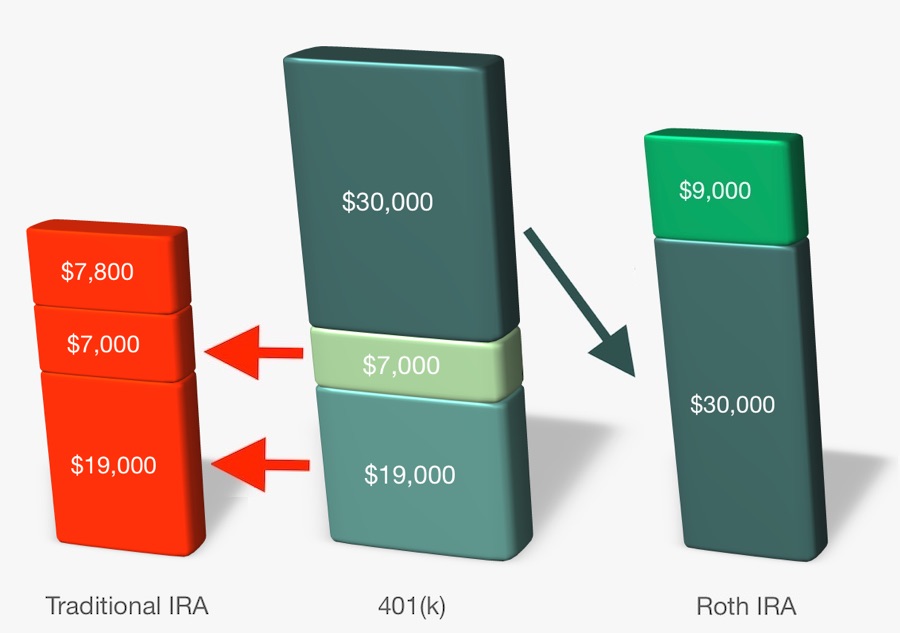

Mega Backdoor Roth Example

Assume the same scenario but rather than leave everything in the 401(k) to grow, you instead immediately rollover your entire balance to two separate IRAs using an in-service withdrawal on January 1st, 2019.

According to the IRS guidance, the pre-tax contributions can go directly into a Traditional IRA and the after-tax contributions can go directly into a Roth IRA.

Here’s what your two IRA accounts would look like when you finally decide to take your money out:

You can see that the $9,000 of gains on the after-tax contributions that would have been taxed in the suboptimal scenario are now protected in the Roth IRA and will be tax free whenever you decide to withdraw the money!

Conclusion

If you are already maxing out your pre-tax 401(k) contributions (see this post for why I believe pre-tax contributions are better than Roth contributions for early retirees) and are also maxing out your IRA, you should check with your 401(k) custodian to see if you can start making after-tax contributions as well.

After-tax 401(k) contributions could allow you to contribute up to $37,000 extra to your Roth IRA every year (in addition to the normal $6,000 IRA contribution limit for 2019).

If you are able to perform in-service withdrawals, you can minimize the amount of growth that takes place before the conversion, which will shield even more of your money from taxes!

What do you think? Do you have the ability to make after-tax contributions? How about in-service withdrawals? Are you going to take advantage of this strategy?

Great write-up, MF. One additional and important point is that the new guidance also clarifies that you can split off the earnings from the after-tax 401k account and send them into a traditional IRA (while sending the contributions to a Roth IRA). This is important for people who don’t have the ability to take in-serve distributions. In addition, I believe for some frugal aspiring early retirees, the approach of letting earnings build up in the after-tax 401k account and then separately rolling the earnings into a tIRA (instead of taking immediate in-service rollovers into a Roth IRA) may be the optimal strategy, because that still shelters the earnings from taxes during the high-income earning years, but allows earlier access to those earnings (as early as five years after retirement, if you fold them into a Roth conversion pipeline immediately upon retirement)–and the loss of Roth tax-avoidance on those earnings during retirement does not matter to the frugal early retiree who isn’t subject to taxes in any event. We were having a debate about this recently over in the MMM forums.

Can you point to a source that says you can convert the gains on your after-tax 401K to a Traditional IRA (and thus defer taxes even longer). I’ve talked to my plan administrator and Vanguard and nobody had seen/heard of this provision in the IRS Clarification 2014-54.

What each of them said is that any contributions made to the after-tax 401K can be converted to a Roth IRA, but gains on these funds would be taxed once I requested the rollover.

Appreciate the help and/or source for this information. Thanks!

The source is Notice 2014-55 itself, which says that in a situation where there is a direct rollover

to two or more plans, “then the recipient can select how the pretax amount is allocated

among these plans. To make this selection, the recipient must inform the plan

administrator of the allocation prior to the time of the direct rollovers.” (Example # 4 in the Notice illustrates this in the situation where the direct rollover is done to a Roth IRA and a traditional IRA.) When you take a distribution from an after-tax 401k account, the portion representing contributions is “after-tax” and the portion representing gains is “pretax,” so you can apply this guidance in the context of a rollover of funds from an after-tax 401k account to allocate the amounts accordingly between a Roth IRA and a traditional IRA. The IRS guidance is still new and hasn’t been implemented yet by all plan administrators, but the transition rules at the end of the guidance make it clear that you can rely on the guidance immediately (and even retroactively).

Thanks for the quick reply. I read through the example, and it’s still a little unclear to me. The problem is that in my plan I have a pre-tax 401K (Traditional 401K) and then the after-tax voluntary option. I understand that the gains from the securities in the after-tax voluntary are technically pre-tax, but they are not in a pre-tax account.

Each person I spoke with was aware of 2014-54, but none of them interpreted the gains in the after-tax voluntary account as transferable to a traditional IRA under this rule. Since it is still early days, I hope there will be more case examples or clearer language/examples to make this easier to understand.

Thanks again!

Hi Ethan, as Eric said, the new guidance specifies that you can direct your pre-tax contributions and the earnings on all of your contributions to your Traditional IRA while directing only the after-tax contributions to your Roth IRA. Whether your 401(k) custodian makes that an easy task for you or not, that’s another story. If I were you, I’d probably just keep calling until you get someone who really knows what they’re talking about. As Eric mentioned, this ruling is very new so maybe some administrators haven’t caught on yet but even if yours hasn’t, I’m sure it will eventually. Good luck!

Hi – I am little confused by this article too. I can understand that the IRS guidance says that after tax contributions can be rolled over to a Roth IRA. The guidance does not appear to state the the “gains from the after-tax contributions can be rolled over to a Roth IRA.

The pictures in the article itself seem to imply that both after-tax contributions and its associated gains can be rolled over into a Roth IRA – which I don’t think is true.

Great article, but can you please clarify?

Thanks!

There are two accounts in a 401(k):

1. Before-tax contributions, before-tax gains, after-tax gains (non-Roth)

2. After-tax contributions, Roth after-tax contributions, Roth after-tax gains

The first account can be rolled over into a traditional IRA without tax implications. The second can be rolled over into a Roth IRA without tax implications.

The new guidance says you can split up the withdrawal so the gains go into a traditional IRA and the principal goes into the Roth IRA. The guidance doesn’t say anything about converting the gains to Roth because that isn’t a new thing. Putting the gains into your Roth IRA has previously been allowed as long as you’re willing to pay tax on them that year, and is still allowed today.

vinod,

The key to understanding the last picture is in the wording preceding it: “Assume the same scenario but rather than leave everything in the 401(k) to grow, you instead immediately rollover your entire balance to two separate IRAs…”

The KEY word is “immediately.” Since you are rolling over the contributions immediately, they do not have time to generate gains while inside the 401k. The $7,500 gains shown in the Trad IRA bucket are earned AFTER the in-service distribution, and are earned within the Trad IRA account (not the 401k account). Same for the $9,000 gains shown in the Roth IRA bucket, they are earned within the Roth IRA account AFTER the $30,000 After-Tax contributions are converted from the 401k to the Roth IRA. Thus all gains are classified under the account in which they are earned. The key to maximizing this strategy is the ability to take in-service distributions, which allow you to minimize the amount of gains earned while the money is in the 401k account.

Good points, Eric! I should put together a calculator or something to help people plan their Traditional-to-Roth conversions so that they know how long it will take to convert, how much tax they’d have to pay, how much they can withdraw every year, etc. That way, they can determine whether they should do the rollover as soon as possible or, as you suggested, wait so that they could access the after-tax earnings earlier, if needed.

That sounds like an interesting debate you were having over on the MMM forums so feel free to link over to the thread so that people (me included) can check it out!

That sounds like it would be a powerful tool if you could do it! There are a ton of variables at play though.

Here’s the link to the thread I was referring to:

http://forum.mrmoneymustache.com/investor-alley/did-the-irs-just-give-an-extra-$35kyr-of-tax-free-growth-saving-space/

Yeah, I haven’t thought about how I’d do it yet but it would be cool if I could come up with something useful!

Thanks for the link to the forum post. I’m going to go check it out now…

Yes! A calculator would be great. I understand the post but it seems like a heck of a lot to keep track of between tax paperwork and tracking everything, then using this to actually help plan if retirement can happen earlier.

I know this thread is a bit old, but now it pertains to me so I have a question!

I have spent the last couple of years paying off ~$100k in student loan debt (I’m 32) but now am ready to put retirement savings into my main financial focus. I currently have ~$50k in my 401k (no match, but profit sharing that comes out to ~$7k/yr) – of that amount there is $5500 in the after-tax (non-Roth, not offered) portion.

Here are my questions:

I make $160k/yr and will be getting a ~$36k bonus check in early February. I have been reading a lot on the MBR strategy and I want to partake since I cannot make Roth IRA contributions. My knee-jerk reaction was to front-load my pretax 401k (50% max contribution rate would put me right at the $18k limit here and not too concerned with DCA at my age/in this scenario) and then use my remaining salary for the year to fund the after-tax 401k at 15% or so. I have the ability to make in-service withdrawals and would likely do so every month as to minimize non-Roth protected growth.

After doing some reading, I am now a little confused as to how a different scenario would work out – that is to skip the pretax 401k all together, put the 50% into the after-tax portion, roll this over to Roth immediately, and then max out the $53k/yr limit (minus profit sharing) all with after-tax contributions to be MBR’ed in a Roth IRA. Is this legal? If so, worth doing?

The second, smaller question is if I roll over the ~$5.5k I already have in the after-tax portion of my 401k as well this year, that shouldn’t count toward any contribution limits correct?

Thanks all for any help you can provide!

Eric – I can only answer one part of your post, but you can make Roth IRA contributions, via the backdoor method (http://www.rothira.com/what-is-a-backdoor-roth-ira). Income limits don’t apply.

I did this for years, until I made the mistake of rolling over a previous employer’s 401k to a rollover IRA. I could still do the backdoor conversion, but I would end up getting taxed on a portion of that, which doesn’t make it worthwhile.

Does the prorata tax issue apply when youre doing an in service withdrawal from a 401k?

You could roll over the IRA into your current employers 401k.

Howard,

I am in the same situation as you. I have previously rolled over 401Ks into a rollover IRA and so I wasn’t sure about how to approach the MBR without getting hit with a tax. I did some research and what El is suggesting seems feasible; roll over the IRA into the current 401K (if you have one), then do the MBR from thereon. Were you able to test this?

Jbird,

The pro rate doesnt seem to be an issue when you make an in-service withdrawal from the 401K based on the article at the link below:

https://seekingalpha.com/article/4182164-new-twist-roth-ira-conversions

In the very last paragraph, it says “The mega Roth applies to employer-sponsored salary deferral plans such as 401(k)s……….many plans allow employees to elect an in-plan Roth transfer. This transaction is the 401(k)-equivalent of a Roth IRA conversion……There is, however, one important distinction. The pro-rata rule does not apply with these Roth conversions and plans may allow employees the ability to pick which sub-accounts or buckets they wish to transfer to the plan’s Roth option.”

Eric, first you need to find out if your employer 401k plan allows you to have after-tax contributions, as some plans don’t and some have limits lower than what IRS allows. Second, you need to evaluate pre-tax 401K vs. Roth, and the most important determining factor is your tax rate between now and after you retire. If you believe your tax rate is higher now than what it will be in your retirement (when you withdraw the money), then it is better to pay tax later, therefore pre-tax contribution is better, and vice versa.

I am lucky that my employer’s 401K plan is probably the most flexible out there, I can tell you how it works for me. I front load my 401K each year, directing 100% of my pay to pre-tax and after-tax 401K, until it hits the IRS limit ($54K in 2017 including employer match). My employer matches 50% of pre-tax (or Roth 401k) contributions, and it vests as soon as it hits the account. So I get it at the beginning of the year and it has nearly a full year to grow. For after-tax contribution, the plan offers in-plan Roth conversion (through Vanguard), so I just click a few buttons and the after-tax money becomes Roth asset in my 401K. I could leave it there to grow tax free, but I chose to transfer it to my Roth account at Fidelity so I have full brokerage investment choices, and it takes a phone call to Vanguard to do that. To minimize the number of phone calls to Vanguard and the hassle, I contribute 100% pay and annual bonus in the first few months, so it does not spread through the whole year.

Wow.Just finding this thread, but what amazing retirement benefit you have!!

Has anyone had any issues with Vanguard in doing this rollover from a non-Vanguard 401k? Basically I started funding my after-tax in my 401(k) every two weeks to the maximum that my company allows. The next day after each pay day I take an in-service withdrawal and they send me a check in the mail to Vanguard as requested. I then send this check to Vanguard with a letter explaining to add these funds to my Roth IRA and every two weeks Vanguard calls me up to confirm that I really want to do this warning me that this will be a “taxable event” and I need to be careful and contact a tax professional. Am I misunderstanding this new rule and doing something wrong or do they just not understand this new law do you think?

I am not entirely sure of the benefits of after tax 401(k). While the gains may grow tax deferred, it is not much different from an after tax investment account where you can also let the gains compound tax free as long as you don’t sell the assets. Sure, there will be dividends along the way that are taxable but choosing an index fund with reinvest option would still give an investor lot of flexibility with a regular after tax mutual fund or brokerage account for these additional savings. If there is a likelihood of higher tax rates in the future, then having sizable assets in after tax accounts is better than relying mostly on tax-deferred accounts in my view.

It is because of this: According to the new guidance, the pre-tax contributions can go directly into a Traditional IRA and the after-tax contributions can go directly into a Roth IRA.

Do you think that Roth investments are worth it? Making your investment growth tax free? With my former employers plan, I could roll out after-tax 401k investments into a Roth IRA every 6 months. This meant that instead of the $5,500 limit, I could put more than $25,000 into the Roth IRA every year. That seems like a pretty great benefit to me, but your employers rules may vary.

Is this type of rollover subject to the 5 year delay for withdrawal like the traditional IRA to Roth IRA conversion?

I asked my 401k plan administrator this question. She did seem to think that, at least for in-service post-tax rollovers, that the 5 year seasoning is still required for withdrawal of that lump sum rollover. From what I’ve read so far in the IRS regs, that seems to be the case.

As always, check with your accountant before taking internet advice though :-) This is all still pretty fluid.

And if you don’t have an accountant, asking prospective accountants about their opinions / recommendations of this sort of rollover is a great filter for those who keep up with this stuff vs. those who aren’t paying attention. It’s harder than I thought to find a modern accountant who was interested in helping my with tax strategy. But they do exist!

Yes, a rollover from an after-tax 401k account to a Roth IRA is subject to the same five year holding period before you get penalty-free access the funds as a conversion of a traditional IRA to a Roth IRA. Take a look under “Additional Tax on Early Distributions” in IRS Publication 590:

http://www.irs.gov/publications/p590/ch02.html#en_US_2013_publink1000231071

Also, be mindful of the ordering rules (discussed in the same IRS publication) that force you to withdraw funds from a Roth IRA in a particular order (which in turn determines the tax and penalty treatment of each withdrawal). So if you do a mega backdoor Roth rollover, but your existing Roth IRA already has other funds in it that the ordering rules will force you to withdraw first and that are subject to penalty, you will not be able to access the funds from your mega backdoor Roth rollover without first withdrawing (and paying the penalty on) those preexisting funds.

The five-year rule does apply, but an important thing to note about it is that the 10% early withdrawal penalty only applies to money you paid tax on at the time of the Roth conversion. If you use this new guidance to split your rollover so the after-tax principal goes to your Roth IRA and the tax-deferred earnings go to your traditional IRA, you could withdraw the principal from the Roth at any time with no penalty.

However you need to take this in the context of any other Roth conversions you have made in the past. There’s a set of ordering rules that determine what money comes out of the Roth IRA first for the purpose of calculating taxes and penalties on that money. Direct contributions always come out first and are always tax-free and penalty-free. Then rollovers come out (first in, first out). So if you paid tax on a traditional-to-Roth conversion two years ago and you rolled over some after-tax money this year, you wouldn’t be able to get the after-tax money back until you first withdraw the money you rolled over two years ago and paid any applicable penalties on those funds.

Thank you for clarifying this. I was not sure how the 5 year conversion rule would apply in this after-tax 401(k) contribution to roth ira rollover case since there are no taxes paid at the time of the rollover. So basically even though the 5-year conversion rule applies, if you take out the roth ira money corresponding to the after-tax 401(k) rollover within the first 5-years, there should be no taxes whatsoever. This is a great way to boost the roth ira balance.

Thanks for this article. I have one question: normal contributions to a Roth IRA are only allowed when one does not exceed a certain income level. Does this also apply to the 401(k) -> Roth IRA conversion? Any limits here? Thanks! F

Hi Fubek,

No, the income limits don’t apply to these types of conversions!

From what I’ve read elsewhere, if you have after-tax gains in your current 401k, they can be rolled into your traditional IRA. So if you couldn’t roll over while employed, you could still put the $8,700 in your example into a tax advantaged account. Am I on the right track with that?

Yes, you are right about that but the sooner you can roll those funds into the Roth, the less amount of tax you would need to pay on those gains (since gains in a Traditional IRA are eventually taxed, it’s better to have those gains be in a Roth instead so that they aren’t taxed). If you can’t do in-service withdrawals though, then waiting until you leave your job and then just putting those after-tax earnings into a Traditional IRA is the way to go.

Thanks for this intel! I’m maxing out my pre-tax 403(b) contributions and my backdoor Roth. As soon as I read this post, I called my 403(b) administrator and learned that after-tax contributions are allowed but not in-service rollovers. I plan to stay with this employer 5-7 years until FIRE. I wonder if I should take advantage of this strategy or if the inability for in-service rollovers would result in 1) too much tax on the growth as income at withdrawal and/or 2) too much risk that the Roth rollover would no longer be an option in 5-7 years. I’d be grateful for any thoughts.

On second thought, of course, my first question is not an issue as long as the Roth rollover is available at the time I separate. So that is my one concern.

Hi Dorothy,

If I were you, I’d still take advantage of it because you won’t accumulate too much in 5-7 years and what you do accumulate can just go into your Traditional IRA. As far as the risk that the rollover option won’t be available in 5-7 years, your guess is as good as mine but I tend to avoid trying to predict the future and instead just optimize things based on the rules available at the time. If things change, I’ll work on optimizing using the new rules then.

I think having some graphs which compare a couple different strategies (compared to taxable account alternative), over time, like in your previous posts below, would have more impact on how great this could be for FI-seekers.

https://www.madfientist.com/traditional-ira-vs-roth-ira/

https://www.madfientist.com/retire-even-earlier/

Good idea, BB. I thought the complicated nature of this topic required a more detailed explanation so I decided to omit those comparison graphs in favor of the graphs that you see above. It seems a lot of people are interested in this idea though so maybe I’ll do a follow-up post and include the type of graphs you suggested. Thanks for the suggestion!

Also, in your research, did you see a need to ever do a “roll-in” to avoid any tax complications or headaches (if you already have other trad/roth IRAs)?

I’m not sure I understand your question. Can you elaborate?

I can’t find the exact context and link I was thinking of.. but pretty sure it relates to the “pro rata rule.”

BB, you might be referring to rolling funds from an existing Traditional IRA into a qualified plan (i.e. 401k) to take full advantage of the backdoor Roth IRA contributions. By completing a rollover of the Traditional IRA into a qualified plan, you avoid the negative consequences of the pro-rata rules for Traditional IRA’s (i.e. more taxable income) when you convert a nondeductible Traditional IRA contribution to a Roth IRA. The pro-rata allocation is determined as of 12/31 each year so you would need to complete the rollover to the qualified plan by this date. You might check with your plan administrator to make sure they allow rollovers from Traditional IRA’s (Roth IRA’s are not permitted). This could allow you to take advantage of the backdoor Roth IRA contributions and mega backdoor Roth IRA contributions in the same year, depending on your situation. What do you think, Mad Fientist?

As always, Nick, your answer is clear and intelligent so thanks for chiming in!

Great! Thanks for the info. It should help others who want to do both bakdoors (they must be extremely lucky to take advantage!)

Initiating a rollover into my 401k from my tIRA now. 401k has some nice investment options and this should allow me to do do a backdoor Roth IRA if I am so inclined. Unfortunately not able to do a mega backdoor Roth IRA.

Nick, would you mind translating this for those of us who may not be at the expert level? I don’t know what the pro-Rata rules are. I am currently contributing to a non deductible Ira and rolling it into a Roth each year. Sounds like I could be doing something better? Or is the pro-Rata the calculation of what % of your funds are taxable vs non taxable? If so, I’d love more detail. I understand that total traditional Ira funds are divided up into what % are tax deductible and what percent are not. Then that percentage is applied to whatever portion you roll into a Roth. So you owe tax on some percentage of your rollover.

Does rolling it into a 401k change that? OH!!!!! Are you saying that you can roll any tax deductible traditional Ira into a 401k that then only the non tax deductible is left and you can roll that into a Roth without any additional taxes due??

Only possible downside I see there is the typically more limited investment options available in 401ks and the potentially higher fees. But if your plan allows in service withdrawals you could just take it back out every year.

You’re brilliant!! Let me know if I am understanding correctly and please correct me if I’m off.

Thanks!

Also I have one big question. Somewhat unrelated. What about the total dollar limitation? I saw it was a little over 1M. Exactly what does that apply to? Your aggregate retirement funds? Just your Roth? Is it as a married couple or as an individual? Is it contributions or total value (including dividends and capital gains?). What happens if you exceed it? Would the tax benefits stop? Would I owe some kind of penalty? I am not near this limit right now but if I start amping up all these techniques it wouldn’t take long … I am especially concerned about contributing now, and letting it sit, and then having it become huge as it is likely to become if untouched over a long period of time.

Nicklaus,

I currently have $75K from in my TIRA (rolled over from my previous employer 401K). I’m in the process of moving the entire amount to a qualified plan (ie: My current employer 401K) and should be completed within the next 4 weeks.

My question here is, would I be able to contribute $6,000 through backdoor Roth IRA in CY2020 and not be subject to the IRS pro-rata rules? Or do I need to wait until Jan 1, 2021?

Thanks!

Well said, always enjoy reading your posts! Nice work, Mad Fientist!

Thanks a lot, Nick!

What’s your opinion on funding your tax advantaged accounts via funds from a taxable account in “cash short” years?

Due to a few unanticipated expenses, I was short of the cash to contribute to tax-advantaged accounts this year from income, however, would it be smart to make up this difference by transferring funds from a taxable account this year for the tax savings?

Also to add to my post. I have a SIMPLE-IRA program at my employer where the account is held at Edward Jones (less than ideal). I currently contribute to the match max (3%). Is it smart to be maxing this account given it is held at EJ? Do the the tax benefits outweigh the expense ratio/fee losses? I have a fear of giving more than the minimum to EJ, though this fear may be irrational given the tax savings.

For example, $7,000 (getting funds from my taxable account and putting into SIMPLE) at 25% saves $1,750 in taxes, way more than the fees I will incur (in the short-term anyway, though in the long run I fear the fees would catch up with me). I’m looking into a trustee-to-trustee transfer to get the money to Vanguard after a 2 year holding period (from what I’ve read on Bogleheads wiki)

In addition, the selling of taxable funds won’t trigger additional taxes due as I have enough in “losers”.

I should have read your follow-up comment because it answered both of my questions that I just asked you in my response to your first comment.

As you said, the tax savings will more than cover the fees so if you plan to get out of those funds anyway within two years, it makes sense to lower your taxes by $1,750 and reinvest that extra money in your taxable account. It sounds like you’ll also harvest some losses by selling so the tax savings resulting from those losses can also be invested.

You still have a month to go before the end of the year so why don’t you try to also sell some stuff you don’t need around the house and then use that to max out your IRA?

I’d also check again to see if there are any low-cost index funds you can invest in at Edward Jones. Usually these custodians have at least one semi-good offering that you can take advantage of until you move the money to Vanguard.

Good luck!

Kurt, would you be selling the funds in your taxable account at a loss or a gain? Would you be the contributing those funds to a pre-tax account like a Traditional IRA or 401(k)?

MF, you never cease to amaze me with how well you find and explain strategies to minimize tax burdens and how to execute a strong plan for financial independence. I wonder how many people at the IRS read your blog and think ‘damn, this guy is good!’

Haha, thanks for the very kind words, Kyle! I can’t imagine anyone from the IRS reads my blog but if there is anyone out there, I hope they speak up because I’d love to hear what they think!

I went from being really excited about this possibility, to then immediately sad, as my 401k neither allows for after tax contributions or in-service withdrawals (until I am 59.5).

Sad face.

The same exact thing happened to me, DB40. I was so pumped about this strategy but then after spending 30 minutes teaching the rep I was talking to all about it, he burst my bubble by saying that it wasn’t possible with my employer’s plan :(

Can you do the same rollover to your Roth 401k, or does it have to be a Roth IRA?

Presumably you could do the same with a Roth 401(k) but if someone out there with a Roth 401(k) has done it, please speak up because I’d be interested in hearing your experiences.

The rollover would be a bit different because the Roth contributions and their associated earnings would go to the Roth IRA, the after-tax contributions would also go to the Roth IRA, and the earnings on the after-tax contributions would go to the Traditional IRA.

Have you determined if this is correct? Or could the Roth 401k be rolled over entirely into a Roth IRA?

Yes I just did in-plan roth rollover by rolling after-tax 401k contribution to roth 401k. there is no fee associated with my plan. I did rollover after tax 401k contribution to an external roth ira too. but that costs me $25 per transaction. so I decided to roll after-tax 401k into the roth 401k instead of rolling into roth ira to save the transaction fee. one more thing I am unsure is should I max out the after tax contribution to take advantage of roth growth before I max out pre-tax 401k? all I read online is to max out pre-tax 401k first. I don’t understand why. If I am still going to max out pre-tax 401k but do it after maxing out after tax 401k in the same year, would it be better since I allow after tax contribution to grow tax free in roth 401k through in-plan roth rollover at an earlier time?

i literally just got off the phone and moved my aftertax to roth ira, so nice timing on the article!

why would you move your pretax portion of your 401k over to a Traditional IRA? why not leave it in the Trad-401k (pretax) bucket and just move the Aftertax-401k portion to Roth (401k or ira), especially if you might already have a good 401k plan, with say Vanguard?

Also, please correct me if i’m wrong, but if you have money in your Traditional IRA then you cannot do the Backdoor Trad>Roth IRA trick without paying some taxes there. (From http://www.bogleheads.org/wiki/Backdoor_Roth_IRA: If you have any other (non-Roth) IRAs, the taxable portion of any conversion you make is prorated over all your IRAs; you cannot convert just the non-deductible amount. )

Also, note when rolling over the AfterTax-401k bucket to Roth IRA, IF you have gains, you may be subject to tax. You can do this: move the aftertax contributions to Roth IRA without penalty AND also move the gains of the AfterTax401k into a Traditional IRA (I just asked Vanguard rep about this). But then you’d have the problem I mentioned previously where you’d have money in a Trad-IRA. In my case, I waited until the end of the year and now I have a small taxable event on the gains that were made this year.

Best way to minimize tax gains is to contribute to AfterTax401k and then IMMEDIATELY rollover that money into Roth (IRA/401k) such that you don’t have gains to pay taxes on. So for example, if you contribute to AfterTax401k on a monthly basis (monthly paychecks) throughout the year, you’ll have to do the rollover 12 times, and probably keep track of all those rollovers.

In regards to your second paragraph. Might the easiest way be to jack up your AfterTax401K contributions the final weeks, or months, of the current tax year and than rollover once?

For example, say I have budgeted for $10,000 of disposable income for the year. What I would do is divide 10,000 by my weekly paycheck. That would tell you at what point in the calendar year I should change my contributions to 100% Roth-401k contributions. Then, wait till the end of December and rollover into Roth IRA and pay minimal tax on the conversion.

Peter: you could, but you may not want to wait until the end of the year in the event you don’t work at the company at the end of the year (maybe highly unlikely for most?). secondly, let’s say you divide your $10,000 by 5 paychecks and deposit $2k every week into the aftertax 401k – that’s 5 weeks of time where gains could be made of which you’ll have to pay that tax on those gains. yes, 5 weeks is much shorter than say 5 months or 10 months so your gains will be potentially lower. just depends on how you want to handle it. some people i know at my company contribute $X from their Friday paychecks into AfterTax401k and then call Vanguard Monday morning and do the rollover every paycheck until they hit max. While this will reduce your gains, for some they may consider extra work to call every Monday to do the rollover.

Panda: Please don’t confuse the rules for the Mega-Backdoor Roth (using After-Tax 401(k) Contributions as the conduit) with the rules for the Backdoor Roth (using Nondeductible Contributions to a Traditional IRA as the conduit). In the former case, when the After-Tax Contributions are withdrawn from the After-Tax Subaccount of the 401(k) (and presumably rolled to a Roth IRA), the only amount subject to tax is any Gain on the After-Tax Contributions (with tax-deferral presumably retained by rolling these gains to a Traditional IRA). Any amounts you may have in other Traditional IRAs, pre-tax amounts in other subaccounts of the 401(k), or any other 401(k) accounts, simply don’t enter the calculation. See:

http://fairmark.com/retirement/roth-accounts/roth-conversions/isolating-basis-for-roth-conversion/basis-recovery-from-employer-plans/

Well according to this

http://fairmark.com/retirement/roth-accounts/roth-conversions/isolating-basis-for-roth-conversion/using-new-basis-isolation-rules/

I could just leave growing my After-tax 401(k) contributions until I decide to rollover. Then I would just separate my distribution to two accounts. My After-tax 401(k) contributions would go to my Roth IRA and the gains on the After-tax 401(k) contributions would be rolled over to traditional IRA.

So there is no need to immediately (January 2nd on the example) roll you contributions from your 401(k) to your Roth and traditional IRA.

And the beauty of it is that you don’t even have to quit your job. Your After-tax 401(k) contributions can be rolled over whenever you want.

Eduardo: You are correct. However, the advantage of rolling your after-tax contributions to your Roth sooner rather than later is that the more of the gains on the contributions will be tax free.

My understanding is that some who use this Mega-Backdoor Roth strategy may have the ability to place a standing order with their 401(k) administrator to roll the after-tax contribution to their Roth immediately after every paycheck. Then there are never any taxable gains associated with the after-tax contribution.

Despite what MF said regarding the hypothetical January 2 example: “the pre-tax contributions can go directly into a Traditional IRA and the after-tax contributions can go directly into a Roth IRA,” there is no need to frequently roll the pre-tax contributions. They and their associated gains are tax deferred either way and could just as well stay in the 401(k) if the investment choices/fees are reasonable.

right, agree on that After-Tax 401k contributions gets rolled Roth IRA without tax implication, but gains on any amount in the After-Tax 401k sub-account would be taxed – I had this exact situation yesterday since I waited until the end of the year to do this rollover and had been accruing gains in this AfterTax subaccount.

What I was trying to say which is separate from above statement, is that I think (and could be wrong) it doesn’t make sense to move the PreTax-401k portion to Trad-IRA per the MF article. My understanding is that I want to have a $0 balance in my Trad-IRA every year such that I can then perform the backdoor Trad>Roth IRA trick without tax implications. If I follow the MF article above and in 2014 move both AfterTax>RothIRA and PreTax>TradIRA (ignoring the gains), I will now have money in my TradIRA, let’s say I rolled over $95k for simpler math. NI now have a $95k in my Trad IRA (which came from the rollover PreTax401k) and in 2015 I contribute $5k into my TradIRA intending to do the conversion to Roth. But per the boglehead link I posted previously, I cannot do this TradIRA>RothIRA conversion tax free but rather it’d be subject to tax of 95% on the $5k (5 = 100 * [ $5000 / ($5000 + $95,000)]) or $4750 is subject to taxes.

Summary is what I would try to do every year:

1. Backdoor Roth : Contribute to TradIRA and immediately convert to RothIRA

2. Contribute to PreTax401k.

3. Contribute to AfterTax401k.

4. Contribute to HSA.

5. Perform AfterTax401k rollover to Roth (401k or IRA, up to you).

6. Leave PreTax401k money there such as to have a $0 balance TradIRA so I can repeat step #1 every year without tax implications in step #1. Secondly – what does it gain you to move PreTax401k to TradIRA anyways?

Okay, I understand now and agree totally. It seems MF confused the issue when he said, regarding the hypothetical January 2 example, “the pre-tax contributions can go directly into a Traditional IRA and the after-tax contributions can go directly into a Roth IRA.” There is no need to periodically roll the pre-tax contributions. They and their associated gains are tax deferred either way and would usually best stay in the 401(k), particularly if the investment choices/fees are reasonable.

I think I’m a bit confused here. Sorry I’m still very new to all this.

Correct me if I’m wrong ……what I’m getting is that you ONLY have tax implications because you are rolling over gains from after-tax account to tIRA that has NON-DEDUCTIBLE contributions?

So in other words….. if all my contributions in my tIRA were deductible contributions and I roll over gains from after-tax account to my tIRA then I don’t have to worry about taxes right???

Sick thread you guys. Tons of great things to consider here. This all pertains to exactly what I’ve been researching regarding this topic.

I have a question about whether or not you can take just the after tax out and not have to take the pre-tax out at the same time. It’s possible that you need to do them both at the same time in order to follow the new guidelines?

http://fairmark.com/retirement/roth-accounts/roth-conversions/isolating-basis-for-roth-conversion/

Lolarobot: The new guidelines tell us how to do the pro-rata treatment of a single withdrawal from the After-tax subaccount of the 401(k). The withdrawal generally includes After-tax Contributions and any taxable Gains on those After-Tax Contributions. You could take out money from a Pre-tax subaccount at that the same time, but most people would want to avoid that. Thus the only taxable money coming out could be the gain (if any) on the After-tax Contributions while they resided within the 401(k).

http://fairmark.com/retirement/roth-accounts/roth-conversions/isolating-basis-for-roth-conversion/separate-subaccount-treatment/

The new guidance, Notice 2014-54, issued on September 18, 2014 addresses how to handle a distribution including pre-tax and after-tax portions, but doesn’t change the existing tax law including the availability of subaccount treatment. As stated in the Fairmark article, you just have to be careful to designate your distribution as coming from the appropriate subaccount.

Great discussion, everyone. I understand what 1dirtypanda is saying…if you are happy with your 401(k) investment options and you need to use your Traditional IRA for other backdoor strategies, it makes sense to leave your pre-tax contributions and earnings in your 401(k) instead of transferring them to a Traditional IRA. I decided to transfer the funds to a Traditional IRA in the example because I wanted to show what would happen if you decided to rollover the entire thing after leaving your job (since I imagine most plans don’t allow in-service withdrawals).

Thank you for this! I have the same strategy but want to clarify my ability to withdraw contributions early without penalty. With that:

– If I max out my traditional 401k. And get the company match (also pre-tax)

– I then do a non-deductible contribution of $6k to a traditional IRA and immediately conver to a Roth IRA (Backdoor Roth)

1) can I withdraw my contributions (less earnings/growth) at anytime (without waiting 5 years) since this was after tax money in the first place?

– I then do after tax contributions to my 401k plan and immediately convert those to the same Roth IRA (mega Backdoor to the same Roth I just did the Backdoor

2) can I withdraw the contributions without taxes or penalties (and without waiting 5 years)?

If yes, I am thinking I should always try to max out the Backdoor and mega Backdoor Roth strategies knowing that if I lose my job or need the money before 59.5yrs old I can always access my capital without penalties and in the meantime it grows tax free.. am I missing something?

Can someone help clarify what we should be doing with the after-tax 401k GAINS? In the article it says you roll them into the Roth along with the after-tax 401k contributions. This comment mentions rolling them into a Traditional IRA. Do we have a choice? If so, which one is a better option? Do we pay taxes on the gains? How about just leaving the after-tax 401k gains in the 401k and just moving out the contributions?

What to do with the gains? You have two options. You can roll them into the Roth, which will cause you to owe some tax on that money this year. Alternatively, the new guidance from the IRS allows you to put the gains in a traditional IRA, in which case you won’t owe tax on that money until you withdraw it from the IRA.

I don’t believe leaving the gains in the 401(k) is an option. My understanding is that if you do a partial withdrawal from the after-tax subaccount of your 401(k), there’s a pro-rata rule that says an equal proportion of principal and gains is considered to have been withdrawn. Once you make a withdrawal you can split the pre-tax gains and post-tax principal, but you can’t just leave the gains where they are.

A downside of splitting the gains to a traditional IRA is that it invalidates the “backdoor Roth IRA” strategy, because that only works if you have no pre-tax funds in traditional IRA accounts. If you can afford to make maximum contributions to your after-tax 401(k) and your IRA, you may want to just pay the tax on the gains, especially if the amount is relatively small.

If the amount of gains is large enough, another possible option would be to roll the gains into a traditional IRA and then roll that IRA into the pre-tax portion of your 401(k).

I personally convert the whole balance to my Roth IRA a few times a year. By doing the rollovers frequently, there isn’t much time for gains to accumulate, so the amount of gains is relatively small. Also my company’s 401(k) plan allows you to roll over the full balance to a Roth IRA with a few clicks on the website, while any of the other strategies would require a phone call and paperwork. I’d rather pay a few extra dollars of tax than deal with that, but your situation may vary.

Thanks for the clarifying response. When I log into my 401k (Vanguard), they have an online tool that allows me to do an-in service rollover for my after-tax 401k. Curiously, the total amount I can do is exactly equal to the total amount of all my after-tax 401k contributions over the years. I have about $4k in after-tax 401k gains that don’t show up in the rollover amount. Even more weird, the target I can choose for the rollover is a Traditional IRA, not Roth.

1. So it seems like I can just rollover my after-tax 401k contributions by doing it online. My gains would be left behind. Although the tool allows me to do this, it sounds like I probably shouldn’t because it’s in violation of the pro-rata rule you mentioned. Maybe the Vanguard tool isn’t calculating the amount correctly and I should just call in to roll over the entire amount?

2. The target for the rollover is a Traditional Ira. This obviously wouldn’t make sense to do because I would be paying taxes on the withdrawal later. Why would Vanguard make this the target of the rollover? Is there a reason when this would ever make sense?

I called Vanguard. To answer my own questions in case anyone else is thinking about doing this with them, you can’t do it online yourself. They’ll mail you a form in which you have to mail back to do the in-service withdrawal. I’m not sure if this is for all Vanguard 401k’s, or just the way it’s set up with my employer.

A mail-in form is *not* required for all Vanguard 401(k) accounts. My wife and I both work for employers that use Vanguard for their 401(k)s. My employer allows you to roll over your after-tax 401(k) sub-account to a Vanguard Roth IRA with a few clicks on the website. For my wife’s 401(k), you need to contact customer support to do the rollover.

“If the amount of gains is large enough, another possible option would be to roll the gains into a traditional IRA and then roll that IRA into the pre-tax portion of your 401(k).”

Can you do that? i.e., roll over the pre-tax gain of the after-tax contribution to the pre-tax portion of the 401k?

Very awesome and concise summary. I’ve seen the “mega back door roth” discussed on reddit and the bogleheads sites, but your graphics convey the practical mechanics better than merely reading about it!

We weren’t able to take advantage of the mega back door roth, although we did have $72,000 of tax deferred/HSA space that knocked our federal tax liability to almost zero on our $150k combined incomes.

Thanks a lot, Justin! It took me a while to figure out how to best represent this strategy visually so I’m really glad to hear you think my efforts were successful :)

Hope you’ve been doing well!

Do you know if the TSP will allow after-tax contributions and immediate transfer into a roth IRA? Many thanks.

A brief search indicates it’s not a promising/viable option for TSP participants. The current TSP rules only allow for one age-based in-service withdrawal (plus one financial hardship in-service withdrawal): https://www.tsp.gov/planparticipation/inservicewithdrawals/ageBased.shtml. So you could only do it once, plus I haven’t been able to find any indication that we even have the ability to make after-tax contributions. :-( But it’s one more benefit to look at when considering future employment in the private sector.

Thanks jexy. I guess the best we can do via TSP is to max out the tax deferred contribution, then rollover to a traditional IRA upon retirement, and slowly convert over to a roth ira depending on our income and tax bracket at that time. Again, this strategy makes sense only if we are anticipating lower income during retirement than during working years.

I believe you can already make after-tax contributions to your TSP with the new Roth TSP option. Now you can max out your Traditional TSP with pre-tax plus employer matching ($18,000 + $6,000), and then put $29,000 in your Roth TSP, which can be rolled-over to a Roth IRA at anytime.

But I’m not quite seeing the benefit of rolling over to a Roth IRA from Roth TSP. What do you see as the benefits? Maybe better investment options? Or setting up an IRA conversion ladder for early retirement?

One drawback to the TSP Roth is that, come withdrawal time, all distributions from your TSP account will be divided between your Traditional TSP and Roth TSP, in according to the percentage of each; e.g., if your account is 74% Traditional and 25% Roth, a $1,000 distribution will be $750 from Traditional, $250 from Roth.

There have been hints from the FRTIB that they are looking to change this, but change comes very slowly with the TSP.

Is a rollover the same as a withdrawal? Or does a withdrawal become a rollover if I make a roth contribution within a certain time window after taking the distribution?Also, what happens if the value decreases? Can you still roll over the full contribution amount?

From the IRS: “A rollover occurs when the participant receives a distribution of cash or other assets from one qualified retirement plan and contributes all or part of the distribution within 60 days to another qualified retirement plan or traditional IRA.” (Source: http://www.irs.gov/Retirement-Plans/Plan-Sponsor/401(k)-Resource-Guide—Plan-Sponsors—General-Distribution-Rules)

If the value decreases below your contribution amount, you’d only be able to rollover what you have left.

This sounds exciting. I wish I understood it! Might try again tomorrow.

Haha, yeah this strategy is a bit tricky. Read over it again and feel free to ask questions here if things still aren’t clear!

Another great article and something I am going to look into! Thanks for sharing!

Glad you enjoyed it, Nick!

A few months I was going to email you to ask you if you would vet this backdoor – but then I found out that I can’t make after deposits either, and it seemed too good to be true. Other ideas:

1. Bargaining when you take a job to take an extra $10-20k as 401k instead or salary. This would work in select places.

2. I’m also wondering if a solo 401k, sep IRAs, and 457s can be used in create ways?

3. Finally, I’m considering moving into consulting instead of a good salary because of sep IRA/solo 401k max-out (and more time off between contracts).

Yeah, the SEP IRA is great. I just opened one up for myself last year so I’m hopefully going to be able to contribute more this year.

I am also interested to know if the TSP will allow for this. Thanks for the great article.

Hey Chris, see the comments above for more info on TSPs.

You can only rollover your TSP while employed if over 59 1/2 years old.

My husband is deploying next year so we will be taking advantage of tax free in and out Roth contributions and then getting as close to the $53,000 max as we can this year due to tax free combat zone rules but in a normal year the TSP will limit us to $18,000.

I’ve been a lurker for a few months, by first post. Thanks for all this great info MF!

Can we do this in 2014? A commenter above mentioned they just did it. All the examples in the article are about 2015, so I wanted to make sure. I would increase my contributions for the rest of the year to take advantage of some of this.

I already have about $20k from 401k after-tax and 401k after-tax growth because I over-funded my 401k a few years back and stumbled upon 401k after-tax contributions. I’m assuming when I do this, I would be paying taxes on this. I’m 10+ years from retirement, so it sounds like it’s worth it to take that hit now in order to start shielding the growth?

Anyone have recommendations on how/where to find a good accountant that can accurately deal with all this madness?

Yes, you can do all of this for 2014 but I figured I’d just use 2015 numbers since we’re nearly there.

It sounds like a good accountant would be able to sort through your issues but I have no idea how you’d find one!

I accidentally did this back in 2012. I was attempting to front load my contributions, and by the middle of the year, my company cut off further contributions because I had hit the before-tax contribution limit. What I didn’t expect was the company match also cutting off, so to get it back I contributed 6% as after-tax. In 2013 when I changed companies and rolled the account over, Vanguard knew exactly how to handle everything. Very smooth. It wasn’t exactly Mega for me, but it works as advertised.

I used this method on accident in 2012. I was trying to front load my contributions for the year and hit the 401(k) deduction limit by mid year. My employer cut off my before-tax contributions and their match. To get the match back, I contributed 6% in after-tax dollars for the rest of the year. In 2013 when I switched companies, I rolled the 401(k) into an IRA and Roth IRA. Vanguard knew exactly how to do it without triggering any taxes. Very smooth and no accountant needed. It wasn’t a Mega backdoor for me, but it certainly could be and works as advertised.

So question…

If I continue to max out a traditional IRA for the tax benefits now and funnel excess into after tax 401K (pre-tax maxed of course) I can then, since my plan administered by Vanguard permits, complete in service withdrawals and roll directly into the Roth IRA also with them? Will not run into a contribution limit problem because of the tIRA? In what way is this strategy preferable for early FI folks to funding a taxable brokerage?

Rollovers don’t affect contribution limits.

This strategy is preferable for early FI folks the same reason it’s preferable for most folks…it’s a way to shield more of your money from tax (IRA accounts vs. taxable accounts)

I think RJ is questioning if the Mega Backdoor Roth is in fact superior to a taxable account for FI (specifically those who can utilize the 0% LTCG tax).

The Mega Backdoor Roth (MBR) shields gains from taxes, but at a cost of liquidity. With an MBR, contributions are tied up for 5 years (it’s treated as a conversion), and gains until 59.5.

Conversely, if I put that money into a taxable account, I have immediate access to the money, and a 0% tax rate on LTCG (which could be tax-gain harvested each year).

Certainly tax laws could change. The 0% capital gains tax could go away, whereas current Roth funds would likely be grandfathered if tax changes happened to Roth accounts.

The MBR is great for higher incomes who can’t take advantage of the 0% LTCG tax, but a taxable account may be better for those who can.

I would appreciate it if you could poke holes in my argument – as I have the ability to do an MBR this year, but am planning on putting that money into a taxable account instead (I can utilize the 0% LTCG).

Ahh, thanks for clearing that up, Carl.

As you mentioned, this strategy is more useful for those with higher incomes so for some fientists, it may make more sense to go directly into a taxable account.

Do I understand correctly that some of the plans mentioned in previous posts allow for in-service distributions before age 59.5? I called the customer service line this morning for our company’s plan and they told me you could not take in-service distributions until age 59.5.

My understanding is that the law does not allow in-service distributions of pre-tax or Roth balances before 59½, but pre-59½ in-service distributions of after-tax (not Roth) balances are legal. Many 401(k) plans allow you to make these distribution, but your plan’s controlling documents may not allow this.

It may be worthwhile to call again and escalate to a supervisor to make sure that these are not allowed for your plan, since after-tax balances are fairly obscure and many customer service representatives may not be aware of this exception to the “no in-service withdrawals before 59½” rule.

In-service distributions before age 59.5 must also be legal for pretax and roth 401k plans, because my company allows it. They told me the restriction is that I can only roll over employer matches that are at least 24 months old. So none of my contributions, earnings, or recent employer matches are eligible. It’s not much, but it’s better than nothing. I assume each company has different rules.

Correct. My plan does in fact permit unlimited transfers of after tax contributions from my 401K to my Roth IRA by a simple phone call to Vanguard up to the maximum combined pre/post tax 401K contribution limit each year. Any gains incurred however though must be taken with the contributions per the rules of the plan. I will call the day after each contribution is posted. I may be able to do it on line via the Vanguard app but have to wait to see if this option becomes available once after tax contributions are credited to the account. A great tip I will maximize going forward. Note however my plan and many limited after tax contributions to a certain percentage of your income, so if you are a serious saver in excess of 75-80%, you may still have to fund a taxable account in addition to this or some other investment vehicle.

This isn’t a legal thing it is dependent on the way the plan provisions are lined out in the Plan document. You can take in-service withdrawals specific to certain transactions (rollovers to an IRA etc) on some plans and with your vested account balance, but others have restricted if withdrawals are allowed while employed. They can also restrict the types of assets that can be used or rolled out or withdrawn at different times. I run large corporate plans for Fidelity and ran large tax-exempt plans for years, and this is all dictated by the provisions setup by the plan sponsor. In-service withdrawals can be anytime for Rollover assets moved into the plan (regardless of taxation) if the plan sponsor allows it. The withdrawals can be based upon pre-tax, or Roth or after-tax and again whatever the vested balance may be. These can be limited to whether it’s employee or employer dollars through match or profit sharing. And most often we see the withdraws limited by age, such as what does the ER deem Normal Retirement Age.

Bottom line, it is a permissible action across all 401(k) plans but it is entirely at the discretion of the sponsoring employer. The largest Administrator and Recordkeepers can administer any of these options and are much more flexible with operational design, but the boutique entities are more restrictive with what they can operationally administer. Hope this helps someone!

I really do learn a lot when a read a MF article. I will check into it ASAP for our company to find out if it is possible for me to utilize. This would be a big help with early retirement if the plan allows it! Keep up the good work, sir.

Thanks! Hopefully your plan allows it!

Is there any way to get around the issue of our MAGI being to to high to contribute to a Roth IRA? Could I roll all of it into a traditional IRA and then backdoor it into a Roth IRA somehow?

Yes, take a look into the normal Backdoor Roth to see how you can get around the Roth income limits.

If you can make after-tax contributions to your 401(k)/403(b), that would also be a good way to legally contribute to a Roth IRA.

If our MAGI exceeds limits for contributions to a Roth IRA is there any way to take advantage of this? Could I roll it all over into a Traditional IRA and then Backdoor it somehow?

Contribution income limits don’t apply to rollovers so your income doesn’t matter when it comes to the rollover strategies described in this post.

Thanks for the post Mad Fientist, another gem indeed! I’m rereading you post and comments every other day and I keep learning more with every reread.

A suggestion for the blog. I find that a lot of my questions and confusions were cleared up by the comments section, but I did find sorting through the comments a bit difficult. What about organizing the comments reddit style with upvote and downvotes so misinformation can be avoided? Could be a good way to crowd-source additional information generated from your post via the comments section.

Hi Jen, thanks for the kind words.

Good idea with the reddit-style comments. That’s actually something I’ve been looking into lately because I’m getting pretty overwhelmed with the amount of emails I’ve been receiving. I figured if I could answer some of these questions in public (via a reddit-style interface), more people would benefit and also others in the community could start answering some of the questions, which would help me get through the backlog. Sadly, none of the solutions I found seemed very good so I’ll keep searching for an easy way to integrate that functionality into my site.

MF – thank you so much for sharing your insights with us. I would NEVER have known any of this without having access to your blog. It seems like there are a lot of strategies to make your money work for you. I am a newbie learning more each day, but it’s all still a little bit over my head. So I have a few questions…

1. Most of us have limited incomes, how do you decide in what order to do things? For example, I’m maxing out my pre-tax 403b at work and contributing the $5,500 to a Roth IRA. With the rest of my monthly income (about $900 after tax), which strategy is next? Do I do after-tax contributions as your article suggests? Or do I put it in a taxable account? HSA? I’m about 8 years from FI which would put me in my mid-40’s. I’m sure it’s a case by case basis…but what determines your case? :-)

2. I am receiving a gift of 32,000 (probably given equally over 3 years), same question as above – what is the best thing to do to shield any gains and have it accessible for FI years?

If I was in your situation, I’d max out my HSA (see why I think it’s the Ultimate Retirement Account) and then put the rest in a taxable account so that I have some money that’s easily accessible. I actually plan on writing a post on which type of account to contribute to first so look out for that early next year.

As far as your gift is concerned, I’d check if you could make some after-tax contributions to your 403(b) and try to do that after maxing out your pre-tax 403(b), Roth IRA, HSA, and contributing whatever amount to your taxable account that makes you feel comfortable.

Thanks so much for the feedback! I will definitely look forward to reading that post.

This isn’t exactly new news – the option has been there for a while, and I’ve used it for a few years now.

For those of us who are self-employed, this is straightforward to implement. You need to set up your own custom IRA plan that allows for both after-tax contributions and in-service withdrawals. All of the financial institutions which will let you open a self-employment IRA have their plan documents set up in a way that does NOT allow that.

What you would need is something called a Third Party Administrator. I use TPA Inc (aptly named). They aren’t in my state and I’ve never met them in person but it hasn’t mattered. Love working with them. They were a little puzzled by me wanting to invest 52K then within a few months rolling the whole amount over – but once I explained it it made perfect sense to them.

The advanced topic question is – how do you invest OVER 53K per year? Afterall the 53K limit is per plan, not per person. If you have two employers (or one employer and self employment ) you could contribute 53K to each plan

What you can’t do is open a second plan for your company. You also can’t create a separate company and set up a separate plan under that. If there’s common ownership (that includes spouses) – there are detailed rules for what that means – then for the purpose of retirement plans it’s considered the same company.

You also can’t use a PEO (professional employment organization) – they will still use your EIN for setting up the retirement plan.

So I’m still looking for options. If anyone has any ideas I’d love to hear.

I talked to my 401K plan administrator. We have both a pre-Tax and post-Tax 401K available under our plan and the plan administrator says that the total contibution limit for 2013 is 17.5K for both the plans put together and not 52K as you mention. Can you please refer to the IRS document that says the combined limit is 52K and not 17.5K.

Sure here’s one link http://www.irs.gov/publications/p560/ch04.html

search for 52,000

here’s an example they list:

Greg can make a nonelective contribution of $52,000 to his solo 401(k) plan. This limit is not reduced by the elective deferrals under his employer’s plan because the limit on annual additions applies to each plan separately.

Your plan administrator doesn’t know what he she is talking about. But it doesn’t matter. If your plan allowed it then they would know about it. That means your plan doesn’t have that option. It won’t help you to rub their nose in it.

There’s a 17.5 limit for contribution per person across all plans; there’s also a 52K limit for each plan. The difference is made up with this Voluntary AFTER-TAX contribution to PRE_TAX plan. The law allows it but the plan document has to have that provision enabled. If your plan’s establishing document doesn’t have it then it’s not an option to you.

Don’t confuse sources as separate plans or what is considered a contribution versus plan deferral limit. The combined IRC limit (yes, IRS code governing the plan type) is $54,000 (2017) annually and typically adjusted for inflation. (unless you are catch-up eligible and those provisions and amounts are different depending on the type of plan. What that means is that if you are covered under two employer sponsored 401(k) plans In total you cannot defer more than an aggregate of $54000 between both plans. This is regardless of source type such as pre-tax, Roth, (combined contribution between those sources is limited to $18000 annually or reduced based upon employer compensation limitations (they say you can only defer up to 50% of your salary and if that is less than $18000 you are restricted to that number)) employer match and possibly profit share contributions (these are non-elective and will contribute to the overall deferral limit. So even if you are covered in two plans that fall under the same IRS code, you absolutely cannot through your contributions and employer matching contributions exceed the annual plan (401(k) being the plan) limit of $54,000. This is all reported on your W-2s and if you are found to have over contributed to the plans you will have to remove the excess contributions and earnings before tax filing deadline of the following year. You will be responsible for paying the taxes on the applicable money (unless it was Roth but responsible for tax on earnings) and subject to penalties if money is not out in time.

The sad part about this issue is the IRS deems the individual as being responsible for making sure limits are not exceeded and the sponsor is not at fault. Be very careful when contributing to two plans simultaneously to understand if you are close to exceeding your limits through EE and ER contributions. This does happen a lot in my line of work and people then have to remove excess contributions. for example: If you work for 6 mos with one employer and max out your $18000 contribution by June but then work for another employer right after, you are ineligible to participate in their 401(k) as you have already exhausted your annual contribution limit.

Suresh – the call center rep who works at your administrator is correct in their contribution information. You do not have two plans but rather a pre-tax and Roth source and the aggregate contribution annually is $17,500 ($18,000 currently) If you have an employer match and or profit sharing contribution made annually (either every pay period, monthly, quarterly, semi-annually, or even annually this amount is above and beyond what you can contribute but reduces any possible amounts you may have eligible for after-tax deferrals if that is a plan option. The administrator does know what they are talking about, and no one ever discusses the plan limit instead of the contribution limit unless your plan has specifically put that source in for additional deferrals. This is largely because the annual contributions are known and dictated by the IRS yearly, but given that many ER matches are discretionary and formulas can change or ER match not even contributed on an annual basis the call center reps do not discuss this as this is typically non-elective by you the participant. If your plan has the optional source, then they will inform you of the additional deferral option up to the plan deferral limit. Another watch out within 401(k) plans is the non-discrimination testing….so, in a really short way of explaining it you may have been able to maximize every possible avenue of contributing up to $54,000, but if you are a highly compensated individual and the ADP and ACP tests fail for the plan you may have to remove excess contributions and earnings attributable to the plan favoring highly compensated individuals. Typically this happens when HCEs want to maximize their contributions but the non-highly comps aren’t either participating or deferring enough. There cannot be a difference of more than 2% between the HCE Average Deferral Percentage and the Non-HCE deferral rate. You could have contributed 8% of your salary and the allowable ADP for HCE is 5.5%, so you will be responsible for removing the amount above the allowable deferral.

Ok, got way deep here. Bottom line is every plan is different, but understand the options available in your plan and how they work. There are always ways to save more, but sometimes we have to be creative.

OverInvestor and MadFientist – what about the ~1M limitation? Is that a hard limit on total funds (401k + Roth + Traditional?) Or is that per account? Is it per person or per family? Does it include gains or just contributions? What happens if it is exceeded?

Jaime, what is the $1m refers to?

Question; when you say the IRA you setup for your self-employed situation, are you talking about a SEP or SIMPLE as those have contribution or rather plan deferral limitations? Then when you say you invested $52,000 then quickly rolled the amount elsewhere, was that to quickly go from after-tax dollars to a Roth and limit the earnings for tax purposes? I mean, you are restricted annually to $52,000 aggregate of EE and ER funds deferred(depending on type of plan) and that is restricted to the plan and IRC it falls under. So I am curious why you’d immediately roll the money out, since you can’t continue to put more money in during that given year?

I totally get the employer sponsored plan (401(k), 403(b), or 457) and their annual limits of $54,000 (2017) aggregate of EE and ER deferrals. Again, this is only if you have the luxury of additional deferral sources above the pre-tax/Roth limit of $18,000 annually and whatever your employer match and possible profit share contributions come out to. Ex. My salary is $250,000, I contribute the maximum of $18,000 and my ER match is 100% of my deferrals up to 7% of my salary. Between those two sources, I am already at $35,500 deferral amount towards my annual limit of $54,000. Add in my 4% profit share and I am now at $45,500 of my annual limit. Therefore, if I have the additional plan provision to defer after-tax dollars, I can contribute another $8,500. But, I cannot then use an in-service withdrawal (even if my plan allows them) to move the money into other possible 401(k) options through another employer or roll them to IRAs and then restart the annual limit amount and invest again within the same year. Once I have exhausted my annual limit I am stuck for that plan and the IRC it corresponds to.

I am only allowed to continue to invest for retirement purposes and utilize the maximum deferral limits if I have access and am eligible to participate in other employer sponsored plans under a different IRC like a 403(b) or 457, or through individual IRAs with their super constraining contribution limits (possibly not having it be a tax-deductible contribution depending on income) and that’s again an aggregate of any and every IRA I have and have made a contribution to.

If I am also self-employed, I can setup an individual 401(k) and set my own parameters and sources but I am restricted to the aggregate limit of $54,000. If there is any employer money put into this it has to be pre-tax to get the corporate or self-employed tax incentive. I suppose you could setup the 401(k) as only allowing after-tax dollars if there are no matching funds or employer contributions made. But, to use a SEP IRA or Simple you are completely restricted. SEPs are entirely ER funded and are limited to 25% of salary or $54,000 whichever is less. Beyond that, the ER gets the tax deductibility of this rendering the money tax-deferred for the employees. You can usually only ever go from SEP to SEP given the nature of the taxation and most rollover/traditional IRAs have a mix of non-deductible and deductible contributions where a lot of institutions don’t want to comingle the assets. (not to say it isn’t done) I suppose you could do a rollover of a SEP then convert to a Roth permitting you pay the tax liability.

With Simple IRAs the EE is restricted to an annual contribution limit of $12,500 and the ER match is then based on the formula of up to 3% of salary annually or a fixed 2% of salary regardless of participation. An income limit is then placed on the 2% match up to $270,000. So, the annual amounts able to be contributed can be more using the 3% method if you are the EE and ER and contributed the max and made a substantial income that year (3% of whatever that is). But again my question is how can these be after-tax sources when the contribution is largely ER and made on a tax-deductible basis?

I am just super curious, because in all my research and career working with ER sponsored plans and having a fairly good plan design, legal, and tax knowledge of self-employed plans; I am wondering what portion of the self-employed plans can you make after tax assets?

Thanks for the great post! It’s very helpful.