Today on the Financial Independence Podcast, I’m excited to share a live Q&A session with Mr. Money Mustache, Paula Pant from Afford Anything, and Doug Nordman from The Military Guide!

This panel discussion took place back in May at Camp Mustache — an annual retreat in the Pacific Northwest organized by Mr. Money Mustache readers.

In this episode, you’ll not only hear about…

- Mr. Money Mustache’s biggest splurges

- The investing mistakes I still can’t seem to avoid

- Paula’s favorite thing about financial independence

- Doug’s suggestion for discovering the meaning of life

…, but you’ll also get varied and diverse perspectives on some of the most important questions facing those on the path to financial independence and early retirement!

Listen Now

- Listen on Spotify or Apple Podcasts

- Download MP3 by right-clicking here

I want to give a big thanks to my co-panelists for taking part, the Camp Mustache attendees for asking great questions, Will from Afford Anything for recording the backup audio, the Camp Mustache organizers for inviting me, and Gwen from Fiery Millennials for the picture!

Highlights

- Top recommendations for people who are close to achieving financial independence

- How to stay motivated when pursuing FI

- What is the meaning of life

- How to foster a good online culture and community

- Tips and tricks to stop you from trying to time the market

- The biggest challenges of reaching FI and how to overcome them

- What we splurge on and why

- Mr. Money Mustache’s thoughts on being featured in the New Yorker

- How to handle changes in your relationships after reaching FI

Show Links

- Mr. Money Mustache

- Afford Anything

- The Military Guide

- Financial Independence Podcast #01: Mr. Money Mustache – Early Retirement Made Easy

- Financial Independence Podcast #04: Afford Anything – Dive Into Real Estate Investing

- Camp Mustache

- Leave a review for the Financial Independence Podcast on iTunes

Full Transcript

I’m really excited about today’s episode because it’s unlike any I’ve done before. This one was recorded live back in May at Camp Mustache in the Pacific Northwest.

If you’re not familiar with Camp Mustache, it’s a weekend conference put on by Mr. Money Mustache readers. It’s about 50 people. They all come to a really cool lodge in the middle of the woods in Washington state and spend the weekend hanging out, talking finances, drinking beer and roast marshmallows in the campfire. It’s a really good time.

But on the last day of Camp Mustache, it’s usually a time when Pete, a.k.a. Mr. Money Mustache, takes questions from the audience. We sit around, and he answers everybody’s questions.

So, I asked if I could hijack that session this year and do a panel discussion where the audience members ask a bunch of questions and we record it as a podcast and record all the answers. It was a lot of fun to do. There were some incredible stuff that comes out of it.

So, here it is. It’s a panel discussion from Camp Mustache with Mr. Money Mustache, Paula Pant from Afford Anything, Doug Norman from The Military Guide and me, The Mad Fientist.

Mad Fientist: Alright! Welcome, Camp Mustache.

[crowd cheering]

Nice! Welcome everybody. I’m really excited to get two old podcast guests back on the show. My first ever interview is sitting to my right—the main man himself, Mr. Money Mustache.

Mr. Money Mustache: Thank you, Mr. Fientist.

Mad Fientist: Welcome back. It’s been over four years since we last formally chatted.

Mr. Money Mustache: Yeah, that’s true. I think I’ll be more polished this time.

Mad Fientist: You were great last time.

And then we’re moving on to my fourth podcast guest ever, which is still way back (I think probably in 2012), Paula Pant from AffordAnything.com.

Paula Pant: Thank you! I can’t believe it’s been four years.

Mad Fientist: And finally, on the panel, we have Doug Nordman, a.k.a. Nords, from the Military Guide. He’s not been on the show yet, but I just locked him down this morning for a future interview. So welcome, Doug.

Doug Nordman: I’m just happy to be here.

Mad Fientist: We are sitting here in a beautiful lodge in the Pacific Northwest. There’s literally not a cloud in the sky. We just had a really fun, intense weekend. You could probably tell that I’m almost losing my voice. Hopefully, it holds out. But lots of great chat. This is usually what rounds off the camp. It’s usually everyone ask a lot of questions. But I asked if I could record everything, and then we squeezed up here too.

So, yeah, we’re just going to kick off with some questions from the audience. It may be directed at one of us, all of us. It’s all going to be interesting. So, for the first question…

Audience Member: Hi, I’m Kevin from Redmond, Washington.

[crowd cheering]

And my question for the panel is, “What is your top recommendation for people who are close to FI?”

Mad Fientist: So, I’ll hand over to the Stache, since he’s the guest of honor here.

Mr. Money Mustache: I think mine would be it depends on what your issues are. But most people seem to have an issue of being afraid to quit. They often get “one more year” syndrome or “Am I really going to be okay after I give up this fire hose of cash from my real job?”

So, for people like that, it is to just set an arbitrary date, which might be this afternoon, and just do it because the sooner you get into the new, exciting experiences of this new life, that’s when the growth resumes.

And that’s the whole point of retiring early and starting new adventures, getting the growth. So delaying the growth is often a problem in people like they make that happen five years or more past when they could’ve been out there doing new stuff.

Paula Pant: I’d say my top recommendation is to think about what your “moving into.” There’s “moving out” of something, whether that’s a job or whatever is the current thing in your life that you want to escape or leave. But then there’s also “moving into” something that really excites you. So, focus not on the escape, but the new opportunity.

Doug Nordman: Start making a list of what you’re going to do all day because it’s going to be a long list, and you’re not going to get half of it done.

Mad Fientist: Yeah, that was very similar to what I was thinking. Think of those big projects that you want to do and get a start, so that when you lead into early retirement, you have some momentum.

I still haven’t gone there yet, so this is all my thinking. But when I took three months off at the beginning of last year, I had plans to do all these great things, and Parkinson’s law says whatever amount of time you have to do something, that’s how long it’ll take, so I had three months of to-do stuff and that’s how long it took, I really didn’t get stuff done I wanted to.

So, I think rather than having a big, daunting start to something new once you have all the time in the world, I think it would probably be more beneficial to start that hard thing now, and have some momentum going into joblessness.

We’ll see if that works out, but that’s what I would suggest probably.

Question number two…

[crowd applauding]

Audience Member: This is for anybody who would like to answer.

What words would you share with someone new to mustachianism to keep them motivated on their financial independence journey?

Doug Nordman: Humans suck at estimating exponential growth. And so you’re going to start this journey. A year later, you’re going to be 1% of the way along the journey. A year after that, you’ll be 2% of the way along the journey. And it seems like it’s going to take forever to finish the journey.

However, 10 to 15 years into it, one day, you’re going to look at your finances, and realize that you’ve made tremendous progress over the last year. It’s almost as if you have an extra person in the household with a separate salary, and they’re almost earning as much as you.

A couple of years later, that investment growth is going to be getting more than you’re earning at your current job, and that’s when you realize that you’re just about financially independent.

So, stick with those first numbers of years, whether that’s 5, 10 or 20 years, because the exponential power of compounding is growing all that way, you just won’t appreciate it until the final few years.

Paula Pant: The main thing that I would emphasize is that—a core part of my philosophy has always been, “You can afford anything, but not everything.”

Every dollar that you spend is a trade-off against something else. And I think that a lot of people, if you’re looking at one purchase in isolation, it’s very easy to justify that particular purchase. But if you think of it as a trade-off either against another purchase or against your time, then that contextualizes it a little bit more.

And then it doesn’t feel like deprivation. It just feels like, “Oh, I’m just choosing x instead of y” regardless of what that x is, whether it’s travel or just having more time to spend with your family and friends, whatever that is that’s more important to you than this shiny thing.

Mr. Money Mustache: I think if you’re not sure what you’re going to start with, it might be good to start with a philosophy of life and read about—if you want to read some stuff or listen to some audio books or whatever about just ancient principles that were around before we became this fancy society that we are right now, things like stoicism and quest for having a reason to be alive.

And basically, what it boils down to is enjoying hardship and practicing voluntary hardship every day—for example, just having a bit less clothes than you might normally wear outside, just all these other things.

So, it’s finding ways to trick yourself into being challenged each day. That’s a way to immediately make your life become more meaningful.

And even if you’re still at the very beginning of getting your finances in order, having this as a framework suddenly makes everything else work better. Suddenly, you can earn more money, you can spend less money because you engage in this quest to make your life better which happens to involve doing difficult stuff.

And most people, we’re trained in this country to avoid difficult stuff. And so that’s the first thing I think you got to get rid of if you want to get anywhere that’s different from the other people.

I just made that up.

Mad Fientist: That’s awesome.

So, you said something about the meaning of life. And that’s an interesting challenge that’s been coming into my life recently. It’s like a job easily distracts you for x number of years. And then maybe children distract you for a number of years. You really don’t have to answer that fundamental question like, “What’s the point of me?” or “What’s the point of all of these?”

But as someone who doesn’t have kids (and may not have kids) and who doesn’t have a job as of August 1st, any recommendation from anyone on the panel? What do you do to work towards a meaningful life? Anyone want to take that on?

Doug Nordman: I recommend buying a longboard and surfing. After a while, you’ll find your meaning.

Mr. Money Mustache: I like Nords’ answer even though I don’t surf. It’s just a fulfilling passion of something that’s difficult and cool. And you can get better at it over time.

And so, for me, that’s like carpentry. That’s my longboard and waves. That just sticks with me through my whole life. Everything else is a framework around that, this core passion.

So, you got to do something with your days.

For our next question.

Audience Member: My name is David Fox. I’m from Colorado. So I had a question maybe if you guys could kind of rewind your minds to when you’re first starting your FI journey, so whether you were like seven years old like Pete.

I don’t know, maybe you guys were in your early 20s or decided that you just hated your job and wanted to do something else, and maybe three or so years into your FI savings, if you had any doubts or any troubles along the way. Maybe you’re working a job that you don’t like that can pay you to a point where you have FI. Maybe you’re just not finding other people who identify with the way you’re thinking.

Maybe you could share an anecdote or some advice that kept you on that path or the step that you took to keep you going. I’d be curious to hear that.

Mad Fientist: Well, I know for me personally, I don’t think it was motivation to keep pursuing FI. It was more I want the opposite way and went so hardcore that I made myself really unhappy during that process because I just didn’t want to do anything that involved spending money. I just wanted to get there as soon as possible.

So that’s the big recommendation I would say not to do. I’m going to pass to someone else as far as what your specific question was, but I figure I’d chime in before and just make that point.

Focus on the power you’re getting along the way with all that money that you’re saving up, and use that power to make your life a lot better along the way. Don’t sacrifice happiness for that final number in the bank. One extra dollar in your bank account is not going to make you really happier. Work on happiness while you’re pursuing it.

Anyone want to take that question from David?

Mr. Money Mustache: I have something in my mind for that. For me, that point was maybe when I was like 27 or 28 years old and I’ve been working in engineering for close to 10 years—eight to ten years depending when you count the start date.

And so I was getting a little tired especially with this big company I worked at. I found I had to practice gratitude a little bit, remind myself how great this job was compared to working at a gas station like I did when I was 15 and remind myself that I was still in Boulder, Colorado and doing all these great stuff.

At the end of each workday—I worked on the fourth floor of this 4-storey building—I remember I was kind of like jumping down the stairs at the end of each work day zigzagging down to where I parked my bike. I remember thinking, “Okay, that’s another $400 or whatever which is another”—and I would calculate how many more weeks closer I’d pulled in my retirement because, by that time, $400 earned that day, I wasn’t going to be able to spend until 20 years in the future, so it would’ve compounded to thousands of dollars.

So, anyway, I was like, “Yeah, I just subtracted another 39 days from my work life.” Little mental games like that just made it feel like I had accomplished a lot in one boring day. And then, I was also reminded that the job was not that bad.

It passed pretty quickly, so I was happy. And then, when I quit, it was just like a really, really guilt-free, wonderful experience because I was like, “I did not miss that job at all.”

The next day I woke up, and that was the last I’d ever thought about, going into the office.

Mad Fientist: Excellent! Nords, how was it when you were coming about with this? I’m not sure there was this many pieces of external information that you could fall back on to help you during your journey? It’d be interesting, one, to shortly tell your story, and then two, to see how would you answer that question?

Doug Nordman: We were doing this with clay tablets with styluses. And then, the number zero was invented.

The early days, all I knew to do was to say, “I knew you had to save a certain amount of money.” I had no idea what I was saving it for. I just knew that I just needed to save a certain amount of money.

And maybe for your initial journey towards financial independence, you’re going to start getting out of debt. Maybe you’re just going to save because you know you’re going to have some new expense coming up and you’re saving for that.

But one day, you’ll figure out what you want to spend your money on or you’ll track your spending and figure out what you’re wasting your money on. And then, you’ll just start chipping away at that waste until you boosted up your savings rate.

But the thing that keeps you going is the motivation to make your life better. And you’ve got to be careful with the line between frugality and deprivation.

I tell my military readers, “That’s easy! You spend most of your time in the military in deprivation. You know exactly where that line is.” In the civilian side, you’re looking at frugality, but if you’re not having fun, if you’re not feeling challenged and fulfilled and enjoying what you’re doing and making that struggle towards financial independence, then you’re probably into deprivation.

That’s the time when you take a step back, try not to save so much or try to raise your income, and try to enjoy life a little bit more, so that you feel revitalized, you feel re-energized, you feel like you can make that journey the rest of the way to financial independence.

My regret in my military career is that when I got to the 12-year point out of 20, my career path had stalled. I didn’t know it, but I just had my final promotion. We also started a family. We had a whole new list of priorities that had little or nothing to do with career. And so, at that point, I should’ve left active duty and gone into reserves.

The reserves or the National Guard is one week in a month and two weeks a year of military. It’s just enough camaraderie, not enough money, much better quality of life. If I had done that, then things would’ve worked out about the same.

We would’ve saved about the same amount of money. We would’ve reached financial independence a couple of years later with a much better quality of life in between. And we would’ve gotten the same amount of money at age 60 than I’m probably going to be getting around age 60 with my savings. We would’ve had a little less in our savings by the time we reach age 60 and that pension kicked in.

Instead, I grimly clenched my jaw and gutted it out for eight more years. By the time I got to the 18-, 19-, 20-year point, it wasn’t so bad. But from 12 to 17 years, you could definitely see in my medical record the stress, the mental and the physical effects of trying to make it all the way there while you’re still in a state of deprivation.

So, if you find yourself in that state of deprivation, don’t just gut it out and say, “I’ve got 10 more years, I’m going to stay the course and keep on it!” Instead, back off a little bit, take life a little better, maybe spend a little bit more money on yourself and delay your plans a year or two. You’ll thank yourself later.

Mad Fientist: Yeah, I’m just going to chime in on that deprivation thing. If you are at that stage like I was, the good news is that when you realize that and try to come out of it, by then you’ve optimized things so much because you likely optimize all your spending before you started depriving yourself of the things you like.

So, when you come out of that and you start spending more freely—like I did last year when I didn’t expect to have a salary, but we were still working—I started spending completely freely, I felt like I was making it rain all the time. And it really didn’t move the needle at all because all the other things, all the other ingrained habits of being frugal were still there. And by then, I had optimized so many things, so when I stopped depriving myself, it really wasn’t that much, but it felt like it was the best thing ever and I was able to do anything.

Paula, you want to answer that question?

Paula Pant: Sure, yeah. I mean, my choice is a little bit different because my focus was just building passive income. Before I ever learned about FI, I learned about self-employment. And because I didn’t know about FI, I thought that that was the goal. And so I became self-employed.

And then, in order to give myself some insurance against ever needing to go back into employment, like W2 employment, I started buying rental properties, thinking that’ll just give me a little bit of a safety net.

And so it was after I started doing that—I just kept doing it basically. And then, I was like, “Hey, wait a second. If I just continue to do this, eventually, this rental income will be enough that I won’t even need to be self-employed if I don’t want to be.”

So, I guess my story is different in that FI wasn’t a goal. Just avoiding employment was the goal. And then, A came about through B.

But in terms of frugality versus deprivation, that’s something that we also struggled with a lot. When I started working, my first job out of college, I made $21,000 a year. And it felt like a lot because, in college, I made about a $1000 a month. And I had to, out of necessity, support myself on that. And so, relative to that, $21K a year felt like a lot of money.

And so, I guess my point is just that deprivation is very much a relative state of mind. Instead of anchoring yourself to what fancy people are doing, if you anchor yourself to either the way that you lived when you were younger out of necessity or maybe the way that you see some friend live or just the way that people in other countries or in very, very low income neighborhood in the United States live, if you anchor yourself to those point, you’ll see that what might feel like deprivation is actually still pretty awesome.

Mad Fientist: I definitely recommend anyone who’s struggling with spending to go spend some time abroad. You’ll quickly see how luxurious your life in America is.

Audience Member: Brandon from Denver. I kind of learned while I’m here that there’s a lot of different types of cultures online even with very similar messages. So what thoughts do you have on guiding culture on your forum with either yourself or with moderators to reach the audience that you want and the culture that you want to have—or not?

Mad Fientist: I think we’ll go to Pete for this one because he’s developed definitely the biggest and the most impressive audience.

Mr. Money Mustache: I think, for me, my own personal situation, there are two different cultures in my online world. There’s like this main blog that has people throwing in comments at the end of articles. And then, there’s a much bigger discussion in this forum section where there are tens of thousands of people having extended discussions that last like years.

I basically don’t take part in that other one because it’s too big. I don’t want to get sucked into it. So, we have—basically, it’s […] with the amazing God-like guidance of Joe who is standing here…

[crowd cheering]

Mr. Money Mustache: Both cultures are great. But that culture is more of like a community. People get to know each other and they exchange things back and forth. I think Joe has set up a set of rules that people have to follow. They’re just loosely enforced. And then, gradually, as the body of discussions grow, it serves as a model for other people. The rules are, “Be excellent to each other and party on, dude!”

That’s different from the main blog which is more like quick, casual stuff. There’s not really an opportunity to talk back and forth. So, I have different type of rules for that. And for me, it’s “only say things with the goal of sharing information, helping or entertaining other people. There’s no sense just reading a comment that’s a complaint. And also, respect what other people have said in the sense that you should read through other things instead of just asking the same question because you’re too lazy to read what everybody else has written before you.”

So, for me, I get to be more of just a dictator. I use the comments section as a chance to publish people’s helpful comments, which is very different. In that case, censorship is sort of appropriate to avoid them getting just like a big zoo like the comments you would get on a CNN article.

So, those are the two differences.

But in both cases, we’re shooting for positivity as being the guide that everybody should follow. And as soon as people see other people being positive, it seems to be self-reinforcing.

And I’ll notice in other websites, without dictators censoring them, it’ll sometimes start out positive, and then a few people will say something negative, and it will just be a race to the bottom of like a complaint-fest. It’s like, “Oh, yeah. I guess we’re complaining now. Well, I’ve got some complaints.”

And it’s neat because that works in real life too. If you’re the “I don’t accept complaints person or at least I gently guide conversations away from complaints, then your real life interaction is going to be a lot more fun too.”

So that may be a more practical thing because not everybody has to manage forums on their website, but everybody does have to manage conversations in real life. It’s really fun to be the “I never complain and I never nurture other people’s complaints in conversations.” I try to just gently bring it back to positive. So, if you haven’t tried that, you should try it. It’s pretty neat.

Any other answers?

Mad Fientist: Yeah, I’m lucky in the sense that people tend to find me through Mr. Money Mustache, and then maybe Jim Collins, JLCollinsNH.com; they get to me. My success with the community that I have on my site has been that I’ve associated with people that I respect like all of these people in the panel and other people like Jim Collins and other blogs out there that I really enjoy. That way, the people that do find me usually filter through one of those potentially, and I get great people. Pre-screened great people are coming my way..

Mr. Money Mustache: At no charge!

Mad Fientist: For no charge, I know! So yeah, I’m very lucky in that sense. And that was not thought out or anything like that. That was unintentional, but it’s been great. I feel really thankful for that.

It’s usually everyone I’ve met at any of these Mr. Money Mustache events have been great. It’s this style of people because they want even more than the blog. That’s the people that eventually would find my blog. So, I’m lucky in that sense.

Anybody else on the panel?

Doug Nordman: For yourself, you’re going to go find several Internet forums and join those, start commenting and find out if those are your people—EarlyRetirement.org, Bogleheads in addition to Mr. Money Mustache.

And maybe there’s a few other forums on places like Reddit where you can start asking questions and find out who’s there and whether they’re fun to be with or whether you’re just going to quietly move on and try again somewhere else.

On your own site, if you build your own site and you’re trying to attract a tribe, you can wait for the commenters to show up—and that can take some time. It can take 12 to 18 months before you build a large community through comments on your blog.

You can also go to the easy answer or the faster answer which is build a Facebook group or join other Facebook groups. You don’t own that comment. You’re at the mercy of Facebook, and you’re going to have to deal with Facebook constrictions on how you do this, but you can build a community a little faster through Facebook to get more people and more comments.

Once you’ve done that on Facebook at Zuckerberg’s expense and with the number of people that are always there anyway, you can decide whether you want to start your own forum on your own site and then build that up.

Paula Pant: So, I would just say in terms of online, I agree with Pete. Don’t let the weirdo into the cocktail party because all the awesome people are going to leave. Don’t let too much negativity come in.

Some people feel bigger by taking other people down. It’s crabs-in-a-bucket sort of a thing where that’s their whole mention, take people down. You just can’t let people like that into your life. And by life, I mean—I’m totally missing something here.

Mad Fientist: Sorry, Pete was pinching me like a crab.

[crowd laughing]

Paula Pant: Yeah, yeah. You can’t let the pinchers into your life.

Mad Fientist: Great! Great question.

[crowd applauding]

Audience Member: Hey, this is Juan from Colombia.

Audience Member: Hey, how are you, Juan?

[hooting]

Audience Member: My question revolves around investing. We’re here in the middle of 2016 after a long boom market. And even though I know what the textbook says and what you guys say on your blogs, “Just keep investing every month a little bit,” one cannot help to think—or to want to time the market anyway. That’s an internal struggle that I have sometimes and other people here have this weekend.

If you can just give some advice, either general or specific, that would be great.

Mr. Money Mustache: Super quick one. So, there are different levels of timing the market that are more or less destructive. And sometimes, you just need a psychological crutch to feel like you’re doing something.

The destructive way would be like, “I’m just going to sell everything, and then just hold it in gold coins under my mattress until it’s cheaper again.” That’s really, really unlikely to work. It’s super likely to cause problems.

At the same time, you’d feel like you’re doing something, but then you’d feel bad when you have no money 20 years from now.

So, instead, first of all, you could keep training yourself and just keep reading these books and be disciplined and always just throw every paycheck into the market. That’s probably the most winning strategy.

But if you really, really can’t do that, you could do little stuff like, “Well, stocks are so expensive. I’m just going to pay a little bit of my mortgage off extra. I’m going to start doing $500 extra to my mortgage next month or for the next year.”

And so you’re still creating a win-win situation where you’re getting positive returns on this money, and you’re diversifying a little bit. You can’t really predict the statistics either way. You might get lucky or you might get slightly unlucky, but you’re still going to come out ahead and way better than almost everybody else.

So, the thing I like to think about with investing is you don’t have to be anything close to amazing to make it worth for you. You just have to keep a net positive over a long period of time.

So, you can actually just do whatever approach, but just don’t let yourself become uninvested. Don’t try to really outsmart the world.

For me, I did pay off my house because I felt, “Well, I want to keep investing in stocks even though it’ll probably exceed this mortgage rate in terms of how much it gives me back.” But I paid off the house, and I’ve never regretted it. I feel great not having a mortgage payment.

Statistically, I would’ve been better to leave the money in stocks and still have a mortgage now, but it’s not a contest for most money. It’s just a contest for feeling good about your financial situation and sleeping well.

So, yeah, I’d say just be easy on yourself while avoiding the most stupid possible decisions.

Mad Fientist: Yeah, this is something I struggle with as well even though I know better and the math shows that you’re better off just having most time in market rather than trying to time the market.

One thing that helped me was to set up automated investing. Obviously, my retirements were always automated. My taxable accounts weren’t always automated, so then I’d end up with a ton of cash, and I’d be like, “I really need to invest this,” but then when you have a ton of it, you’re like, “Whoa! It seems really high rate now. Just wait until one dip.” It just never works out.

So, I set up automatic investing, and that really helped. But I have a confession. I stopped automated investing because I did some tax-loss harvesting early this year, and I still haven’t started to back up because I can’t get around my own stupid brain, so now I have a lot of cash again.

So, it’s something I’m trying to work on too. But I also want to point out that we could’ve had this conversation in 2012 and been like, “Wow! This boom market is crazy!” And if you had stopped investing then, you would’ve been sorry. You can never tell when the boom market is going to stop.

But that’s coming from some guy that’s still struggling with this, so take it for what it’s worth.

Paula Pant: The way that I’ve dealt with this is instead of thinking about, “I’m going to invest less when I feel like the market is high,” flip your mindset into, “When I feel like the market is low, I’m going to invest even more.”

So, whatever amount you’re currently investing monthly, just keep doing that. And then, when you see a dip, be like, “Okay, sweet! What is something I would’ve spent some money on, just something ridiculous, but instead, I’m going to take that and invest that now at the dip.”

By taking that approach, you end up investing more money than you otherwise would’ve because you’re just taking money that you would’ve otherwise spent at a restaurant or on clothes or on fancy cat groomer or whatever. Now, that is the way that you enjoy timing the market. It’s just bonus investments.

Doug Nordman: I’ve spent 35 years doing this. You can share from my wisdom and my mistakes. The first wisdom is you can’t control the market. You can’t influence it. You can’t have any effect over it. The only things you can do is control your reactions, control your responses and try to control how you feel.

One of the ways to do that is to read all you can about the market. I recommend history books. The more you read about the history of the stock market, the more you’ll feel that today’s volatility is very mild compared to what it used to be and you get an appreciation for no matter how bad the market have gotten, the American economy has continued to rise, gotten stronger, given everybody more wealth, raised the standard of living.

If you invest in the long-term benefits and the long-term potential of an economy like that, then despite of the volatility, you’ll still come out ahead 20 years from now.

And remember, humans suck at appreciating that exponential growth. So you have to stick around for 20 years to appreciate how much things improved.

If you find out that no matter how much you read, how much you study, you still can’t live with the way the market behave, then don’t invest in the market. Go find something else like real estate. Go find out a way to start your own business. Start your own income-producing way of bringing in money.

Maybe it’ll be passive income from rental real estate, maybe it’ll be an income from a job. I know a hedge fund manager who, at the peak of his prowess as a hedge fund manager, sold out. He took a big pile of cash and really enjoyed life.

Twenty years later, he realized that what he really should’ve done is he should’ve hired a crew of hedge fund managers, paid them well and compensated them well for doing it while he retained a small interest in that hedge fund. Ten, fifteen or twenty of the profits would go to him.

That’s about as passive as your income can get. He didn’t have to care about the stock market. He just had to care about how well his hedge fund guys are doing their job.

Mad Fientist: And Nords has mentioned the history of the stock market. I actually have my computer here and I saved some interesting quotes any time I come across them. Just to show how overwhelming the upper trend in the market actually is, starting 65 years ago, we’ve had a new high over 1100 times which is about once every 15 days, the market has been opened. So you’re hitting new high’s about once every 15 days.

And if you pick any month of any year, it turns out you have a 75% chance of the market being higher one year later. So, three out of four times, this month next year is going to be higher.

So, the overwhelming trend is up. And this could be the lowest the stock market ever gets, but nobody ever knows. So just keep the faith.

Let’s hear it for Juan.

[crowd applauding]

Audience Member: Hi, I’m Isabel from San Francisco. This is more of a light-hearted question. What is your biggest splurge?

Mr. Money Mustache: My biggest splurge is my relentless insistence on fancy houses. Every single detail has to be my view of fancy. For example, I could not live with a white dishwasher or a white microwave. It has to be silver in color. And I would never be satisfied in the long run with a plastic shower pan. It has to be finely installed tiles with just the right grout and stuff.

So, yeah, I’m really sucker for the physical environment that I spend most of my time in. And even though I keep trying to put it in the human history context, I’m wedging myself into a narrow slice of only this tiny fraction of every experience. I’m living in a house like that, but I just keep indulging it anyway.

And I’m going to keep doing it.

Mad Fientist: Mine is definitely fancy beers and fancy scotches over in Scotland and things. Fancy food is also one of my splurges, but I don’t really consider that a splurge because it’s nourishing. I at least feel it’s essential, whereas alcohol is completely counter-productive for health. It’s good for social-ness…

Audience Member: […]

Mad Fientist: Yeah, right. It’s good for social situations. I was probably a lot more outgoing this weekend thanks to all the beer. But yeah, since it doesn’t really contribute to a good, healthy lifestyle, I consider that my biggest splurge.

Paula Pant: For me, it’s travel. It’s a splurge, but it’s also a very intentional and a very deliberate priority in my life because it’s been a big part of what shaped me and what’s made me who I am.

And I’ll do it with staying in AirBnB places or stay in hostels or guest houses because it’s not about fancy accommodation. It’s just about meeting people and experiencing the place.

But yeah, my carbon footprint is massive unfortunately. I try to like—yeah, I mean, I admit it. I travel a lot. I spend a lot of my money and my time and my energy there.

And yeah, I’m just going to keep doing it.

Doug Nordman: Surf wax. Any questions?

I feel like I’m relentlessly optimizing my life when I’m at home. I have a photovoltaic ray that I enjoyed building solar panels and solar water heater. And yet that’s a hobby that clearly pays for itself. I enjoyed doing it. I enjoyed putting it together. And now, I enjoy the benefits of having done that.

But Paula has already mentioned that one of my splurges is travel. The other one of my splurges is spending excessively when we’re traveling. And example of that is FinCon. I know I’m going to FinCon once a year. I know it’s only going to last for a certain amount of time. No matter how hard I work at it, I probably can’t spend an entire year’s investment income at FinCon—not for lack of trying.

I go to FinCon, and I don’t worry about the money I’m spending on a hotel room. I don’t worry about the money I’m spending on whatever I see going on around FinCon or whatever else we do around Fincon.

I know that’s a limited time of the year. It’s okay to splurge. I’m not making that a daily habit, and I’m not making that a daily splurge that’s out of control.

Mad Fientist: Great question! A round of applause.

Audience Member: Hi, I’m Janet from Seattle. I think as a lot of us are working toward FI, we’re really focused on the financial parts of it and maybe sometimes get a little bit too obsessed about that. But it seems like a lot of experiences, once you get there, that’s not really such a big issue. So I’m wondering for the four of you, what has been the biggest challenge about reaching financial independence? And how have you dealt with it?

Mr. Money Mustache: For me, it’s true that the money part has completely faded away pretty quickly. So, yeah, we don’t think about money or investments or anything. It’s more about trying to make sure you’re getting the most happiness out of each day.

And for me, because I can be a bit spaghetti scatter-brained, it’s trying to get more strategic about long-term life stuff, so that I really feel like I’m living a worthwhile life and not just getting too caught up in little activities, just trivial pursuits or reading stuff that I don’t really get enjoyment out of.

So it’s more like day-to-day time management that’s my big thing. I’m really, really happy with my family situation and parenting situation and health. There’s certainly nothing to complain about. But there are definitely some days at the end of the day where I’m like, “Oh, I just wasted this whole day of retirement in a beautiful location.”

So that’s the thing I’m working on, trying to get those days down to zero.

Mad Fientist: I’ve already mentioned the whole meaning of life question that’s been popping up every once in a while. But I haven’t stopped working, so maybe things will change after that. But also, the only other thing since getting to this stage has been like a little bit of guilt or “Why am I so lucky that this has happened? How did I get to be so fortunate to get this sort of situation when a lot of my colleagues and friends and family aren’t? And they’re just as talented and hard-working as I am.”

Mr. Money Mustache: They’re not. You’re just really awesome.

Mad Fientist: That is going to be the title of this episode, the Mr. Money Mustache quote.

So, those are the two major things that I have struggled with that I didn’t really expect to happen. But they’re definitely manageable, which is great.

Paula Pant: For me, I think it’s knowing when to stop with regard to any kind of money-making pursuit. And again, my story is a little different because I was self-employed. And so once I became FI, I didn’t have a job to quit. I just had a smattering of clients. And slowly, I had the option of letting go of some client that I didn’t like.

So, instead of having one very defined moment where I’m like, “Boss, I quit,” it’s more like, “Okay, I’ve got a dozen different clients. Maybe I’ll let go of this one and let go of this one and let go of this one.”

But then it’s like playing whack-a-mole, right? You let go of a couple of clients, and then these new ones pop up, and you’re like, “Oh, that sounds interesting. Sure! I’ll take it. And I’ve got this space in my schedule now, so sure, I’ll take that one. Sure, I’ll take that one.” And then, before you know it, you’re like working 60-hour weeks, you’re not really enjoying it and you’re like, “Why the F am I doing this? I don’t even need the money anyway?”

And then you fire a bunch of clients again, a bunch more pop up and…

So, that’s been the struggle for me. It’s like developing those boundaries and being able to say, “Wait a minute!” It’s kind of similar. It’s in a different rein, but it’s similar to what Pete was talking about, time management and setting priorities, really thinking about how you want to spend your days and what’s important.

And it’s even harder when there’s money involved, financial opportunity cost involved. This also goes back to the “one more year” syndrome. It’s the “one more client” syndrome or the “one more project” syndrome. That is like the eternal thing that I’ve had to fight.

Doug Nordman: The two pieces of advice I have are “don’t recreate your old environment.” You’re financially independent now, you don’t have to go back there.

The other one is “forget about who you were, and discover who you are.” And that’s particularly applicable to military retirees and veterans. Maybe you want to recreate some of that because you miss the camaraderie, you miss the mission, you miss the people you used to work with, you miss that sense of accomplishment that you got from the military some of the time and you want to find more of that. Well, that’s where you go and figure out some other way to do that.

I find that way by writing, by writing about military topics and answering questions for military readers. Other ways to do that are volunteering, finding somebody else to take care of if that’s your family or if that’s your community or figuring out something that gives you the sense of pleasure, the sense of accomplishment, fulfillment by going out there and doing something completely different that gives you the same feelings.

As a nuclear engineer, I’m told—I’m a little skeptical of this—that I tend to be hyper-competitive and a little over-achieving. When you reach FI, you can back off. And if you’re that kind of personality, an even bigger challenge is becoming less hyper-competitive and less over-achieving.

And it’s difficult! I’ve been FI almost as long as I was struggling towards FI. And I’m still struggling toward that backing off and not working so hard and not grabbing for every dollar bill that floats by.

When you are FI, when you’ve gotten past the point where you’re FI, and you’re no longer scrambling for every dollar, one day you’ll wake up and you’ll realize that it is actually raining money out there. It is tempting to grab a bushel basket and go out there and get your [share again].

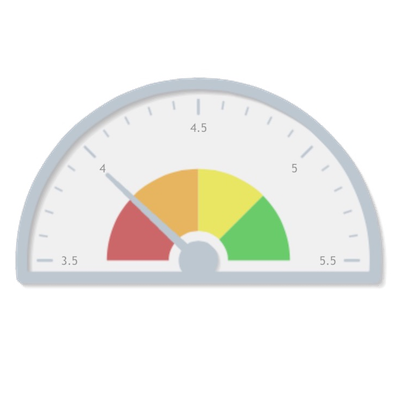

But when you’re pushing yourself toward FI, and you realize that the retirement calculators are giving you an 80%, 90%, 95% chance of success, as human beings, we tend to focus on the 20%, 10%, 5% chance of failure. However, that 80% chance at success is about as reasonable a success rate as you can get.

It also means that eight out of ten times, you’re going to have way more money than you need. So, one more theme to watch out for in financial independence is the potential burden of stewardship. You get to financial independence with what you think is enough money, eight out of ten times, it’s going to turn up to be more than enough. A couple of those times, it’s going to turn up to be way more than enough.

Mad Fientist: Thanks! Good question.

[crowd applauding]

Audience Member: I’m Jonathan from Portland. Pete, you’re reasonably profiled in the New Yorker which is an experience that not very many people have had. I’m a big fan of the New Yorker—have been for a long time. To me, that seemed like a major development in terms of people’s awareness of your blog and the whole movement I guess.

I’m just curious […] what that experience was like, if there were any surprises in terms of how the piece turned out and some of the ripple effects of having been profiled in such a mainstream publication?

Mr. Money Mustache: Well, it’s definitely not as good as it sounds. There’s nothing special about any kind of media profile. It’s basically not very fun, that’s what I’ve learned, for any type of interview.

The first big one that I really locked into was right near the beginning of the blog. It was in the Washington Post. Everyone’s like, “Oh, wow! The Washington Post is huge!” and I didn’t even know it. But that brought a lot of people to the blog, so that’s what I realized is the benefit to me.

Every time you do an interview of this type of thing, it’s like a negative experience for you because you get a lot of negative criticism, very little positive reinforcement comes with it. It’s usually pretty dull and repetitive questions you have to answer. So, the only reason you should do it is not for personal vanity, it’s if you have a reason for attention to be called to your cause.

So, in this case, I wanted more people to my blog and the related blogs that I support. That’s why I do any of these. That’s the only reason that I do these interviews.

And the New Yorker was surprisingly a small effect. You think of it as a giant magazine because your parents read it when you’re a kid and everybody else read it. But it only had a small, temporary boost to the blog’s traffic partly because there were no direct links in it on their online thing. That’s a really key thing. People have to be able to click and get there. So other interviews were actually much bigger than that one.

And then, the final comment I would have is the New Yorker is kind of a satirical, high-brow, super New York-y culture thing, so they had to make fun of me—I guess. I didn’t know this was going to happen. They got a lot of details wrong, which I felt hurt the tone of the lifestyle I’m trying to promote. I was a little self-conscious about that.

And the whole thing was different actually. I wanted it to be—what I thought we agreed we were going to do, me and this writer, was describe mustachianism and what it means as a cultural idea and could this actually become a big thing in the U.S. culture.

But instead, it was a lot about this guy named “Peter Adeney who does these weird things allegedly in this town and goes down to buy his pot on a Wednesday” and stuff like that, all these stuff were, I thought, super irrelevant. But then that’s how some of these magazines work.

So, yeah, I wouldn’t recommend it. Personal profiles aren’t a personal boon. But I did like the wheelie picture that we got to use. That was the biggest plus of that story.

Mad Fientist: Next question. Yes, thank you.

[crowd applauding]

Audience Member: My name is Hunter out of Washington. This kind of segues nicely to what you were just talking about. We tend to focus on the nuts and bolts and the tactics you guys apply to reach FI.

Maybe you could say something to how, having reached that or having become really close to that level where you don’t need as much and you can leave a little less for yourself (you might be a little less this physical body with needs and fears and stuff and you can champion these causes, and maybe you’ve been living a little greater state of transcendence in some ways whether you get that in different ways in your life which you’ve kind of touched on a little bit) — I’m just curious about the sense of strength and clarity you’ve gotten from not having those needs and having to be so preoccupied with just arranging your life around your basic needs.

Mad Fientist: I’ll kick off this one just to change up the order.

But yeah, I think there’s an incredible amount of power that you get from being able to not have to work for a living. And I am still working, so that’s why I’m really focused on “I’m going to use that power after I quit.”

I know obviously Pete’s having a huge movement and changing lots of people and helping the environment with all these bike-riders now. That’s great. And that’s something, luckily, the blog has taught me. It really does feel great to help other people and be creative and create things and put it out in the world. Hopefully, that reaches people.

I know that’s something I’m going to want to do a lot more of and use the power of not worrying about the monetary reward, to maybe tackle some things that other people aren’t tackling because of the monetary reward.

Paula Pant: I would say the ability to work on long-term projects. I think, to me, the greatest thing has been I don’t worry about anything on a month-to-month basis because I know that I’ve got this passive income that comes in that can cover all of my bills—and extra with a nice buffer.

And so, the question of supporting my cost of living just doesn’t enter my mind. And so if there’s something that I want to work on that I think is a worthwhile project, I can work on it! And that’s amazing.

But again, the biggest barrier is me. And this goes back to prioritizing. When anything is open and available to you, it’s very hard to choose. And so you really have to focus in on like, “What are my priorities? What are my values? What do I want to create in this world? What do I want that contribution to be?”

And sometimes, it can be messy and you zigzag around or try something. That process isn’t smooth.

So, yeah, having that space to—like a child almost—try stuff and finger paint a little bit—

Yeah, I’ve forgotten the original question. Now, I’m just going to pass this to Doug.

Doug Nordman: That was good. I think it was either Socrates or Plato or maybe it was Peter Parker from Spiderman that said that “With great power comes great responsibility.”

When I started writing and began writing the book, one of the hooks that I used to get the help I wanted to write the book, one of the hooks I used to make sure everybody understood that I was financially independent was to give all the profits from my writing, all the revenue from my writing to military charities. That way, I’m not having some junior enlisted person buy my book on figuring how to achieve financial independence, “Oh, by the way, you just paid me $8 and a couple of bucks of that is going to go toward prolonging my financial independence.”

One of the things I did after I reached FI was take some of that extra money that I had for investing. Everybody should have 10% to 15% of their investment portfolio in what’s called “highly aggressive, shoot-the-moon, testosterone-poisoned” investing…

[crowd laughing]

None of you have ever heard that term before.

In my case, I took that and devoted that towards something I’ve always been curious about, angel investing. My impression of angel investing was you went into a room, you ask a lot of questions, you did your due diligence, you wrote some checks, you went away, you came back 18 months later and Google was paying you a million dollars.

That reality is not there.

The reality that surprised me was that you learn a lot more about investing by becoming an angel investor than you ever learn from reading about Wall Street or the randomness of stock markets or how to analyze a stock. So, angel investing, the 8-year journey I’ve spent on it so far has made me a tremendous investor. I wish I had started out being an angel investor first. That would’ve saved me a lot of problems in the long run.

The second thing that angel investing taught me is that it’s a good thing I’m doing it now, it’s a good thing I’m immunizing myself about angel investing now, so that when I’m 82 years old, I won’t be tempted to go out and start writing checks in the hopes that I do discover the next Google. I don’t think that’s going to end well. I’ll be able to wind down angel investing and focus on what I think are the important parts of it now while I’m at the hypothetical peak of my cognition and able to not be tempted by the unknown later on when I’m not at the peak of my cognition.

The third thing that really surprised me about angel investing was how fulfilling it would be developing the relationships with the founders and the other investors. Another word for it might be angel philanthropy because you really are giving away large sums of money, and those large sums of money are going out to create jobs. And instead of giving somebody a handout, you’re giving a person who’s incredibly committed, enthusiastic, fierce, hard-working founder what they need to go out and solve tremendously ugly, gnarly, nasty society problems. And then, you know they’re going to work on that a hundred hours a week and hire a bunch of people and create a bunch more jobs and use the revenue they bring in to grow the business and hire more people. You’re actually pouring your money back into the American economy into the kind of people that you really would like to help without giving them a handout.

So, angel investing has taught me a lot more about stewardship, philanthropy, charity and investing.

Mr. Money Mustache: I have a super short point to add. I was always kind of cautious in my younger years because of my upbringing. We’re kind of a cautious family. So, I was like, “Save your money. Protect yourself. Build up walls to make sure you can never possibly run out of money.” That was fun and somewhat rewarding.

But then once I got to the ridiculous surplus point, shortly after that, then I realize, “Well, the only logical choice is to devote your time to helping other people because you don’t need to help yourself anymore.”

And then I realized that that’s actually a much more fun way to devote your time. So, in a way, being almost purely generous is the most selfish thing you can do because you’re having—it makes you feel much better than just giving yourself stuff, giving yourself more security and treats and everything. It’s like a double win because you can be selfish by being generous for the rest of your life.

So that’s a great pursuit. It’s suddenly a new thing to do with money and time. That was a big surprise for me there. I didn’t know that that was going to happen.

Alright! I think we have Eric.

[crowd applauding]

Audience Member: Hi, my name is Eric. I’m from Everett, Washington. My question was more around—this is a great community, right? We’re a bunch of like-minded individuals. I’m about seven months into my journey. I’m the type of person that once I find something that I really enjoy, I go all in and I go down the rabbit hole really quickly. And then, I become very evangelical and annoying about it.

So, how do I temper that? We go back to our circle of friends, and they may not be even aware of this—this community and this fire. How do I temper that? How do I bring them along in that journey?

Mr. Money Mustache: You probably can’t. People don’t really listen to you that much in real life, I find. But you can just model the behavior and make sure you’re having a good time of it.

And then, you’re curious friends, which are, in the long run, the ones that are worth keeping, they are going to ask you themselves. And if they see good results, they’re going to naturally want to follow it.

And non-curious people, they get old after a while, so you might drift into different friendship patterns as you go further on. That’s my super quick answer.

Paula Pant: I agree. I find that you’ll have friends who are very receptive and very open and who will just start asking you questions.

I have a friend who is right at the beginning of paying attention to her finances. She’s 36, and up to this point, she always thought, “Well, as long as I’m paying my bills on time, that means I’m financially responsible.”

She just discovered that there’s actually more to it than just that, and she’s like wowed by it and amazed it and really open to learning.

I don’t have to bring her along because she brings herself along. She’s always asking questions. And her enthusiasm really rubs off on me, and it makes my afternoon more enjoyable because I get to re-experience that stage vicariously by being with her.

But I’ve got other friends who are like, “Money is evil.” And there’s no talking to them because they’ve just got this wall where they’re like, “I am better than you because I never think about me because money is evil.” There’s nothing you can do with that.

Doug Nordman: You’re in a role, the teacher. And when the student is ready, the teacher is already there. The teacher has already been there for many, many years before the student was ready.

So, the people that you’re wanting to perhaps persuade of the wonderful world of FI, they may not be ready yet.

So, the best you can do, they say that living well is the best vengeance, well, living well is the best example as well. And so one day, they’re going to be ready, and they’re going to come and talk to you.

In the meantime, if you want an outlet where you can feel like you’re accomplishing something without waiting for people to recognize your brilliance or your wisdom, the other thing you can do is start writing. And it’s as simple as posting in Internet forums.

Somebody asks a question on a forum, you answer it from the perspective of financial independence. That person who asked the question might not quite be onboard with you yet, and the response that they’ll give you will be, “Yeah, but… this isn’t working for me. It’s not the right time in my life,” whatever their excuse may be.

However, thousands of people will be reading that same thread on that Internet forum. And some of those people will be ready.

You can start a blog. Same purpose. Whenever I answer a reader’s question on the blog—most of the time that I answer a reader’s question on the blog, I never hear from the reader again. On the other hand, I have another couple of thousand people who will read that post and they’ll be ready and they’ll respond.

So, it’s not that you can’t reach those people in the immediate circle around you as much as you’re demonstrating what you’re living, the shining example of truth and the way you live your life. People will gravitate toward that.

You don’t have to be needy for the people to follow your example and do what you want them to do. You just have to live the kind of life you want to live and show the example you want to be. Those people will come toward you.

Mad Fientist: Great question!

[crowd applauding]

Mad Fientist: So, we’ve been going about an hour. I know Pete doesn’t like sitting still for longer than about 30 minutes. He’s probably getting antsy. And I’m in dire need of vitamin D. I can see the sun is shining. So, we’re going to take our last few questions. Anyone else still want to ask something, if you want to pop up.

Audience Member: Once you reached FI, how did your relationships with your personal friends, your ex-coworkers or your family changed? And what effect did that have on you?

Doug Nordman: Financial independence will separate your co-workers from your true friends. And you’ll find out you have a lot of co-workers.

The other thing financial independence will do is give you and your spouse and your family time to grow closer together. One early 1980s, 1990s perspective on financial independence was “What happens if everybody stops working and goes and does whatever they want do all day? What kind of an example are we setting for the children by behaving in such an irresponsible manner?”

The answer to that question is the kids don’t care about your work. They care about you. They want to have more time with you. As adolescents, they just want to spend time with mom and dad and play around and have a good time. As teenagers, they don’t want to be seen in public with you, but they do want your car keys and your wallet. They want you to be there for them to support them.

And years later—I’m almost positive of this—when they’re young adults on their own, they’ll come back and thank you on a regular basis. And I’ll let you know as soon as that happens in my case.

Also, what will happen once you’ve reached that financial independence and you’re out there living your life and waiting to find out where your co-workers and your friends are, you’ll find new friends. You’ll find new people that you encounter on the journey, and you’ll have a good time with them because you have the time to reflect, the time to think about the way you want to live your life, the things you want to do with your time. People see will you enjoying life, having fun and say, “Whoa! That’s somebody I want to get to know.”

So, again, the more you enjoy yourself as a responsible adult with financial independence, suddenly, the more people that will gravitate toward you and want to learn more about how you did it. The right kind of people will be the ones that will gravitate toward you.

Paula Pant: Yeah, I’d say it goes back to the friend thing. Some people may not even realize it. A lot of people don’t think too hard about what they themselves or others do for work and money. So, at least in terms of friendships, I think some people don’t even know or it doesn’t even register. There’s no impact at all.

And then, the friend that I just described, the one who’s just discovered the world of money management for the first time, those are the friendships that get enhanced.

So, in my experience at least, as far as friendships go, it’s either completely neutral because it just doesn’t register for them or it’s actually a friendship enhancer because, now, you’ve done this thing that they think is really interesting and they have a lot of questions about it.

Mr. Money Mustache: And my final thing is just echoing Nords’, which is I found family and close friends become much closer—especially the family part, because suddenly, you never have to say no to stuff that you would want to do because of work.

So, as soon as we retired and had a kid, we started spending the entirety of every summer in Canada hanging around with siblings and grandparents and stuff, whereas in the old days, if we had kept our jobs, it would’ve just been two weeks, limited. And if they plan something in the middle of the winter or anything else, you can always just go up there and just have time.

It’s nice to take work away as your first priority. And that lets people you care about—I think they sense a lot more warmth coming from you because you no longer have to give your soul to the office anymore.

Mad Fientist: I think that’s a good way to end this. So thank you all for being here and asking amazing questions. Thanks to my panelists being open and honest and answering all the questions. It’s been a lot of fun. So thanks!

[crowd cheering]

I wish I was back there again! Thanks for moderating the panel and putting it out there for everyone to listen to. See you soon!

I like what you said about spending completely freely, once you’ve conditioned yourself for optimized spending, gets you a ton of utility for not much actual financial cost. There really are huge diminishing marginal returns to spending, and that works both ways — it’s easy to cut those first thousands per year, and highly rewarding to go from tight constraints to slightly less (subconscious) constraint.

Great podcast Mad Fientist!

I was especially intrigued by Doug Nordman’s comments on angel investing. It doesn’t sound like it’s something he’s made a ton of money doing, but none-the-less he feels good about doing it.

I think that’s really the definition of having “more than enough” — when losing money on an investment can actually feel good.

I asked Doug more about angel investing when I interviewed him last week (for an upcoming podcast episode) so stay tuned for more details on that topic!

Is there any video of this? would love to watch

Sadly, no. Audio only.

Sounds like a great camp! Thanks for recording the great panel discussion. Loved hearing their various insights.

Out of curiosity – do you use any software for the transcription? What is it?

I have similar recordings and I have done the no-budget Google Docs which has a recording feature (speakers–>mic), but the stream words takes time to manage.

Thanks

I actually pay someone to transcribe the episodes for me.

Nicely done, MF!

Impressive panel and great questions from the audience.

As I know him least, I was especially interested in Doug’s take on things, and am very intrigued with his way of thinking about Angel Investing.

Doug, if you’ll be a FinCon I’d love to hear more.

Thanks, Jim!

Doug will be at FinCon but I also interviewed him for an upcoming podcast episode so you’ll be able to hear more about his angel investing soon, even if you aren’t able to chat in San Diego.

Thank you Mr Fientisy! This is an awesome podcast, I really enjoyed listening to the panels insights — very realistic and meaningful, especially, the part about sharing FI idea/concept with friends and it doesn’t sit well with them… It’s a great reminder to me: that the student has to be ready, before the teacher appears… And meanwhile I’ll stay focus and enjoy my FI journey and attract others who are ready and of same frequency to grow in the FI jounrney!!

Amazing podcast and amazing questions!

I knew Pete, MF and Paula but I must admit I didn’t know Nords before today. Nords, you just acquired a new follower :)

Thanks a lot MF for this podcast!

Dude, that was awesome! Bet you’re getting excited for San Diego!

Thanks for the great podcast! That sounded like a great camp experience. I loved hearing everyone’s insight on their FI journey. It was great to hear such thoughtful questions and answers and has me reflecting on my journey to go. This gave FI a deeper meaning to me. The panel reminded me of why I’m pursuing FI and to enjoy the journey more and deprive myself less.

I love that Nords exemplifies operational security in this pic: cleverly satisfying thirst so as to obscure his identity! While I await the Mad Fientist interview with him here – hopefully full of math for the military environment! – his interviews on Radical Personal Finance are excellent.

Thank you for sharing the panel discussion.

Glad to finally see/hear this — and to have a tangible momento from CM! There was so much information and so many stories to absorb, it has all kind of blurred together. The panel was an awesome way to wrap up the weekend. Looking forward to CM 2017 already…

Really enjoyed listening to this episode! Brought back some great memories from that weekend!

The bad news is that I am now fully caught up on all the episodes of the Mad Fientist Podcast, so I don’t have one to listen to today. How many iTunes reviews for you to publish one episode per week? ;)

All joking aside, great episode and great podcast!

Wow! Powerful session. Nice to heara range of perspectives and experiences of life on the other side. Thanks for sharing!

Great episode and great Q & A.

Thank you, Mad Fientist and panel people for doing this and for making it free to listen in.

You are all AWESOME!

Hi madfientist,

I have been really enjoying working my way through your podcasts. Until now I have been able to just lurk and learn. This time I was a little too curious to let it go. You answered one of the questions that you had trouble keeping your taxable money invested so you set up automated investing (which you turned off at one point for some tax-loss harvesting). Could you describe what process or service you used to do that automation?

Thanks for all the educational entertainment.