I love beautifully-designed software.

I love powerful/flexible financial software.

It’s been a while since I’ve found an application that’s both, but that’s exactly what I have for you today…

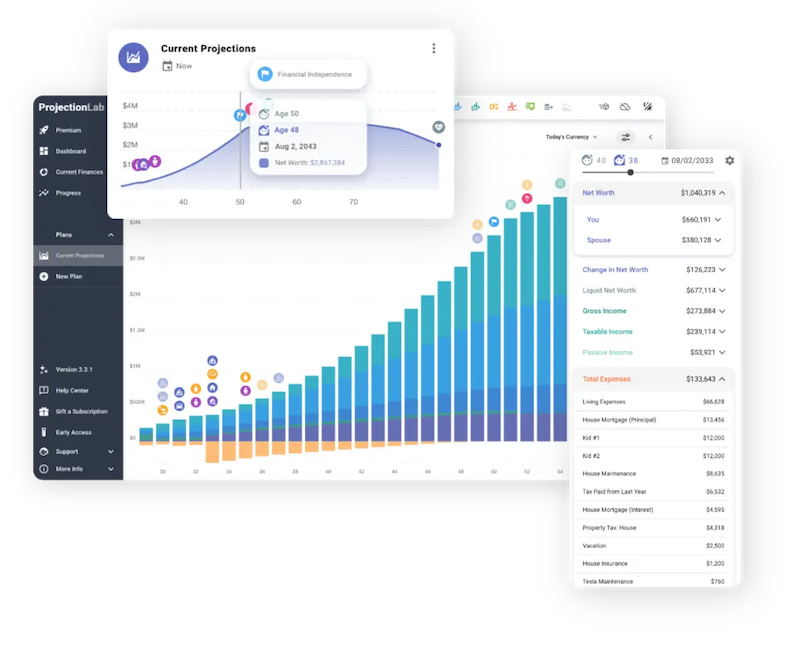

ProjectionLab is the most beautiful financial planning tool I’ve ever seen.

And, it was created specifically for people pursuing FIRE, so it’s also the most-useful planning tool I’ve found for FI!

The indie developer who built it is here today to tell you all about it.

Take it away, Kyle!

Hey everyone, I’m Kyle.

When I finished undergrad back in 2015, I never thought that just 8 years later I would have achieved financial independence by 30… and I was right! I have not 🥲

But I have at least started getting my act together. Thanks in large part to blogs, books, and podcasts like The Mad Fientist, The Simple Path to Wealth, A Random Walk Down Wall Street, Psychology of Money, Financial Freedom, and many other favorites.

During my early years in “the real world,” I rarely thought about money. Sure, I knew a few rules of thumb – save some for retirement, don’t spend an exorbitant amount on rent. But mostly, I would daydream about when I’d have enough PTO for another vacation to go scuba diving and make travel videos.

But what accompanied those daydreams was a gnawing feeling that there should be more to life than the classic American pattern of working until you’re too old to enjoy it.

Does sacrificing the best hours of your best days of your best years to meetings, briefings, and bureaucracy really add up to your best life?

Then I discovered FI community thought leaders like Pete Adeney, J.L. Collins, Vicki Robin, and The Mad Fientist. Their message hit me like a freight train. I knew right away that I needed to take more active control of my financial future. And that if I did, someday I might eventually have the freedom to be my best self all the time, not just a few weeks a year.

I dove head-first down the FI rabbit hole. I learned about leanFIRE, fatFIRE, regular FIRE, coastFI, Barista FIRE, and everything in between.

But something was missing. Theory is nice, but I wanted to really see how this was going to work. I wanted a hands-on and visual way to map out all the options and explore the trade-offs between different life plans. So, I went looking for a long-term planning and forecasting tool. Something modern, fluid, nuanced, and actually fun to use.

[ Cut to black.]

So I made a thing

[Camera fades back in. Blur effect. Narrator wakes up in a daze, trying to shake off two years of caffeine-powered nights and weekends.]

After a couple thousand hours of coding, let me introduce ProjectionLab!

I couldn’t find the perfect long-term financial planning tool, so I decided to build one 🙃

With ProjectionLab, you can create beautiful financial plans with a level of nuance and flexibility that exceeds the standard online retirement calculators. You can run Monte Carlo simulations, backtest on historical data, review detailed analytics for estimated taxes, and plan how to live life on your terms. And with some luck, reduce anxiety around your finances.

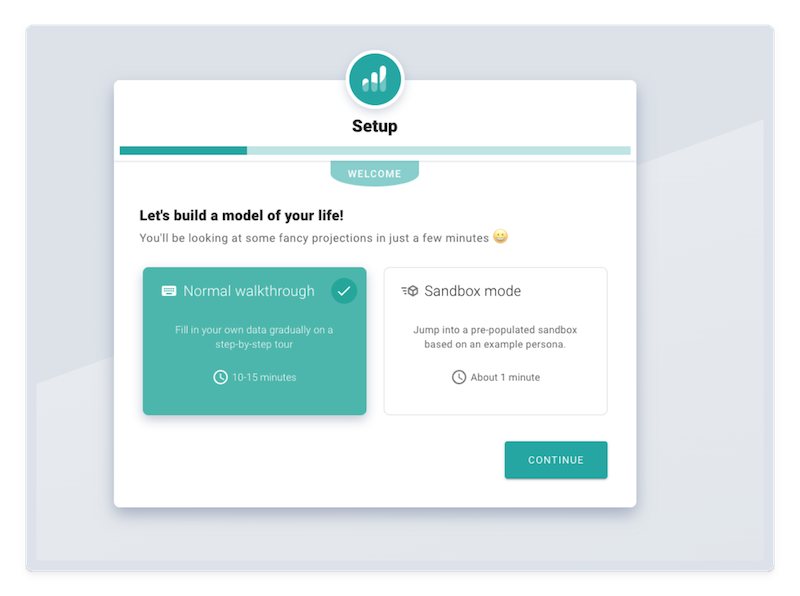

There is a free sandbox, if you just want to hop in and see how it works. It does not ask to link your financial accounts. You do not have to create an account to try it, and it works pretty well for international scenarios.

It respects your data and will not try to upsell you on advisory services. It’s just a thing I made that you might like 🙂

Okay, but who am I?

I am a software engineer from Boston. Originally, I grew up in coastal Maine.

I did not expect to one day become a “Masshole” as they are, um, affectionately called back home 😅… but here I am!

And I did turn 30 this year. Ever since I was a kid, I’ve always had a passion for making things. I started coding video games in middle school, and mastered the art of dodging suggestions to “go play baseball instead”. Over the years, I’ve always had a personal project or two on the side.

The way that coding can enable you to take creative ideas and manifest them in the real world will always feel a little like magic to me. And with side projects, it’s refreshing to be free of the constraints that frequently make writing enterprise software a drag. No stand-up meetings, no sprint retrospectives, no changing requirements, and no funding to worry about!

ProjectionLab started as one of these creative outlets. And it has grown into a lot more.

TL;DR. What can you do with this?

Here is a quick summary:

– Build nuanced models of your whole life

– Plan separately or as a couple

– Define what terms like financial independence mean to you

– Model complex decisions based on goals like achieving FI, taking time off for travel, home ownership, or starting a rental empire

– Create multiple plans and compare them

– Visualize projected cash-flow with Sankey diagrams

– Review estimated taxes and effective tax brackets for each kind of income

– Apply granular controls for how you expect accounts/income/expenses/inflation/etc to change over time

– Experiment with Roth Conversions, 72t (SEPP) Distributions, and other advanced strategies

– Model international scenarios

– Backtest on historical data and run Monte Carlo simulations to analyze the spectrum of possible outcomes

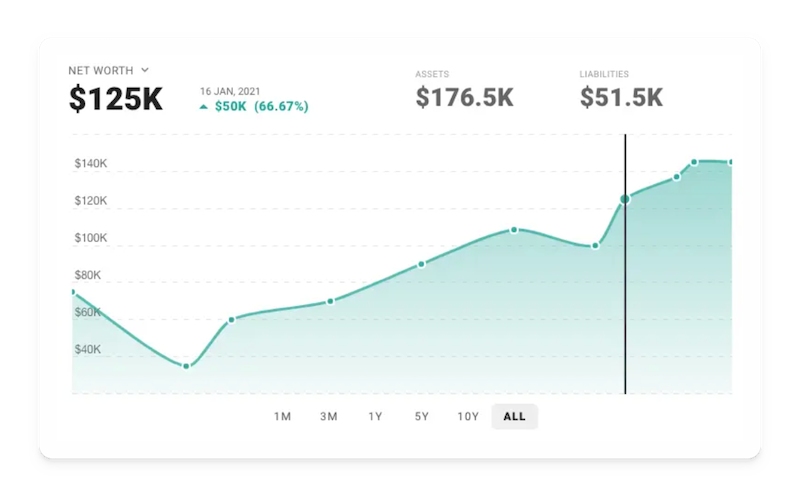

– Track your actual progress over time

– Control where your data is saved, with no link to your real financial accounts

What does FI mean to you?

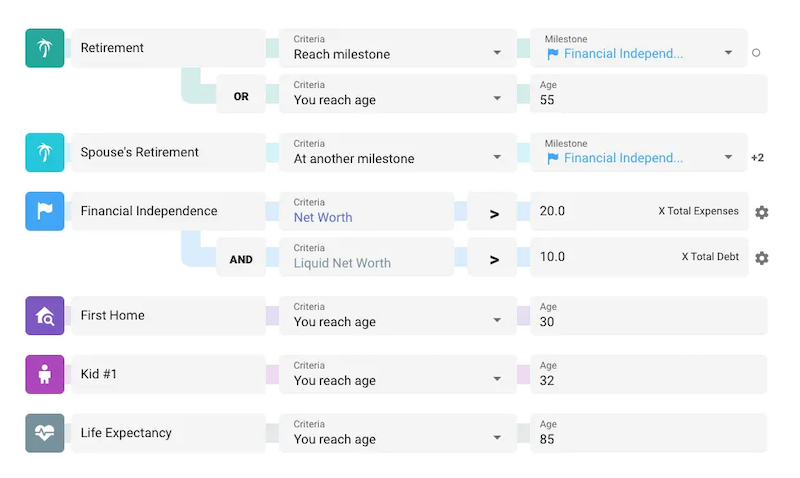

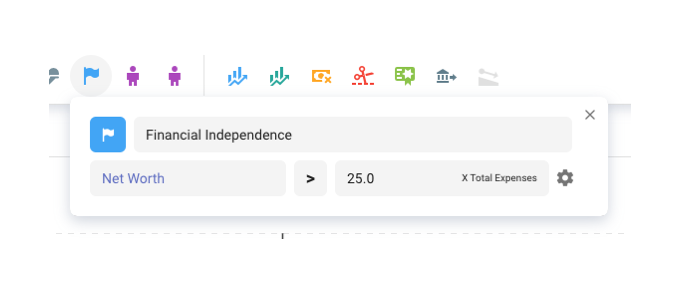

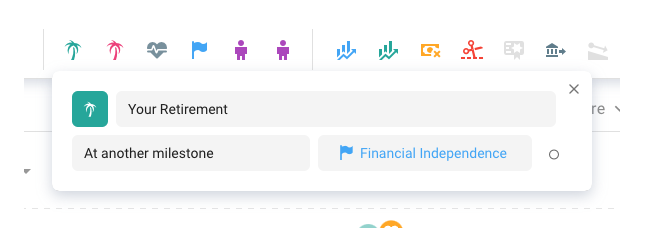

Think about the future you hope for. What are some of the milestones along the way? One of the first touch points when you create a plan in ProjectionLab is the milestone system. It helps to capture the big-picture goals you care about. And since you’re reading The Mad Fientist, chances are that financial independence is one of them.

But what does FI mean when you break it down? People have different definitions, and I wanted the milestone system to accommodate that. For instance, do you only consider yourself FI at a specific multiple of expenses and a certain liquidity-to-debt ratio? No problem: you can create a milestone with additional criteria.

I’ve put some thought into making milestones flexible and customizable. They can be anything from retirement or purchasing a home, to reaching your personal definition of financial independence, having kids, moving to a new state or country, switching careers, going part-time, etc. They can even have tax consequences.

And most importantly: you can use them as a framework to help scaffold the rest of your plan and control when various events should start and end (income streams, expenses, asset purchases, etc.)

Okay. Whatever. Is that just marketing speak, or is this actually useful? How about we build a scenario together and find out!

Let’s build a plan together

Today, we’ll be an early-career married couple with student loans, currently renting, wanting to have kids someday, and we just found out about this thing called “financial independence.”

Let’s see if we can get a sense for where we currently stand, where we are headed, and how to plan a life we’ll love.

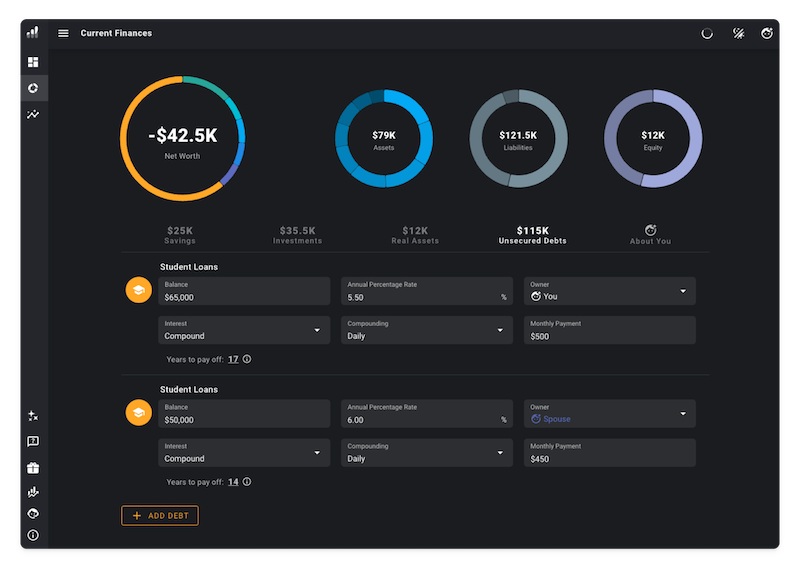

Once we cruise through the setup wizard, here is how things are looking within the Current Finances section. I will also take the liberty to point out that there is a dark mode, if you’re into that 😎

Our current net worth is negative, due to the student loans, but we’re going to get things moving in the right direction soon.

To make projections for the future, let’s create a plan and define growth rate and inflation assumptions for the deterministic planning mode. We will add milestones, income streams, expenses, and cash-flow priorities, choose our tax configuration, set a portfolio-level stock/bond allocation over time, and define a drawdown sequence.

In the interest of time, let’s gloss over that setup process.

The baseline scenario

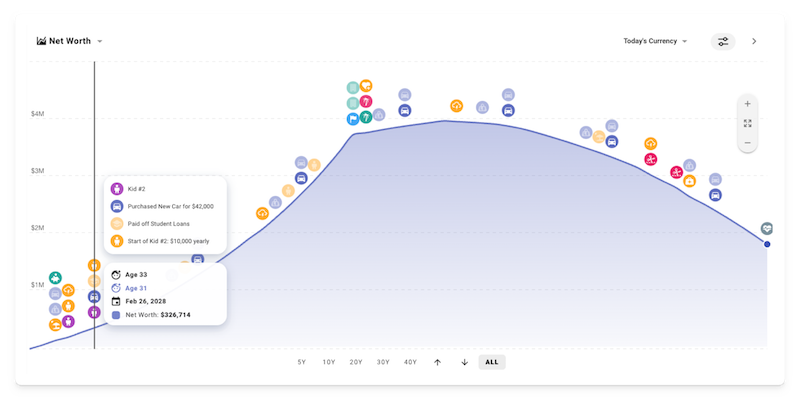

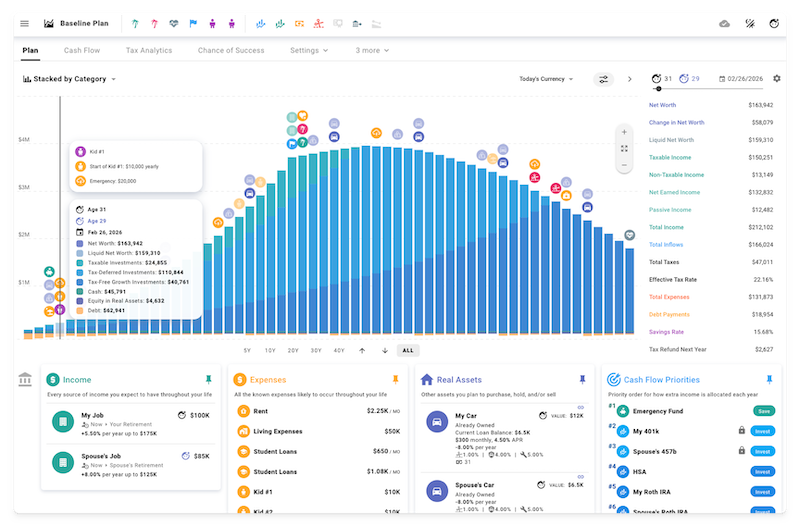

To keep things approachable, this is what a basic version of our plan might look like.

It includes two kids, straightforward career progression, contributions to some employer-sponsored retirement accounts, buying a car every 8 years, medical expenses increasing later in life, and some unexpected emergencies occurring every 15 years (and scaling up a bit each time).

In this case, we will define Financial Independence as a milestone that occurs when net worth reaches 25 times expenses.

And we will configure retirement to occur once we reach it.

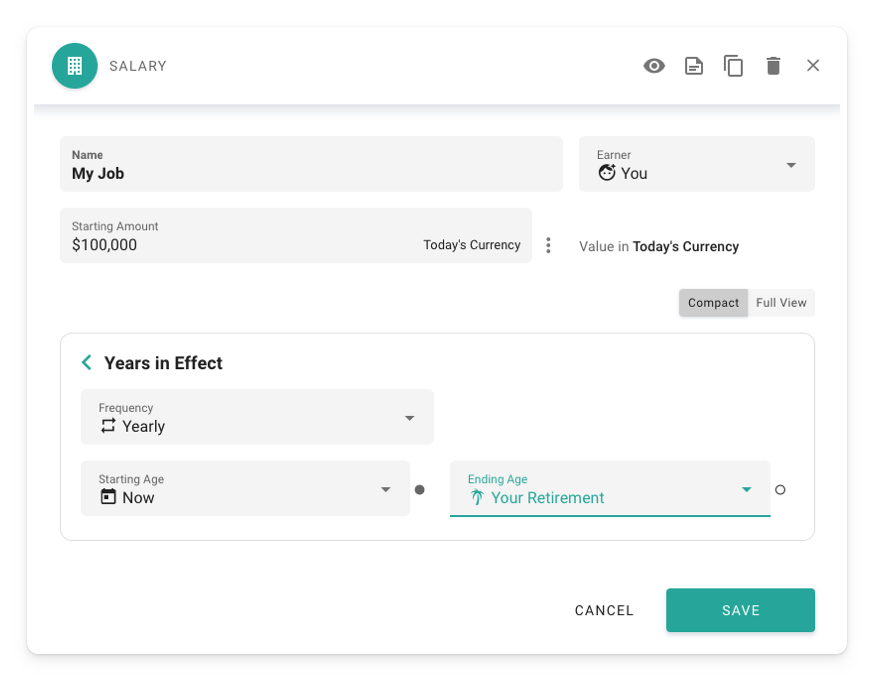

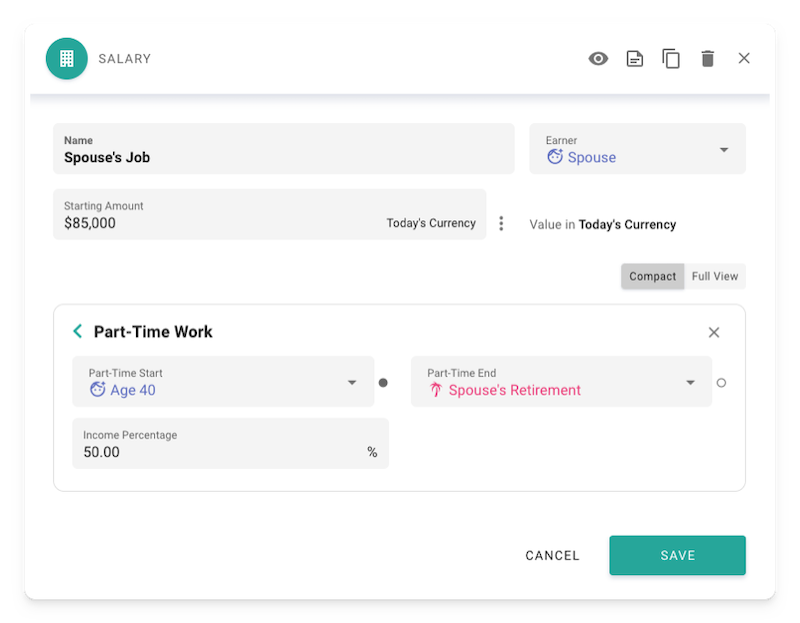

Then, we can use these milestones as bindings when we create other events. For instance, here is a W2 income stream configured to end at the retirement milestone.

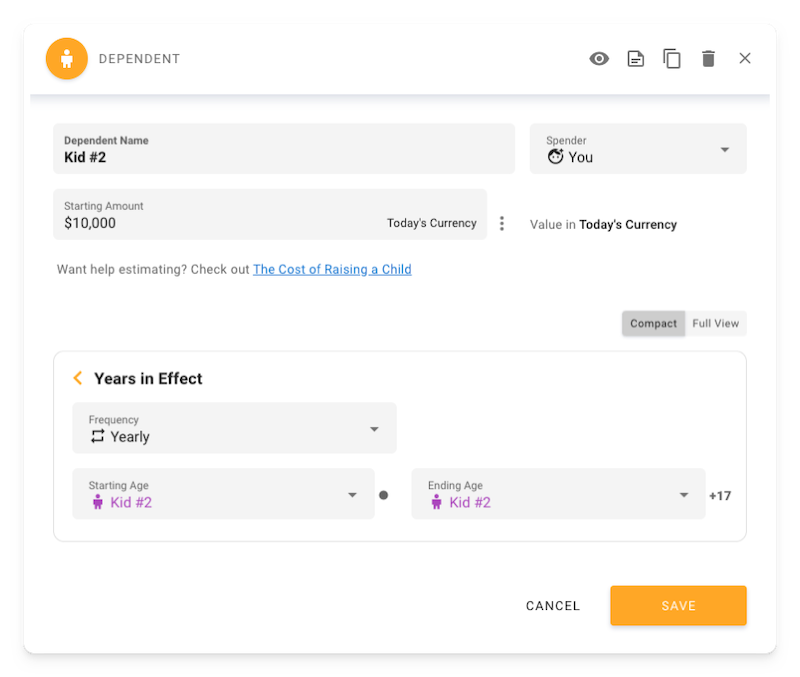

We can also add milestones for the kids, and bind expenses to those. This way, any tweaks we make later to our milestones will propagate to everything else in the plan automatically.

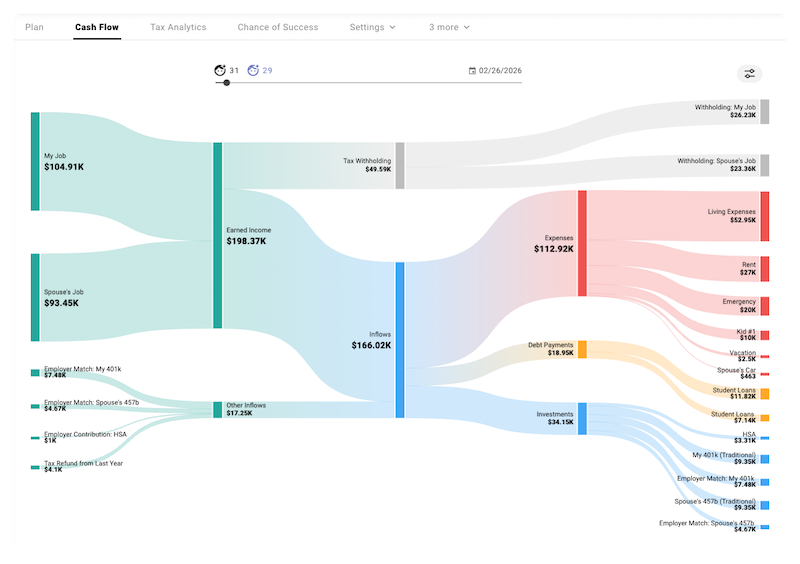

Cash flow visualization

So, what exactly is happening in one of these simulated years? The sankey chart in the cash flow tab can help with that.

We can see how earned income (less withholding) flows into the plan, along with employer match/contributions to tax-advantaged accounts, and how these inflows are used to pay for expenses, service debt, contribute towards investments, and/or build an emergency fund based on our cash flow priorities.

Tax analytics

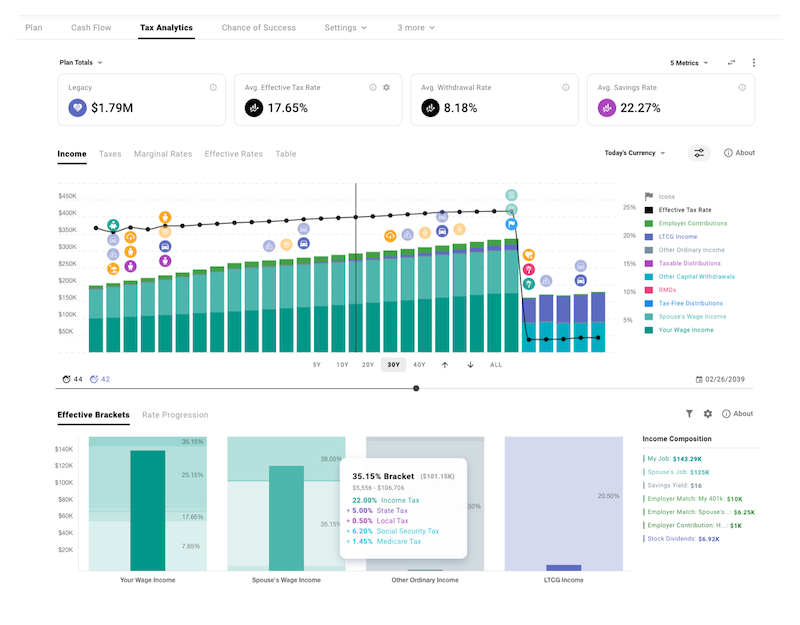

We can also use the tax analytics module to drill down on specific years and examine how the various kinds of estimated taxes and their underlying brackets apply to each income type.

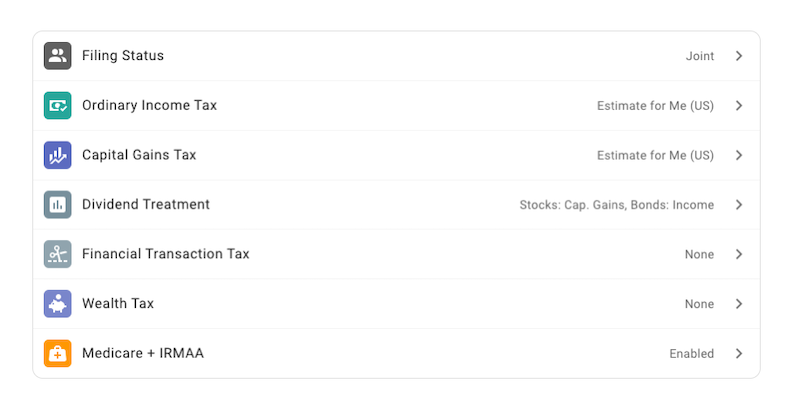

Within our plan’s tax settings, we’ve enabled US tax estimation:

And here’s a look at our projected future income and the effective tax brackets that apply to each type.

You can plot marginal and effective tax rates over time, and also see how extra hypothetical dollars of each kind would be taxed.

Monte Carlo simulation

But can we expect the market to provide a consistent return every year? Nope. And our plan shouldn’t either.

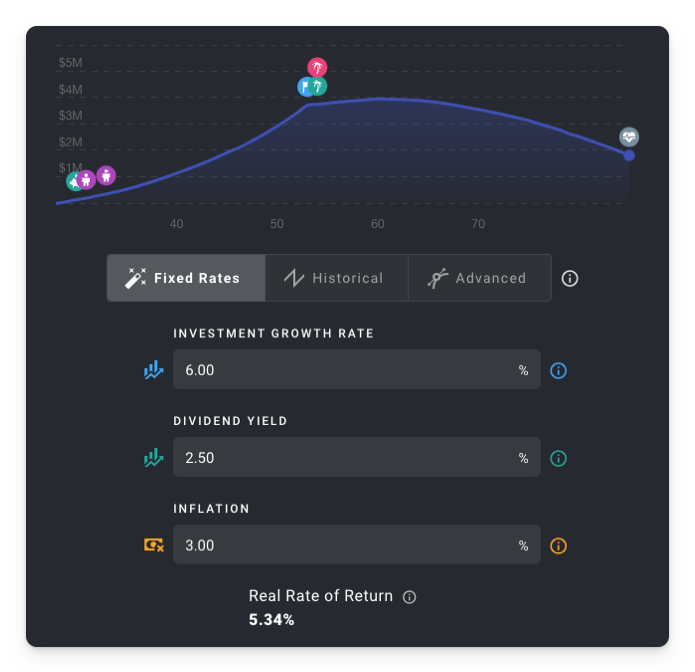

So far, we have just been playing around in deterministic mode and assuming a consistent 5.34% real rate of return.

We could choose to explore a specific historical sequence, or create custom return/inflation curves to model a scenario of our own design.

But what if we really want to get a better sense for the full spectrum of possible outcomes? Time to visit the Chance of Success tab and run some Monte Carlo simulations!

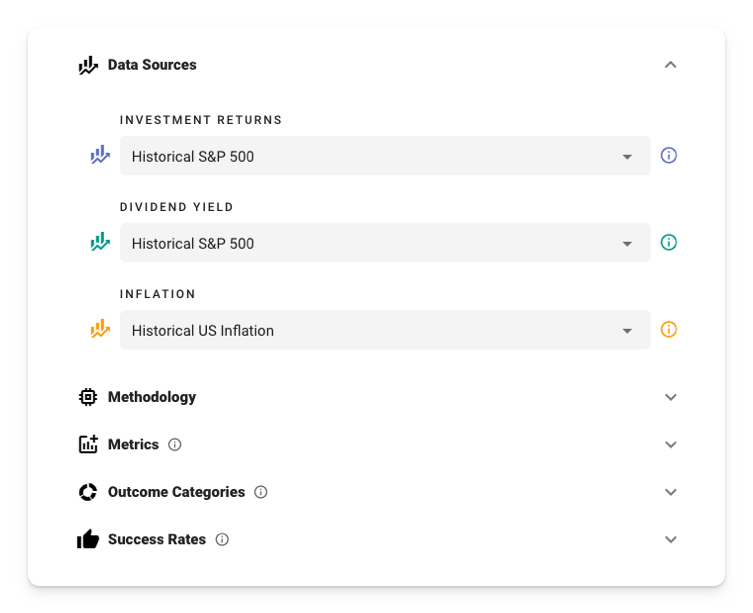

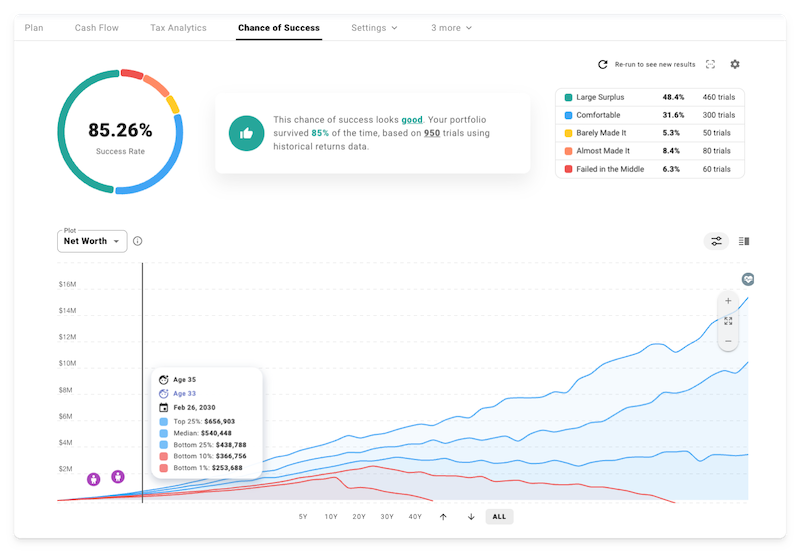

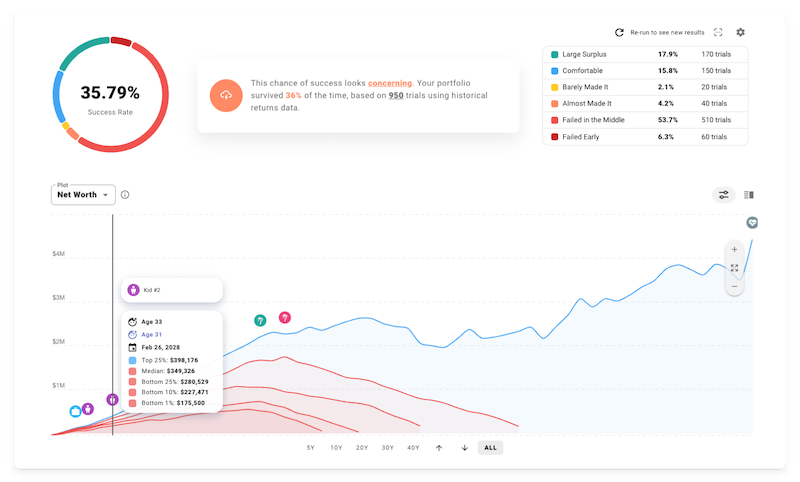

Based on 950 trials using historical S&P 500 returns, dividends, and US inflation data, here’s how things are looking so far:

Pretty solid chance of success! And many potential outcomes that actually exceed our future needs by a large margin.

But, is the life we’ve modeled up to this point really the one we want?

Reaching FI in our early to mid 50s after nearly three decades of full-time work is a great accomplishment. But is there any way we could buy our freedom even earlier?

The dream plan

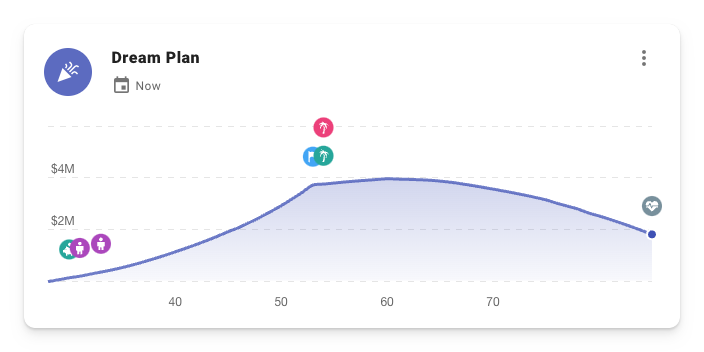

Let’s create a second plan and find some ways to get creative. We’ll start by cloning and renaming the original.

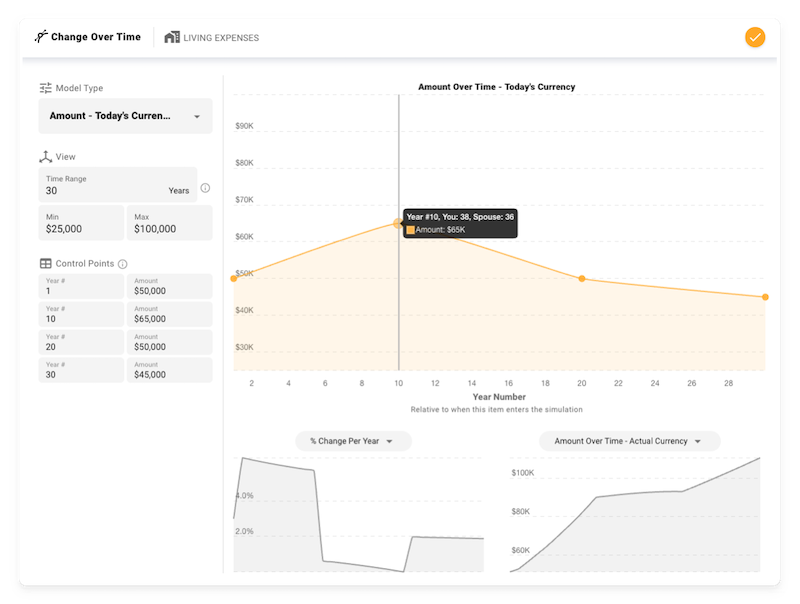

Last time, we allowed some lifestyle inflation to drive up our annual spending over time. Here, let’s keep that under control and build a more granular model for how we think our essential living expenses may evolve.

We will also stop renting and buy a house for $500k around the time Kid #1 is born. Then, we’ll drop down to 50% part-time work at age 40, and we’ll both attempt to fully retire from our W2 jobs at a fixed age of 45.

What does all that do to our chance of success? Okay, so version 1 of the Dream Plan is not looking great.

Hmmm.. but what if one of us works hard over the next couple years to land a job paying 25% more, and we avoid inflating our expenses to match?

That brings us closer to a 50% success rate.

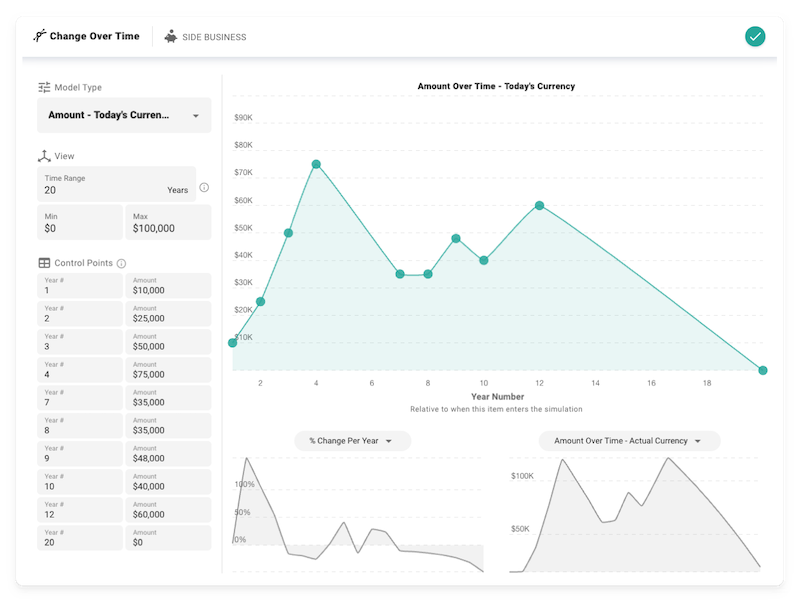

And what about the extra time we’ll have during part-time work and then early retirement? Maybe we have some hobbies or passion projects we have always wanted to try to grow into a side business?

Let’s model one that starts generating some revenue during that period of part-time work.

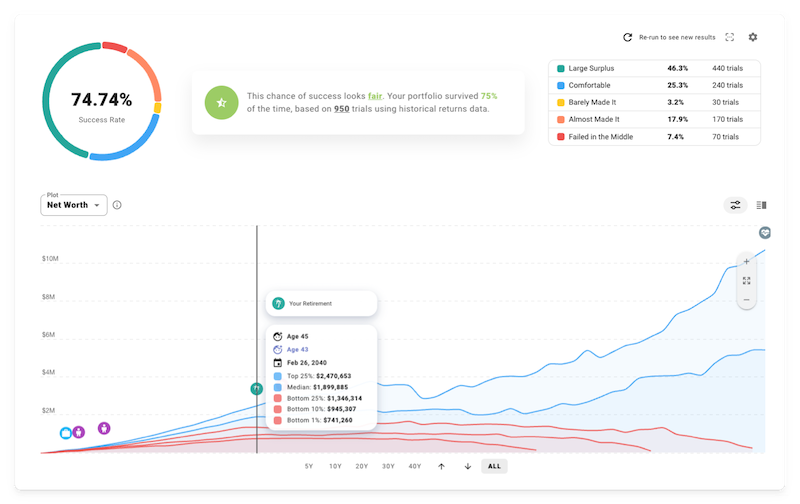

That extra income smooths out those early years after retirement, and brings the success rate back to a more reasonable level near 75%.

Want to learn more?

At this point, we have just scratched the surface of what you can model in ProjectionLab.

If you feel like taking it for a spin, you may want to dig further into account types and liquidity settings, stock/bond allocation over time, international templates and tax config, patterns of asset purchases + sales, drawdown order, rental properties, progress tracking… Okay, I’ll stop now 😛

Here are a few links with more info:

- The tool: ProjectionLab

- Podcast appearance on The FI Show: http://thefishow.com/kyle

- A video review by Rob Berger

You can run basic simulations for free with the sandbox version, and you can use this coupon code for 10% off the premium version: MADFIENTIST-10 🎉

Thanks a lot for sharing, Kyle!

Since I think this is the most-useful (and beautiful) FI planning tool available, I added a permanent link to the sidebar of the FI Laboratory, so that you can easily run projections when you’re updating your FI numbers.

Head over to ProjectionLab now, run a few simulations, and see if you’re as impressed by the software as I am!

Kyle! I’m so excited to see you on mad fientist (we usually connect via the discord chat). I’ve used projection lab for about a year and absolutely love it. It makes me feel completely in control of not just my day-to-day finances, but also retirement, large purchases, and things like figuring out whether I’m saving too much vs investing, etc. The cash flow priorities module is my favorite thing, and such a powerful tool! I’ve used it many times to play with the consequence of paying off debt early vs investing more, spending vs saving leftover income and so much more. Thank you for creating this incredible program! I hope to use it for years to come.

Thanks so much Ashley! That kind of feedback from the early adopters like you is one of the things that has kept me energized and motivated, and full of ideas for how to keep making the tool even better :)

IS INCREDIBLE!

Thanks for sharing this! It was really interesting (and painful) to see where I’m currently at and what it’s going to take to get there but having something visual to help with the calculations goes a long way to putting me back on track. I can’t wait to see how it develops and look forward to the next Mad Fientist email newsletter!

This looks great and I’m certainly interested in checking it out. I’ve spent some time withNew Retirement Planner and would love to know about differences compared to this software! Does ProjectionLab include future income from Social Security? That is one area where I think planning software can really add so much value given the complexity of the program (especially for a married couple thinking about a joint claiming strategy).

Hey Stephanie, PL currently points to the ssa.gov link to help estimate future social security benefits, but in US tax mode it does estimate the taxable + non-taxable portion for you, which you can review in the tax analytics screen.

From the start, I’ve done what I can to make the tool general enough to support international use cases beyond just the US (e.g. the international account types and tax configuration presets), and I plan to keep dialing those in and making them more granular over time.

It’s been a while since I’ve played around with NewRetirement personally, but I think it’s a cool tool as well. I’ve chatted with Steve Chen before, and he’s a good guy. The world needs better planning software :)

A few areas that I knew I wanted to focus on with PL for my own planning purposes include:

– Precise and intuitive control for how things may change over time (e.g. the advanced change-over-time editor shown above). Can be helpful for modeling career trajectories, expense patterns, experimenting with return sequences, etc.

– Flexible milestones that you can bind to other events in your plan, so you can build dynamic configurations that are easy to edit and iterate on

– Customizable Monte Carlo simulations and historical backtesting, where you can see and change the sampling methodology or experiment with your own probability distributions

– Sankey cash-flow visualizations

– Tax analytics and breakdown of effective brackets year-by-year

– Customizable plots where you can choose what metrics you want to see and whether or not they should be aggregated

– Sorry, it’s past my bedtime and I feel like I’m just listing features at this point . Happy to chat though if you have questions.

–Kyle

I agree with Stephanie, this feels a lot like New Retirement. I like the way ProjectionLab handles Milestones…and the Cash-Flow Visualization chart is pretty slick.

OH MY GOD! I haven’t been this excited in a while. My issues with Mint & Personal Capital (now Empower) is they don’t always update as needed and the advertising is insane.

Thank you for creating this. Can’t wait to play around with this over the weekend while I prepare my taxes.

Thanks for checking it out! If you run into any questions over the weekend, feel free to reach out on the PL Discord community (email works too, if Discord is not your thing).

Interesting looking tool, and clearly has a nice UI. I can’t fathom creating an account and trying something that won’t save any of my data without signing up for a paid subscription. So a pass for me until they rethink that bit.

Hey Alex, no worries if it’s not for you. Just wanted to point out that there is a free trial of Premium, and if you’d like more time than 7 days to kick the tires on it, I grant longer trials on request. There’s also the free sandbox with example personas you can check out if you’d just like to get a feel for the tool without needing to populate a bunch of data.

So you want them to develop it using thousands of hours of coding and then give you full access it to you for free?

Why would they do that?

I think you are being pedantic. Offering access to a Software as a Service platform with no ability to save your data is not something I have ever encountered. There are ways to control the saving (frequency, versions, etc) behind premium features but I am positive that not allowing data to be saved at all prior to putting in credit card details will stop many from trying it out.

Not really an accurate opinion Alex, though yours is certainly noted. It makes sense to me and the many others that have commented. I cannot imagine any other way for the guy that created everything for you to offer to save and support your financial game plan for free until you decided to support his his financial game plan or not. No need to hit him about it, just don’t do anything if it is not your deal.

It would be way better if even if your not allowed to use, your data is saved. So you’re not throwing your work away.

I have never heard of this tool yet so thanks for introducing it. I will read it and google feedback about it later but I have questions in advance ;-) since I assume Kyle will take a peek at comments for a shortwhile after writing on MF.

Is the tool capable of spitting out a comprehensive report comparing various scenarios a client has created on their account? Say they create a dozen of scenarios with different withdrawal & conversion strategies from their retirement and taxable accounts plus different SS claiming timelines for each spouse a report that succinctly summarizes tax consequences, optimality of cashflow generation vs. ending balances on one page/screen would be very helpful.

Does it run Monte Carlo only? I have heard of 3 or 4 types of scenarios including MC. Historical would be the 2nd type, I would guess, but I cannot recall the other two. Of course, I’m not an expert to know which ones are best since they are all based on the past and we’re trying to look into the future LOL.

How long is the 10% discount valid for?

Thanks.

Hey Orange, you can create a variety of plans with different strategies, and there are ways to compare one plan to another, but it sounds like what you’re really after here might be a new feature request for an additional view where you you can compare a customizable set of metrics across every plan in your profile at once? That does sound like a cool idea, and feel free to add that on the public roadmap if you like.

On the simulation topic, there are a few different kinds. In the simple / deterministic planning mode, you can choose between fixed rates, a specific historical sequence, or custom curves. And in the advanced / Monte Carlo mode, you can choose between using historical data or custom probability distributions, and also define what kind of sampling method you prefer.

If you check it out and have other questions, feel free to reach out any time. Discord or email is easiest; the comment system on here seems to be a little wonky.

Sorry if this existed and I just didn’t see it but… can you tell me if this projects traditional 401k rollovers to Roth IRAs and the estimated tax saving/implications?

If you’re looking to model Roth conversions, you can find those within the corresponding account form in the plan interface. If you have any trouble, feel free to reach out on discord or email.

This looks like a great tool Kyle! I feel like I might have seen it maybe once before, can’t remember when though.

I particularly like that you allow folks to specify the mean and std dev of returns for the Monte Carlo analysis.

Question: have you considered allowing users to adjust the kurtosis as well? I.e., allow for thicker tails in the probability distribution?

Hey, thanks Corwin! I’ve actually been meaning to add support for more advanced statistical Monte Carlo inputs for a while now. Last month I added the ability to customize names/definitions for MC success rates and trial outcomes, and I think things like kurtosis would help to flesh out the suite of modeling options even further. Not sure if that one is already on the public roadmap, but if not, feel free to add it!

Looks very cool!

1) Does any external party check the calculations in these tools? Is it being audited so we can trust the results?

2) Is this better or cheaper than New Retirement or Pralana?

Hey Steve, on the topic of testing/validation, I’ve built a variety of automated test suites that do things like regression testing, unit testing, integration testing, spot-checking specific scenarios (including cases where results are compared to known outputs from other tools), auditing metric and tax calculations and sankey chart output, etc. At least 5-6 thousand tests are run for each change that makes it to prod. The idea of getting an external firm involved as well could be a good idea though; I’ll take a note to explore that.

For #2, a surprising number of folks tell me that PL’s price point should actually be higher, but I try to err on the side of keeping it affordable for as many people as possible (and grant discounts on request sometimes too). I spent a lot of time experimenting with the other tools out there before building PL, and for me at least, the existing tools didn’t have everything I wanted or the kind of UX I prefer. But as the creator, of course I would say that, right? ;)

+1 on the first point. Getting an independent, reputable firm to audit the software and outcomes would remove the one aspect of PL that makes me hesitate to renew my subscription.

Aside from that, it’s a great tool!

I would be interested in playing with the tool, but even to test it out will be kind of wasting my time probably because I will have to redo scenarios over and over if data isn’t saved when I just need to change a portion of the scenario and the rest of it from the previous scenario. Pictures do look pretty in the article, so I’ll see if I wish to test your tool.

Questions:

Is this tool completely functioning or is it in Beta version? I hope the former if fees are charged, but want to make sure.

Does the tool allow to enter all the tickers of the mutual funds, individual stocks, CD’s, and I-Bonds and then determine AA (similar to Personal Capital) or is all this planning based on the generic classes with manually assigned annual performance (stocks 8-10% a year, bonds 3%, etc.)?

Is the tool capable of running projections for many years and ‘advising’ which of the two ‘wins’: Roth IRA conversions and unsubsidized premiums for an ACA insurance (for people who retire much earlier than 65) or foregoing Roth IRA conversions, but getting sizable ACA subsidies?

If you want to really kick the tires on PL including all the advanced features, I’d be happy to set you up with an extended free trial. Just shoot me a message on discord (or email if you prefer).

And yes, the tool is functioning haha.

Currently PL isn’t really geared for super granular asset allocation modeling down to individual tickers. You can model a variety of account types with differing tax treatment (international and US), and you can experiment with overall portfolio-level stock/bond allocation over time (and backtest on corresponding historical data in MC mode), but if you feel you’d get a lot of value out of another layer of depth when it comes to AA modeling, feel free to capture some of your thoughts in the discussion on this roadmap item: https://changemap.co/projectifi/projectifi/task/5670-asset-specification-allocation/

You can model Roth Conversions and compare outcomes across plans. I haven’t implemented automatic estimation for ACA subsidies yet, but if that’s something you would like to see, there are a couple related items on the roadmap you might want to upvote.

This looks promising! Can it handle different assumed growth rates for different types of investments? I have private investments that I expect to grow at a different rate than the public markets.

Yep! You can override the plan growth rates for specific accounts, and define how those may change over time if you like.

If I buy a month-to-month membership for $12/mo and after using it for some time cancel, is my data saved and I can restart it later, when I need another set of calculations done? Or do I lose all my data and start over?

Hey Steve, if you restart at a later date it will still be there :)

You can also export your data to JSON as a backup if you like.

Hi Kyle, related question: is it possible to import existing historical data from other tools? For example, Empower (formerly Personal Capital) allows export of all transactions in a .csv file. Would it be possible to populate an account with this data so as not to be starting from scratch? Thanks in advance for any clarification!

Looks slick.

Does this work for Flamingo FI type plans and semiretirement?

Also wondering if the Australian tax presets include negative gearing and offset accounts?

Cheers!

Hey Christian, PL excels at things like Flamingo FI / Coast FI scenarios :)

Offset accounts and negative gearing are two nuances I don’t yet have first-class support for, but there are a couple related items on the public roadmap you might like to upvote.

The recent review on flamingo FI’s site disagrees with “excels at”, since the current support is a static number. But the author suggest you have planned future updates to better support moving targets for scenarios like Coast FI, which is great.

The Coast FI milestone is an interesting case. I remember chatting with some users back when I was first adding a set of default milestones and wondering if I should add one for Coast FI and what shape it should take. I know a lot of folks like to use a Coast FI definition along the lines of “assuming a fixed rate of return and retirement at a specific age, when can I start coasting”, and I floated that idea to users at the time. In Monte Carlo mode though (and/or historical/advanced config in the standard plan view), returns are variable, not fixed. Plus, people often define their retirement milestone in a dynamic way rather than at a specific age. At the time, the users I surveyed didn’t want to see me spend time developing a custom milestone type unique to Coast FI implementing a formula that was itself sort of a coarse estimate with assumptions baked in. But if that specific formula assuming a static rate of return and fixed retirement age is what people really want there, I’m open to the idea of revisiting it.

That being said, my comment above didn’t actually have the milestone system in mind. When I think about semi-retirement scenarios in PL, the area where people tend to think it excels is being able to model a bunch of different income streams and transitions between phases of life with varying amounts over time, part-time work, side hustles, etc. And then you can experiment with shifting around those transition points, and run backtesting / Monte Carlo simulations to build a better intuition for your overall chance of success.

Happy to chat more on discord/email if you like. My objective is to build what the community would like to see, and all feedback is welcome :D

I’d say this is an even more powerful tool for FlamingoFI type options as compared to simpler calculators, and what I wound up spending most of my time experimenting with. Neither my wife nor myself really see ourselves stopping with work short term, and had always planned on experimenting with actually spending everything we make for the first year after hitting a planned FI milestone, both of which were nice things to experiment.

You can manually set a milestone by creating a dummy taxable pension if you plan to work part time (and have that shift at arbitrary age milestones if you have to kludge it slightly),

I know knowing about upside-down taxes, sorry.

Mostly, thanks for pointing out what ‘FlamingoFI’ is, because now I have a name for the approach I had been trying to work out independently, but wasn’t really sure if I had a complete enough framework to validate… which now I do. Cheers!

Hi Kyle, looks wicked! I’m based in Melbourne, Australia and I wonder if the different tax nuances can be tailored for superannuation here.

Thanks Jacqui! Have you seen the account types and cash flow priorities for concessional and non-concessional superannuation? (And also the Australian tax configuration preset). If so, and you have some ideas on how to improve fidelity further for Australian scenarios, just shoot me a message/email.

It’s brilliant!! Let’s see who buys it :). Thank you so much for sharing!

Hey Kyle this looks and feels great! I’ve been trying it over there weekend but the only downside for me is I’m in the UK can’t get a feel how the income tax works/ doesn’t. The DB pension doesn’t seem too intuitive, I’ve a career average DB but I had to mess around to get a future accumulated payment. Maybe need to join you Discord for some tips but great work!

Hey Peter, thanks for checking it out! I’m assuming you’ve seen the UK tax config preset(?) If you have any tweaks to recommend, feel free to send me a message on Discord or email :)

Hi Kyle, I’ve seen the config preset but it’s a premium feature. Default sits at 30% effective tax and 15% capital gains which isn’t correct for the UK so difficult to get a feel for how accurate the projections are at least short term. The sandbox shows the UK mid-career effective tax at 30% which is low as there are NI contributions and a lower rate taxpayer circa 45k income is around 14%tax and 9% NI so it’s too high at 30%.

Probably best to do the trial!

Yeah, that’s where the free trial of Premium might be helpful, so you can give the tax features a real test. If you’d like a longer trial than the default 7-days, just let me know!

Was excited to try it. But kinda a rough first experience.

Finally get all my data loaded in, hit the “Add Plan” button and the dialog is just frozen with “Fixed Date” selected. Cant click any of the buttons. Tried refreshing and still same issue. Tried opening a new tab and it just kinda holds my data ransom and wants me to pay.

I get deserving to get paid for your hard work. But kinda a bummer in this situation. I either have to pay, re-enter everything or move on. Running in Safari on latest iOS that just released.

Hey Craig, haven’t heard of anyone else having issues with Safari. I test pretty regularly for compatibility across the major browsers, but if this is something reproducible for you, just send me a message on discord/email and I can help troubleshoot.

Also happy to set you or others up with an extended free trial if that would be helpful :)

Looks like a great product! I’m looking forward to playing around with it. Does the tax planning include the EITC? the ACA credits? Are there any college planning projections, as in how to maximize the FASFA?

There isn’t an automatic estimator for EITC, ACA credits, and FAFSA yet, but you can model custom tax deductions/credits if you like. Feel free to add an estimator for those as a suggestion on the public roadmap too.

This is such a great idea and I have been setting up and playing around with it. Would definitely pay for a subscription if I can get it accurate to my circumstances.

I might not have yet got to grips with it but as a company director paying myself I can’t seem to be able to enter income in a way that reflects how I pay myself and pay tax. It’s just modelled for PAYE only or am I missing where I can enter this?

Also can’t seem to play around with types of mortgages, interest only v repayments and making overpayments. This may be on the paid version? It’s also adding large property taxes as its in USA tax mode but this feature may resolve if I paid for the premium and had access to the UK tax structure option?

Hey Katherine, just shoot me an email or DM on the PL discord and we can chat about your scenario. PL is generally geared more for personal finances than complex corporate structures at the moment, but custom income streams and tax deductions/credits can offer some flexibility there.

For modeling extra mortgage payments, have you tried a “pay extra” cash-flow priority? And if you’d like an extended trial of the premium version so you can really test everything out, just let me know.

Sounds great. Do you have a New Zealand model? Can you chance the tax rates and GST rates? I’m a ball park kind of guy. Like to keep it simple?

I’ll send an email.

Hey Brian, there is a tax template for New Zealand and the brackets and rates are customizable :)

If you have more questions, just shoot me an email.

Hi Kyle, is there also a similar template for Australia?

Yep, you can see the full list in Plan Settings > Tax > International Presets.

Looks like a great product. Questions…

1. How Canadian centric or supportive are you? Do you have Canadian CPP and OAS calcs, tax rates, etc…, etc…

2. How are you handling corporations owned by the user

3. How are you handling insurance and “borrowing” from corporate policy to fund retirement

Thanks