The most significant tax-reform bill in decades has just been signed into law – The Tax Cuts and Jobs Act of 2017.

Although one of the primary goals of the new bill was to make taxes simpler, the tax code is still very complicated and littered with loopholes that we can take advantage of.

Some additional optimization opportunities have also emerged, which I’m excited to write about soon. So if you want to be notified when new articles are published, just click here.

Today though, let’s dive into some of the strategies I’ve already written about to see what’s still possible under the new legislation…

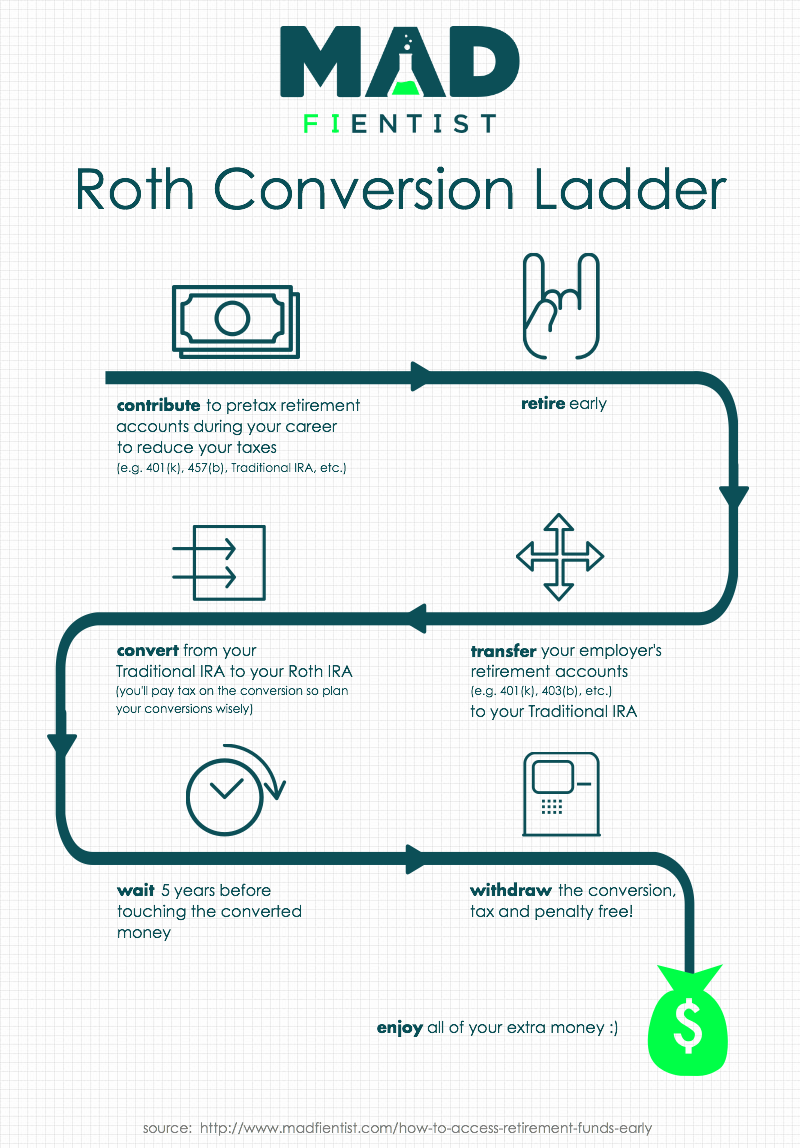

Roth Conversion Ladder

The Roth Conversion Ladder is a strategy that allows you to legally access the funds in your retirement accounts before standard retirement age, without paying any penalties.

Here’s how it works:

- Contribute to pre-tax retirement accounts like 401(k)s, 403(b)s, Traditional IRAs, etc.

- Transfer your 401(k)/403(b) funds to a Traditional IRA

- Roll the money from your Traditional IRA over into a Roth IRA (paying tax on the conversion)

- Wait 5 years

- Withdraw the converted money, penalty free

Here’s a graphic that illustrates the strategy:

So is the Roth Conversion Ladder still valid under the new legislation?

Verdict: Still valid!

The new legislation still allows the Roth Conversion Ladder but if you decide to convert money from your Traditional IRA to your Roth IRA, you can no longer change your mind and undo the conversion.

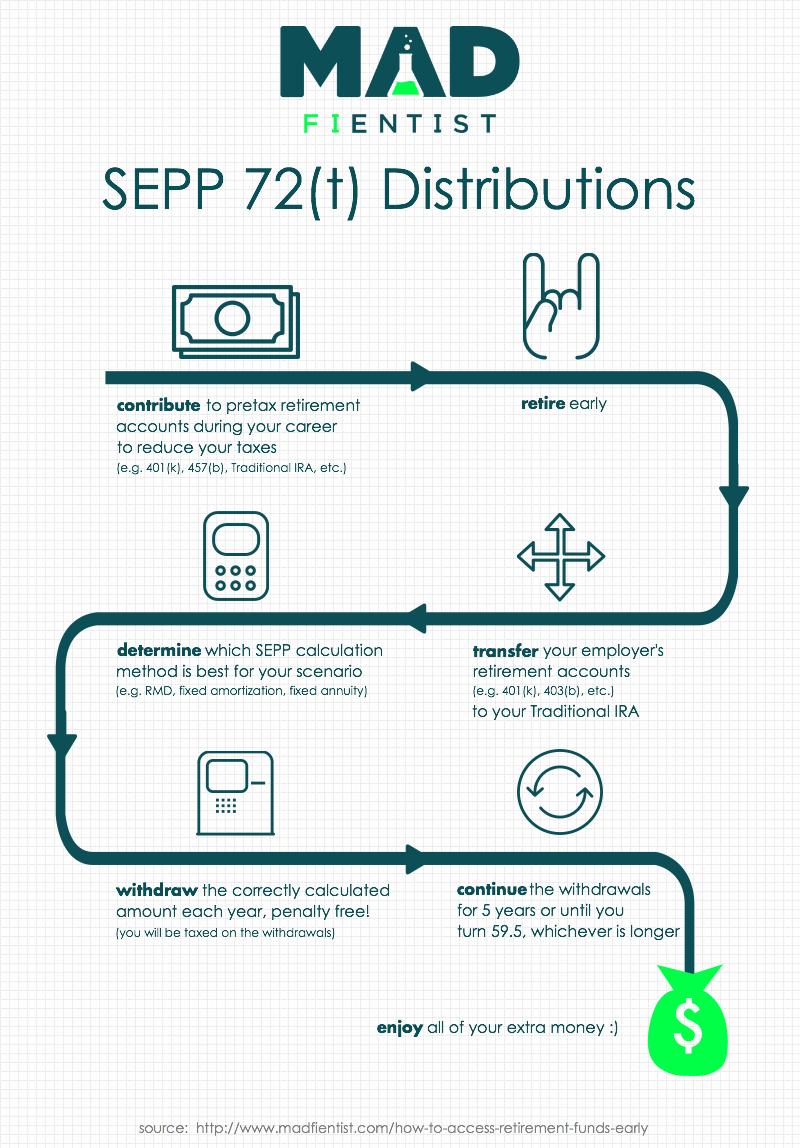

Substantially Equal Periodic Payments

Another way of getting access to retirement account money early is through Substantially Equal Periodic Payments (SEPP).

Here is a graphic to illustrate this strategy:

Verdict: Still valid!

The SEPP rules appear to be unchanged in the new legislation.

Backdoor Roth

The Backdoor Roth strategy allows someone who wouldn’t normally be able to contribute to a Roth IRA (due to exceeding the income limits) to legally fund a Roth account.

The way it works is this:

- Make contribution to a non-deductible Traditional IRA

- Immediately roll that money over into a Roth IRA

Verdict: Still Valid!

Since this is such a blatant skirting of the rules, I figured this loophole would be closed but it wasn’t!

The new tax legislation still allows for the Backdoor Roth but the only difference is, you can’t undo the Traditional-to-Roth conversion after you execute it.

Mega Backdoor Roth

The Mega Backdoor Roth is similar to the Backdoor Roth but it allows you to potentially contribute an extra $36,000 to your Roth IRA every year.

Here’s how it works:

- In addition to your normal pre-tax 401(k) contributions, make additional after-tax contributions

- Perform an in-service withdrawal and move your pre-tax contributions to a Traditional IRA and the after-tax contributions to a Roth IRA

Is the Mega Backdoor Roth IRA still possible with the new tax legislation?

Verdict: Still Valid!

This loophole has also survived!

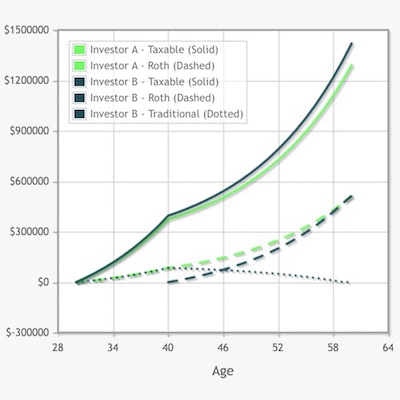

Roth IRA Horse Race

The Roth IRA Horse Race is an advanced strategy that allows you juice your IRA conversions.

You can check out the link above to get all the details but you may not want to waste your time because now this strategy is…

Verdict: Eliminated!

You can no longer recharacterize or undo IRA conversions so sadly the Roth IRA Horse Race and all other IRA-recharacterization strategies are dead.

Tax-Loss Harvesting

Tax-Loss Harvesting is a strategy that allows you to lower your taxes by:

- Selling shares that have decreased in value

- Buying simliar but not identical shares (e.g. selling a Total Stock Market index fund and buying an S&P 500 index fund) so that you realize the loss but remain fully invested

- Using the tax loss to reduce your taxable income

Verdict: Still Valid!

You can still harvest your losses and use those losses to decrease your taxable income.

Tax-Gain Harvesting

Tax-Gain Harvesting is a strategy that allows you to increase your cost basis so that when you eventually sell shares, you have less gains to pay taxes on.

Here’s how it works:

- In tax years that you are in the 0% tax bracket for capital gains, you sell shares that have appreciated and pay tax on those gains (since you’re in the 0% bracket though, you actually pay nothing)

- Immediately buy back the same investment

- Since you bought the investment back at a higher price, you’ll have a higher cost basis and will therefore have less gains to pay taxes on when you eventually sell the investment (or you’ll have a bigger loss to harvest next time you do some tax-loss harvesting)

Verdict: Still Valid!

Specific Identification of Shares

To make tax-gain harvesting and tax-loss harvesting easier and more effective, you should set your taxable investment accounts to use Specific Identification of Shares so you can pick individiual shares to sell.

There were rumors that the new tax bill would require FIFO accounting (First In, First Out) but that didn’t make it into the final bill so Specific Identification of Shares has survived too!

Verdict: Still Valid!

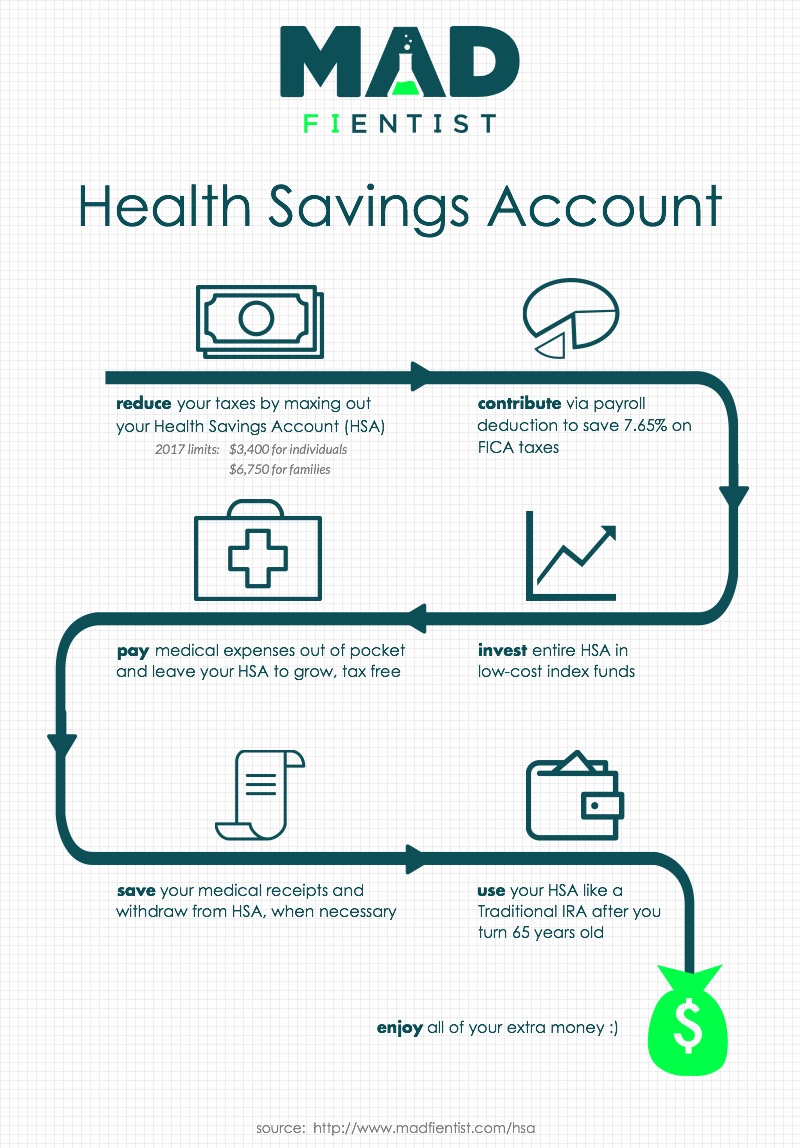

Using the Health Savings Account as a Retirement Account

The HSA is actually the Ultimate Retirement Account when used as an investment account rather than a savings account.

Here is the strategy:

Verdict: Still Valid!

Although the Obamacare individual mandate has been repealed, the HSA rules haven’t changed so this strategy is still valid!

Conclusion

It’s great that all the tax-avoidance strategies I’ve written about over the years (except for the Roth IRA Horse Race) have survived the new legislation.

Not only that, there seem to be some exciting new opportunities that early retirees can take advantage of so I look forward to exploring those soon (I’m looking at you, “20% deduction for pass-though entities”).

It will also be interesting to see if the new cap on state/local/property tax deductions causes people to focus more on domestic geographic arbitrage. Or, if the increased standard deduction makes people realize the mortgage interest deduction isn’t all it’s cracked up to be, resulting in more people renting instead of buying.

There’s still a lot to process with these changes but at least most of the core early retirement tax-avoidance strategies are still in place.

If you want to read more about the new tax legislation, check out this comprehensive summary by past podcast guest, Michael Kitces.

And if you’re a glutton for punishment and have nothing better to do over the holidays, here’s a link to the actual tax bill so you can see all the details.

What do you think? Will the new tax law help you achieve financial independence sooner? Are there any new strategies you plan to take advantage of? Anything you plan to do differently? Let me know in the comments below!

Finally a post on this topic ! Thank you

Did the 457b rules change at all? The house proposed to make it 18.5k total amongst 401k, 403b, 457b etc as well as removing the 457bs early withdrawals without penalties….I can’t find definitive answer….

Check out the white coat investor forum for this topic. My understanding is that 457 F accounts were significantly impacted, and nongovernmental 457 b accounts may have been.

The separate contribution limit for 457(b) plans was not changed. You can still contribute 18.5k (for 2018) to your 403(b), and another 18.5k to your 457(b).

Super helpful; I appreciate the quick breakdown and analysis of each of the strategies, too. It makes for a nice easy reference. Definitely looking forward to reading more about pass-through entities. Thanks, Fientist!

THANK YOU! Thanks for taking the time to figure this out. Any thoughts on pre-paying property tax or becoming a c-corp to further get tax incentives?

I want to try to prepay my city property taxes before 12/31/17 if I can. Looks like it could save me $500 in tax for 2017 tax year, with no implications at all for 2018 tax year. The office was closed, so I have to wait until Tuesday to see if this is possible.

I haven’t done enough research on it yet, but as something to think about:

It seems like Pre-paying 2017 property taxes makes sense if you itemize, are not in AMT, and are able to pre-pay (some counties don’t allow it).

I don’t see much of an advantage to becoming a c-corp as still double taxed (20% at corp level then dividends taxed on individual level to get money out). Where it may make sense would be in estate planning (heirs would get the step up basis in their shares and could pull the money out as dividends and not be taxed at estate rate). I don’t think many people on these blogs have over 20 million though since it is not really the point.

There are rules set up to disallow random people from becoming passthroughs, but may make sense to set up a pass through in certain circumstances.

about c corps and double taxation. this is simply not a prob with proper planning.

if you have a c corp and you and your spouse are the only employees–with part time children, of course–you take all those legit biz expenses that really help lower your after tax living expenses, pour as much as you can into either a 401k or, better, a defined benefit plan. pay yourself a salary that keeps you in the 15% bracket and there’ll be little to no profit anyway so you wouldn’t pay a dividend, Or, you could have a modest profit, pay the 15% corp income tax but if you’ve kept your w2 income to the 15% bracket, the tax on the dividend is ZERO.

What happens to all the “extra” money that the business makes and you aren’t paying yourself through your somewhat low 15% tax bracket salary? Does that money just hang out in your business’ bank account? I’m currently a one-woman-show LLC. In 2017 I made $210,000/gross and $193,000/net. If I paid myself a small salary of, say, $50,000, what happens to the other $143,000? Good at making money, bad at tax strategy and actually running a business.

You would put that in the defined benefit plan. The money has to either be taxed now or tax deferred until later. By waiting until later you can possibly take it out in th 15% tax bracket when you retire.

You should absolutely prepay property taxes assuming you aren’t in AMT. As for becoming a C Corp, that depends on a variety of things. For example, in PA we have a high 9.99% tax rate as opposed to a 3.07% scorp/partnership rate, so in most cases (in my state) it won’t make sense.

Nice! You basically have done the homework for us. I truly appreciate the information.

Oh man, thanks for the link to the actual tax bill, but I am not a glutton for punishment! I have no intention of spending my holidays reading it!

Thanks for the quick summary! Glad to see the tactics I plan to use are still in place! Plus my 457 & 401k double contribution option survived!

Thanks for this easy to read summary! There is so much speculation and mis-information out there, much appreciated!

Thanks, Mad Fientist! As an HSA lover, myself, I thought I’d suggest an additional strategy for your consideration. Note it’s possible and perfectly legal to take a taxable distribution from an IRA, 401(k) or pension and contribute the proceeds to an HSA, up to the statutory limit. Because one is not required to have earned income to contribute to an HSA, it’s possible to use this approach even if one’s entire income stream is derived from qualified plans.

This maneuver results in the tax on the qualified plan distribution being negated by the tax-deductible contribution to the HSA, thus perpetuating tax protection of the assets. This could be quite handy for early retirees who are receiving qualified plan distributions, are eligible to make HSA contributions, and who are trying to leverage the strategy of using an HSA as a retirement account as you describe above.

This is awesome Brendan. Thanks so much for making the effort of reading the new bill and saving us the pain of having to do so. MAD Fientist rocks!! Merry Christmas!!

Ugh…sorry for misspelling your name Brandon. Thanks again for the article!

Is there any reason to convert a traditional IRA to a Roth IRA before early retirement?

Dustin, the reason most wouldn’t want to do this is because the Traditional IRA rollover to Roth IRA is a taxable event. If you are still working, you would be paying your marginal tax rate on every dollar of the conversion. It’s usually better to wait until the spigot gets turned off (you stop getting paychecks) and your marginal tax rate is lower, like 0 or 10% brackets, instead of paying maybe 25% or more on the conversion.

Also, ***important point*** pay the taxes with money you have outside the IRAs, as you want the new Roth funds to continue growing, but taking a big bite out to pay for taxes would hamper their ability to keep growing for you.

It is a function of your income and tax bracket. Normally, income is lower in retirement and thus you are in a lower tax bracket. However, if your time period is long, say 20 years, it’s better to convert early and have the roth grow tax free at a compound rate.

Ralph, picking on just the one sentence of yours. Time period is totally irrelevant! It only matters what tax rate is when making contribution vs when making withdrawal.

Bob – You raise a good point as I think many people may misunderstand the math.

However, if you are contributing the maximum using after-tax dollars you are effectively contributing more vs per-tax. Even if you invest your pre-tax savings, there are cases when a ROTH could make sense – and one component of that decision is period of time. The longer the period, the better chance a ROTH will outperform Traditional + taxable account. Of course lots of assumptions come into play – this articles does a good job explaining it further with a nice spreadsheet to play around with the numbers: https://thefinancebuff.com/roth-401k-for-people-who-contribute-max.html

I am a small business owner, Dustin, and the Roth is way better for me than the traditional since it grows completely tax free. I have been doing Roth’s since 22 and the tax-free growth on that account will be millions of dollars.

I also do some SEP IRA and convert those contributions to Roth at the year’s end. The only reason not to do a conversion, if you’re young, is if you can’t pay the taxes with money outside of your accounts.

Just my opinion but it works for me!

Good summary Brandon. I’ve been following this legislation through it’s various iterations, and was glad to see most of the strategies you’ve written about survive. At one point there was chatter about limiting pre-tax contributions to either 401k / 403b or 457 up to a combined limit (~$18.5k), but not being able to fully fund both types of accounts up to that limit. I was glad to see that this provision did not make it into the final bill (at least this is my current understanding). The ability for me to fully fund a 401k and my educator wife to fully fund a 403b and 457 is a big piece to our FIRE plan. Thanks for your leadership in this community, and keep the great content coming. Looking forward to reading more from you in 2018!

Nice quick summary – that’s what I gleaned from the new bill as well.

Awesome post. Very clear and concise. You were able to — in a few lines — clarify the difference between the Backdoor and Mega Backdoor Roth, which, embarrassingly, is a distinction I struggled to grasp. I think I speak for us all when I say, we look forward to more content! (Fantastic podcast this week, by the way.)

Looking at it based on these best practices the bill seems pretty good. We lose the IRA horse race but keep the rest.

The bill is unfortunate for those of us in states with high income and property taxes. I guess we can always move though.

Excited to read about all the new hacks that are discovered.

I was happy and surprised to see most of the strategies survive intact. The recharacterization horse race seemed like kind of a PITA, so I’m not sad to see it go. I’m very happy to see TLH survive — 2017 didn’t present any good opportunities, but I made out like a bandit with $45,000 ini paper losses in 2016, a year in which the market actually went up about 12%.

I had a great guest post about the pass-thru deduction (yes, they spelled it “thru” in the legislation — I need to correct my post) published yesterday. For people like me in a “service industry” the deduction phases out at taxable income from $315,000 to $415,000, but at the sweet spot of $315,000, the deduction of $63,000 is worth over $15,000 per year.

For people like the blogger in me, there isn’t such a limitation for a pass-thru business not considered a service industry (also architects and engineers). It’ll be an even better deal for these types of businesses.

Personally, I’m happy to be getting a child tax credit for the first time ever (phaseout starts at $400,000 versus $110,000 in the past for married folks). I also expect to be in the 24% tax bracket rather than 33%. Those are a couple huge wins for us.

Action item for those who are charitably inclined: this might be the best time to open a Donor Advised Fund if you have been considering it. You still have time to get it done by 12/31/2017. My rationale here: https://www.physicianonfire.com/the-sunday-best-12-17-2017/#daf

Cheers!

-PoF

Tremendous thanks for making this content available. These are exactly the kind of things that have been on my mind, it’s great to have someone break everything down so directly.

Nice run-down! I wanted to give a couple of updates on how the bill affected real estate tax strategies. During negotiations several of the tax benefits I wrote about for you here: https://www.madfientist.com/tax-benefits-of-real-estate-investing/ were potentially on the chopping block or at least up for being tweaked.

For example, the Live-In-Flip time period which is currently 2 out of every 5 years living in house to get exemption from capital gains ($250k individual/$500k couple filing jointly) was discussed being extended to a longer, less favorable period. And rental income was discussed as being taxed with FICA taxes.

But in the end, it seems the current laws were retained for both of these and other tax laws that affect real estate investing. The National Association of Realtors have a nice summary of how the tax law affects real estate: https://www.nar.realtor/taxes/tax-reform/the-tax-cuts-and-jobs-act-what-it-means-for-homeowners-and-real-estate-professionals#!#Current%20and%20Prospective%20Homeowners

It’ll be interesting to see how the higher priced real estate markets and 2nd home markets are affected by the limits on interest and property tax deductions. Could affect prices. But investment properties still have interest and other expenses as fully deductible, so shouldn’t affect most real estate investors.

I am most impressed that you got this article written and turned around so fast. You are going to need to put your typing fingers in cold water (or around a cold beer) and rest for the remainder of the holidays. Lol.

Just when I started to get frustrated with posts with incomplete info, not knowing whether I grasped everything relevant for frugal FIRE-aspired people, your post answered all my lingering concerns! No post that I have read so far summarizes so succinctly all key strategies we need to keep in mind and plan for in advance. You are a marvel MF!

I look forward to your insights into new tax benefits for self-employed income.

It’s too late for early retirement for me. I’m going to turn 65 in April. I started contributing to my 401k through my company when I was ~40 and just starting to raise a family. As with others, the market’s been pretty good to me, except for a couple of bumps along the way; so far.

My present company matches my 12% salary, pre-tax 401k contribution with a 9% contribution of their own. Instant gain!

I verified the following article’s content through our retirement specialist. https://www.kiplinger.com/article/insurance/T039-C000-S002-when-to-sign-up-for-medicare-when-to-delay.html I recently discovered this article stating that if I didn’t sign up for ANY Medicare at 65, I could continue to purchase my subsidized HDHP (MUST be a high deductible plan) though my employer. This allows me to continue to contribute to AND max out my HSA every year with the 50+ catch-up provision! My employer also contributes an annualized $1000 towards my maxed out HSA contributions. I plan to retire at 70. This should help bolster my nest egg.

Thank you for your excellent summary of the new tax law strategies. I’ll definitely begin using my HSA to contribute to my low-fee index fund I already have, as well as consider your other strategies.

-dougbert

careful about medicare. the cost to retirees goes up every year, the only way to combat that is to take social (in)security and at 65 pay for medicare by having the payments deducted from your social (in)security check. Read this

http://danielamerman.com/va/BenefitAge.html

We’re still working on our capital gain harvesting for 2017. Should be a good chunk of tax free capital gains. I’m happy to see they didn’t change that up on us :)

Cheers to the ER life, and best of wishes for you in 2018!

Thanks! That was a great post. Didn’t know about most of it :)

Brandon – Thank you for the outstanding analysis, both in recapping the tax strategies and restating that almost all of them are included. Thank you for the work you do for the FI community

Thanks for a great summary!

Did you talk about what tax bracket you need to stay within in order for capital gains to remain tax-free? I would think it would be 12% but I haven’t read it anywhere.

Also, I keep reading about the “tax breaks for individuals expiring in 8 years” but what part? Is it just the deductible increase that’s expiring or the tax brackets reverting to previous levels or both.

Thanks again!

Excellent questions, Amy! I’ve been wondering the same.

I have the same question. I just bought a house with the intention of living in it for two years and then selling it to get the capital gains exclusion. But in the new law you have to live in a house for five years instead of two in order to get the exclusion on your home. But if my income is low enough, I might be able to take advantage of the tax-free capital gains rule.

Per go curry cracker, it’s no longer coupled to tax rates: “Under the new law, the amount of tax free dividend / gain income is no longer coupled with the other tax brackets. Now we have to look up another number (simple, right?) fyi, for 2018 those numbers are $38,600 for individuals and $77,200 for married couples”

http://gocurrycracker.com/tax-reform-early-retiree/

Michael Kitces has a good image which compares income tax brackets and dividend brackets: https://www.kitces.com/wp-content/uploads/2017/12/Graphics_5-2.png

Brandon-thank you so much! You never disappoint. Finally a post on this topic! Very helpful! One topic i’d like to get a better handle on is: I have heard the mandate that “every American must have health insurance or else will be fined” has been repealed. Given this change, how does this affect our budget for healthcare in Early Retirement?

And Best Wishes for the Christmas season and wishing you a happy, blessed new year ahead!

Great rundown Brandon, I’m also surprised that so many of these strategies survived. I really have to work on the Tax Gain Harvesting as I’ve been missing out on that strategy.

Thanks for the great post, surprised you didn’t mention the deductibility of 529 plans now being extended to K-12. Looking forward to your thoughts on that!

Thank you so much for this post and all of the great work you do. It is much appreciated!

Brandon – great post, thank you for early assessment on the new laws!

Nice focus for this tax article, it definitely stands out as a unique and useful take on it. Though we haven’t had a chance to take advantage of many of these, we’re getting there…just did a trial Mega Backdoor Roth (surprisingly easy) and have been maxing the HSA for years. Looking forward to take advantage of the others while saving a decent amount on taxes until we FIRE in a few years. I may not agree with the legislation, but I won’t turn down the savings. It’s even prompted us to start our DAF early this year so we can get our charitable giving plan in order.

Thanks for the great info!

Thanks a lot for taking the time to do this for us!!

Thanks for the rundown on these, Brandon! It’s good to hear that most of these strategies are still good to go.

We just started following your strategy to use our HSA as a retirement account (thanks to you!). We’re also planning to start a Roth IRA Conversion Ladder in 2 years, so this breakdown is fantastic news!

— Jim

Thanks for the simplified breakdown!

Thank you Brandon for keeping us informed! Here’s wishing you and yours a cool yule! Happy New Year too!

Brandon,

Timely article. Thank you. This fellow Tar Heel is assuming recharacterizing a Roth to a Traditional IRA would also no longer be possible for people like me who are borderline Roth eligible each year (income limits). For the last several years I’ve contributed to a Roth only to have to go back and convert it to a Traditional due to my income making me ineligible for a Roth. I guess I need to either forget about new Roth IRA contributions (wait until early retirement to convert), or find out more about penalties for contributing when you are financially ineligible under the new law (they are pretty steep now). Thanks again for the update. Rob

Rob,

Maybe I’m missing something but why not just do it the other way? Contribute as a Traditional IRA and then do a Roth conversion to move the money into your Roth. This should completely avoid the income limits for the Roth and there aren’t (I don’t think) any income limits for a Roth conversion. My wife and I do this with our SEP IRA… just contribute in the pre-tax IRA, do a conversion to a Roth, and pay the tax on the conversion amount which we would have paid anyway with a Roth contribution. As an added bonus (for SEP users) it allows higher contributions to your Roth than you could do otherwise by using the SEP contribution limits instead of the Roth contribution limits. But even with a traditional IRA it takes care of all of your issues.

Dave,

Funny I am re-reading this over a year later. The process you mentioned would be great if my tax bracket now didn’t make this so expensive (32%). I plan to wait until I walk away from my career and do the Roth conversions when my (passive) income is more in the 10-12% tax bracket. I’ll let the 20+ years of Simple IRA contributions continue to grow tax-deferred and take small chunks out over the next 30+ years to stay in the 0-12% tax brackets on conversion years.

Forgot to mention the most important thing. As someone with an active Simple IRA and another Traditional IRA (from a previous job with horrible 2% fees that I rolled over to Vanguard when I left the company) make a traditional to Roth conversion complicated now. I could probably find someone smarter than me to explain how to do this (traditional to Roth conversion when you have 2 or more traditional IRAs), but I haven’t found this person yet. Any suggestions?

I have the same problem. I contributed to my Roth IRA account this year and received larger income, which makes me ineligible for a roth contribution. I converted it to traditional IRA to be later converted back to Roth IRA based upon my broker’s suggestion. However, I just read this article after the fact and I’m now not sure if I convert it back to Roth IRA. Does anyone know?

Thanks a lot for this summary!

Excellent post. Thank you for the easy to read summary!

This is why Mad Fientist is best in class for me for tax information. Timely, accurate, punchy, what I want to know/to the point, and written so simply than even a moron such as I can understand it! :) TY

Yup moron here ;p can attest this!

Never even heard of a IRA horse race before so I guess it’s no love lost :] thanks for the report. Glad to see HSA & backdoor survived.

Brandon, the ability to tax gain harvest will be significantly reduced for those who currently itemize. This is due to personal exemptions being combined with the new larger standard deduction (they will no longer be separate from the Itemized or standard deduction). All of this results in a reduced ability to reduce your taxable income below the 0% capital gains threshold, especially for large families. Personally I stand to lose about 28K in personal exemptions (big family). This may be the last year of capital gain harvesting for me.

Great post! There are two questions for everyone that I could use some help with:

1) With the bigger child tax credit, the triple-tax-advantaged HSA will not lower my income taxes at all. Does that mean I should ignore the HSA and put that money in taxable? Index funds in taxable are still quite tax-efficient. The only advantage of the HSA I can see in this situation is lowering my assets for college financial aid, which does not seem to be worth the potential 20% penalty if I need access to the money for non-medical reasons in early retirement. Does that sound right?

2) Are non-refundable credits subtracted from tax due before or after a refundable credit? In other words, with tax due (before credits) of $2,000, but then using various non-refundable credits totaling $700 (child care, saver’s, foreign tax, etc.) and a child tax credit of $2,000 (that is completely refundable up to $1,000 and partially above $1,000), would there be a refund of zero, about $1,120, or something else? I am assuming zero, but a different answer would affect my strategy.

Great article. My wife just sent a text to our accountant and he said that you can still re-characterize up until April 15th 2018 if needing to. Then after that, game over.. Is this true? We wanted to move $$ over this week and have never done it before, so hopefully we hit the nail on the head!

You are a genius with numbers and tax. Thanks for all the information you have posted. I am 31 with a goal of retiring early at 40. I file my taxes as Married filing jointly and my wife stays at home taking care of the baby. I do max out on MY 401k & MY Roth IRA and for my wife a 5500$ for Traditional IRA.

Can I use Backdoor methods to create a Roth IRA on my Wife’s account along with Traditional IRA?

I am wondering if you see merit in doing a BackDoor Roth IRA conversion for my wife to convert Traditional IRA to Roth to start the 5 year window rolling.

Thanks

John.

I know it’s probably more of a guess right now, but any thoughts on what repealing the health mandate impact will have? I have read both sides of the argument, but it does seem it’s one step closer to getting ACA to go away. I hope that is not the case, but if premiums continue to rise and there is no way to stop it, not sure it can survive?

Thanks!

Are IRA contributions still deductible under the new tax law? I haven’t seen that question addressed.

Ben, yes IRA contributions are still deductible; but the limits have changed and there at a certain point are only partially deductible. Fidelity has a good calculator for this year and 2018.https://www.fidelity.com/calculators-tools/ira-contribution-calculator .

Excellent analysis :)

I don’t suppose you know of any equivalent online repository of relevant information for the UK structure?

I do what seems obvious in terms of tax minimisation and efficiency but am always keen to discover if there is anything I missed that someone else knows about.

With the 20% 199A deduction, how will that impact solo 401k contributions? For a sole proprietor or Single Member LLC, will the Profit-sharing contribution be based on the net-profit before the 20% deduction?

I’m a consulting engineer and I spoke with my accountant about this. The 20% deduction is based on your business income AFTER contributions to pretax accounts. So contributing to a pretax retirement account reduces the deduction slightly.

I currently have a SEP-IRA and am I in the 25% tax bracket. So I would still get slightly more of a deduction in the present by making the max contribution to my SEP-IRA, but I suspect that I would be better in the long run by setting up and max-ing out a Solo ROTH 401k.

I’m getting married this year, and my fiancee has a 403b that she doesn’t contribute to (she has a pension). So my accountant recommends maxing out her 403b before contributing to my retirement accounts, which I will do. Then I’ll set up and max out the ROTH 401k.

Buying similar but not identical shares is an interesting tax-loss harvesting method I hadn’t thought of (and probably thought wouldn’t have thought was valid) that I’ll have to try should I ever have taxable investments. For now, though, all my investments are in tax-advantaged accounts such as 401ks and Roth IRAs.

Brandon, You knocked it out of the park, like you always do! Thank you and well done.

Hi – i was recently laid off and currently don’t have a job as 2018 starts. I have $500k in an IRA and wonder if there is a way to convert it to Roth and take advantage of no income tax if I don’t work this year? I can’t find a clear answer…can anyone help? Is it treated as untaxed, or does it trigger income tax on the exchange?

Thank you for breaking this down!

I haven’t got around to breaking down the new tax law on my own, so I appreciate your analysis on it! I am going to start actively researching HSA’s because I am eligible for one through my employer, but I simply don’t know enough about them yet. The majority of my families assets is tied into our 401(k)’s and Roth IRA’s.

Thanks again for the breakdown!

Awesome summary.

I’m glad they didn’t destroy a lot of the tools in your toolshed.

This post is simply awesome. The second I heard that the tax bill was law, I knew you would come to the rescue and discuss the Roth horserace and conversion strategies.

Thank you, as always!

My employer offers a matching Roth 401k contribution. Could I withdraw the employer match as part of the contribution portion and not be subject to tax? I’m thinking in terms of funding early retirement and being able to with Roth contributions tax free.

Or is the employer Roth contribution placed in the same category as earnings and therefore subject to tax?

An employer’s match is always pre-tax regardless of how the employee makes their contribution.

I’m looking forward to your “20% deduction for pass-through entities” post.

I’m interested in how the new tax bill deals with long term capital gains and qualified dividend. I heard Congress wants to base upon income instead of tax brackets like before. Can you do a post on this and provide examples please?

As far as I know there were no significant changes to LTCG Taxes. Incidentally, while they changed the tax brackets for 12%, 22% etc. They did not change the thresholds for 15% LTCG, so you need to be aware of the discrepancy if you are maximizing.

Hi MadFIentist or MF fans, I have a question on Roth IRA contributions. I am interested in contributing the full amount to a Roth IRA account ($5,500) in 2018. However, I think by the the time the year is over, my adjusted gross income (AGI) will be more than the IRA allowed limit to contribute the full amount to a Roth IRA. What happens to the $5,500 that I would have already put into the IRA account?

Thanks in advance for the help.

Bobby,

If, towards the end of the year, you see you will be over the limit, I would withdraw the contributions, along with the interest and dividends. You could also re characterize the contribution to traditional. Then, if you want it to be in a Roth account, you can convert it back to a Roth (backdoor Roth).

Here is a link that does a great job of walking you through the options.

https://www.thebalance.com/what-to-do-if-you-contributed-too-much-to-your-roth-ira-3192888

MadFientist (or others),

I know this will sound misguided, but what would you recommend if I wanted to invest, be financially independent at 50, but am not planning on retiring until well into my 60’s, or even 70’s, after which I would start to get hit with the RMD. Would you still recommend investing in traditional retirement accounts and planning a Roth Conversion Ladder, or should I stick with investing in Roth accounts? My question is not around IRA’s, but 401(k)’s. I am self employed, and have an Individual 401(k), with a Roth option available.

Thank you!

Aaron my $.02, it really depends on what your tax bracket is now versus what you might think it would be through your 50s-60s life versus your 70+ life. Both as far as your earnings as well as where federal tax brackets might go (most seem to say taxes need to go up to cover deficits and entitlements) as well as whether you might relocate to a different state or country, what your social security payment will be, etc.

Being self employed is great in that it can give you some flexibility in setting your salary and potentially deferring income to manage taxes.

You really have to run your own numbers and predictions.

Some things to consider;

– Give yourself flexibility with piles of both pre- and post- tax money

– If you might have extended periods of underemployment or vacation in your 50s-60s then consider building up some pre-tax traditional IRA money that you could convert to Roth at that time, assuming you are below the non-taxable traditional IRA phaseout.

– If you basically expect you bracket to remain the same through your 50s-60 and you are Roth eligible, contribute to the Roth. The younger you are the more valuable the tax free growth in the Roth is.

– Depending on your situation in your 60s, you might start converting some pre-tax IRA/401K money before you start taking social security and taking RMDs. The nice thing about the Roth is there aren’t any RMDs to worry about.

Not knowing any of your details I would say;

– Apply some money to the Roth Ladder if you think you will have a period of time where you can convert it to Roth at a low tax rate

– If you don’t expect years where you can do a low-tax conversion then just put money in the Roth 401K if you think your going to have so much money that RMDs will push you above the 15% bracket.

Back Door Roth: One point that I think should be stressed here is that if you do this, you are taxed on the weighted avg of ALL of your traditional IRAs so if you have some existing traditional IRAs (let’s say from previous 401k rollovers) then you will be taxed. You can’t just open up a new IRA, contribute after-tax, and then convert to Roth. The IRS looks at all of your IRAs combined. To skirt this, you would need to convert those existing IRAs back to 401k if your employee allows or any other mechanism.

Hi, I retired in 2017 at age 53 and transferred my lifetime 401(k) funds to my traditional IRA. This is the first year where I thought making a small, traditional to Roth IRA conversion would be feasible. But then I learned that any amount I convert will be viewed as income for my ACA insurance plan and reduce or eliminate my premium subsidy. In my situation, even a small conversion, under $18,000, could wipe out my subsidy, valued at $4,170 for 2019. It makes no sense to me to pay income tax on the conversion and lose my subsidy. I have been researching this issue online for over a week now and have yet to find a workaround. If you have suggestions, or can let me know if there’s something I’m missing, I sure would appreciate it. I know the RMD age has been increased to 72 with the CARES act and there is talk it may increase to 75, but I would still like to convert as much of my traditional to my Roth as possible over the next 16-19 years. I currently have enough funds in my taxable account to fund my living expenses for 10 +/- years. Thanks!

yes, it’s hard to quantify the loss of even a partial subsidy due to increased income because of converting to a Roth. I am waiting until I get Medicare and then doing my conversions.

What about that 300 in above the line donations? It looks like filers not itemizing can donate up to 300 and deduct from AGI? And donations under 75 that generate benefits (like a membership that comes with free parking) also qualifies?

Am I interpreting that right?