Well, this was a big surprise!

About a month ago, I was working on a Mad Fientist article one evening when my wife (who is not a fientist…or so I thought) said she was going to bed.

As she said goodnight, she mentioned that she had something for me to read on her computer. She didn’t say what it was about though.

I tried to continue what I was doing but curiosity quickly got the better of me.

What I found surprised me, to say the least.

After a month of attempting to persuade her to let me publish what she wrote, she finally agreed.

I have added links and made other minor changes to convert what she wrote into a blog post but all the words are her own (British spellings and all).

This is what I found on her computer after she went to bed that night…

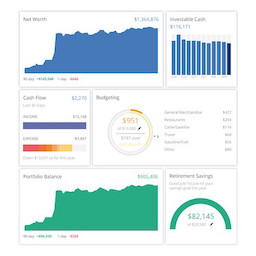

Automatically calculate your net worth, asset allocation, and investment fees with this free portfolio manager!

Get StartedSometimes it didn’t even matter what I bought, it was the act of spending it that brought me joy. Or at least I thought it did.

As my Mother would put it, money always seemed to be burning a hole in my pocket.

In the past few months my feelings towards spending vs. saving money have dramatically changed.

So what brought about this sudden change after all these years? Is it because I married the Mad Fientist 9 months ago and he has forced me to change my spending habits?

No. One thing about my husband is that although we have always had very different views on money management, he has never tried to control how much I spend or what I do with my own money and this has not changed now that we are married.

So although we may have had some minor disagreements over the years, we have never argued about money or found that it negatively affected our relationship.

I have always known that my husband gains no pleasure from spending money and instead enjoys saving it and watching it grow. I have also learned in the past couple of years of his goal to save enough to be able to quit his job and pursue his own interests.

Although I understood the benefit of this for him, I had no desire to follow in his footsteps. If I left my job what would I do?

I enjoy my work and I enjoy having money to spend on the things I want. If I left my job so young, surely I would be bored for the rest of my life and would not have the money to go out and do fun things. I would feel like a completely useless, unproductive member of society. What would be the point in my existence?

The first thing that began to change my way of thinking was the Mad Fientist blog. I was one of those people (along with his own family) who would often ask him, “Why do you deprive yourself of the things you really want?” and “Why can’t you just learn to relax and spend money without worrying?”

When I read his article, Triple Value of Income, it made me realize that he really doesn’t feel like he is depriving himself of anything. He just doesn’t feel the need to have a lot of things.

I started thinking about the things I like to spend money on and wondered if I would be any less happy without them. Maybe I could even be happier if I stopped wanting material things and could be satisfied with what I already have (or even much less).

But this still didn’t make me want to save enough to quit my job. I still thought that I’d be happier working full time and enjoying the benefits of having that regular cash flow.

However, my outlook was significantly changed when we were on our honeymoon and one day my husband asked me, “What would be your perfect life?”

Now for me this was actually a difficult question to answer. I have sometimes fantasized about what it would be like if I won the lottery and had endless amounts of money and could do whatever I wanted. But to actually visualize a realistic version of that dream was much more difficult for me.

I suppose I still believed, as a lot of people do, that we do not have that many choices in life.

So we discussed what the most important things in our lives are and we eventually came up with our Perfect Life.

Now that I could picture the benefits of not having to work full time, I was starting to come on board with the idea of financial independence. However, I still did not want to stop working completely. So maybe I could just work for half of the year?

I was slightly hesitant about taking all that time off though. In the past, long periods away from work tend to leave me feeling restless. Even if we planned to travel to new and exciting parts of the world, how would I keep my mind stimulated?

Then I started thinking about all the exciting opportunities out there that I could take advantage of if I wasn’t working. I could volunteer my time to help others. And better yet, I could possibly even pick up some new skills along the way.

All it took for me to be 100% onboard with my husband’s plan was to be able to visualize all the exciting opportunities out there in the world that we can take advantage of if we are not tied down to living and working in one place.

I have already lost a lot of the desire to spend money just by having a definite goal for the future. I think that once I get used to this new mentality of not feeling like I need to spend money on material things, I will ultimately be a happier person.

I have also come to understand that financial independence is not the same as early retirement, as I used to think.For one person, FI may mean being able to quit their job and never having to work again. In my husband’s case, it will mean being able to stop working for someone else but continue to work on things that he finds interesting and challenging. For someone else, it may mean having enough money to give them the courage to leave one job in order to pursue a better one. For me, I think it would mean being able to continue doing what I do because I really do like my job, but would allow me to work less, spend more time with loved ones, travel more, and hopefully pick up new knowledge and skills along the way.

Once I have cleared my current student debt, I will be more likely to save as much as I can and enjoy this newfound freedom with fewer possessions and hopefully even more happiness.

My husband realised that his own motivation for being financially independent is not necessarily what would motivate me to change my spending habits. So instead, he encouraged me to re-assess my life and my goals and in the process we came up with some pretty exciting alternatives to our current situation. Trying to persuade me to change my spending without this goal would probably not have worked (it hasn’t worked up until now).

And so after more than 10 years together, I am finally coming around to my husband’s way of thinking. Something I don’t think either of us ever expected.

When I started this site, my goal was to develop strategies and tactics to help people (myself included) reach financial independence as quickly and efficiently as possible.

If what I wrote helped convince people that FI is a worthwhile goal, great, but that was never my primary objective.

The fact that my articles (and those written by Jim Collins and Mr. Money Mustache, since she’s an avid reader of both of those blogs now) have helped change my wife’s mindset is something I never anticipated.

Although Jill was mortified when I first asked if I could publish what she wrote, I’m really thankful she eventually let me.

I think her story perfectly captures the epiphany that each of us likely had at some point and also highlights the importance of letting your loved ones follow their own journey.

Now that our financial paths have finally merged though, I’m even more excited about the future!

My wife is somewhat frugal, but she doesn’t get it. She thinks that I’m some kind of miser who doesn’t enjoy life.

She could retire right now and with our investments realize a yearly income of $100K. No kids and absolutely no debt. But she thinks she needs to keep working.

Hey Mike, great to hear from you again. I bet my wife would have described me in exactly the same way just last year so don’t feel too bad.

I’m not sure what advice to offer you because as my wife said in the article, had I tried to convince her or make her change her ways, she would have just ignored me completely. Maybe ask your wife to proofread your blog posts so that some of this stuff gradually sinks in (I think that’s what happened in our case). We also had the pleasure of spending some time with Jim Collins and his wife so hearing the same ideas and advice from someone other than a nagging husband probably helped quite a bit as well.

Mike and Mad Fientist,

These are real issues. Challenging issues. My parents were so different in how they related to money that they split my dad’s paycheck 50/50 (my mom was a stay at home mom). That actually worked incredibly well to eliminate tension, and I give me dad credit for suggesting it.

I don’t think there are any easy answers to this other than as MadFI says to not try to change anyone and hope you rub off. I have found that to be the case, but relationships are always about compromise and no two people relate to money exactly the same.

Mad FI, you are lucky the Mrs. came around ;).

I think our (the frugal minded) approach is not clear when we tell others that they don’t have to work. When we focus on the not working part, it makes people uncomfortable. But when we focus on feeling safe and secure and having financial independence, it hopefully makes more sense to them.

I believe that once people know that what we mean is, not HAVING TO or being forced to work is a great gift that frugality can provide. It does or mean that every body that is financially independent, MUST stop working. The most important part in my opinion is having a choice and being free to able to enjoy your work instead of being force to work that people need to hear more about.

Wonderful blog

and thank you Mr. Money Mustache for referring me to this blog.

Great point, Paris. It’s hard for people like us who are so excited by the freedom to understand why it could make others feel uncomfortable but it definitely does. As you said, focusing on the security of financial independence is a great way to counteract that uncomfortableness.

I also agree that differentiating between ‘not having to work’ and ‘never working again’ is extremely important. Personally, I can see myself working at a variety of different jobs after I achieve FI but I will be doing it to learn new things, have new experiences, and meet new people rather than to get a paycheck.

I just read your comment over at MMM. Separate finances are a great way to keep money from causing arguments in a relationship. My wife and I pay all of our major expenses jointly but then everything that’s left over stays in our separate accounts. It’s worked great for us for the past 10+ years so I hope it works just as well for you and your husband (and hopefully he will eventually come around to your way of thinking once he sees how happy and wealthy you are)!

Thanks for stopping by and thanks to Mr. Money Mustache for being so kind to point you this way.

The issue is fear, fear of running out, my sister in law works like a dog, 80 plus hours a week, driven by the fear that she will run out, it took two years of talking to finally convince her that she could retire at 67. Even today in our conversations I told her pensions will cover all her living cost with plenty to spare!

So you need to find out why you wife is fearful of

Good Luck

Wow! Congratulations to both Mr. and Mrs. Fientist on this interesting turn of events.

Living a good life yourself sets a pretty irresistible example for your spouse, so I’m definitely not surprised.. but this will still bring hope to other couples who are earlier on in the battle..er,ahem..journey.

Hey MMM, thanks for stopping by! It is definitely an interesting turn of events and one that neither of us expected.

I remember back when we talked prior to our podcast interview, you mentioned that blogging was a lot of fun and that a lot of cool, unexpected things came from it. Well, getting my wife and I on the same wavelength is definitely one good example. Having a few beers with you and hopefully Mrs. MM in St. Louis in October will no doubt be another so I look forward to seeing you both then!

Mmmm….

could I tag along?

Jim, this is the thing I was trying to get you to go to when I emailed you a few weeks ago.

Does this mean you’re thinking about coming now? You definitely should.

Okay . . . I’m not sure how I missed this potential meeting but I’d like to pop in and meet you, MMM and JLC when you’re in St. Louis as I live in that area. Care to share when and where you guys are meeting?

Hey Prob8…

I haven’t yet definitely pulled the trigger on this, but after I get back from Ecuador in late September I probably will.

I don’t know what MMM & MF have planned, but you are one of my favorite commenters.

I’d be honored to have a beer or coffee with you.

Hey Prob8, it’d definitely be great to meet up in St. Louis! I actually want to buy you a beer to thank you for suggesting that I interview Billy and Akaisha Kaderli for my podcast. I just spoke with them last weekend and really enjoyed the conversation so thank you very much for the recommendation! I hope to get the audio edited this weekend so look out for the podcast episode sometime early next week.

The conference we’re all going to in St. Louis isn’t until October so I’ll email you nearer the time and we can try to figure out when to get together. Look forward to meeting you!

@ JLC – I hope you decide to attend in St. Louis as I’d love to meet you.

@ MF – You are very welcome on the Kaderli suggestion and I can’t wait to hear the podcast. I look forward to the details of the meeting in October.

Well first, that’s not English spelling in her post. Clearly it is Scottish. :)

But that established I am ever so pleased you persuaded her to let you post it.

I am especially moved by her epiphany that it’s not about “retirement” it’s about freedom. That, and letting go the false prize in the trap.

The great irony is, of course, that those who do find their investments soon amply filling their purse in ways labor never could.

Well played!

Haha, I had to edit most of the Scottish out so that people could actually understand what she was saying ;)

By the way, thank you for helping me convince her to share what she wrote. I think your encouragement played a big part in her agreeing to let me publish it.

Was this post meant to get my CONSUMERSAURUS wife on board with FI or was it intended to open my eyes to better understand her? At first I was thinking “this is great! I just have to get her to read your article and everything will click for her.” Then after some more time my thoughts changed to “wait a minute, I’ve been doing it all wrong. I’ve been trying to force feed FI and my version of it to her and I just expected her to climb aboard all this time?” Can you hear the click? That one’s all mine. Please share my thanks to your wife for allowing you to post this. I have been an ass and I need to apologize to my better half and reset the whole thing. I think a date in front of the fire with a bottle (or box) of wine, some chill tunes and the question “What would be your perfect life” is a great place to start. – Thx.

Haha, fantastic comment, Dave!

You captured the essence of this article perfectly.

My wife really liked your comment as well and wanted me to ask you to keep us posted on how the “perfect life” conversation goes. As she mentioned in the article, coming up with your perfect life isn’t as straightforward as it seems so it will likely take multiple conversations (and hopefully multiple glasses of wine).

Good luck and please let us know how everything turns out!

I really liked your “perfect life” post and even commented on it. Unfortunately it never appeared and must have been caught in the spam filter. Or something. Deciding what makes a perfect life isn’t easy but it’s something I’ve been working on since I read your post. I’m hoping to figure it out and get my partner on board too!

No! I always worry about people’s comments going into the spam folder but this is the first time it’s happened. I looked through the folder and didn’t find anything from you but it just got emptied two weeks ago so if you left the comment before then, it’s gone. I’m glad you tried again and were successful this time. Now that you’ve commented once, you should be able to comment as much as you want without your comment being flagged as ‘spam’ or ‘awaiting moderation’.

It’s crazy how difficult it is to nail down your perfect life, isn’t it? I think the process of figuring it out is extremely valuable though because it really brings to light things in your current lifestyle that aren’t important. I’d be really interested to hear what your perfect life turns out to be so once you figure it out, please leave a comment or send me an email.

Blogging has definitely allowed all of us to leave our thoughts for others to read without any forceful persuasion. I am glad that your wife recognized that you are pursuing path of financial freedom not because you want to spend time on the beach everyday; rather, you want FI to have freedom to do whatever that excites you most in life. She is a great writer, so perhaps, she can pen down more thoughts in the future…

Shilpan, you have such a knack for perfectly summarizing a post in an eloquent sentence or two.

My wife will be very happy to hear that you like her writing. I can’t imagine she’ll write anymore but I would have never expected her to write at all so she may surprise me again!

Brandon, thank you for the kind words. She, indeed, has uncanny ability to express her emotions well, and that’s the hallmark of a good writer. I’d love to see her contributing more on this blog in days and weeks to come.

This post is Excellent!! I’m so glad your wife decided to share what she wrote.

This part (the goal) is key and is exactly what did it for me as well: “Trying to persuade me to change my spending without this goal would probably not have worked (it hasn’t worked up until now).”

This is only the beginning… enjoy!

Thanks, Mrs. MM! She will be very happy to hear you enjoyed the post so I’ll be sure to let her know.

Reading about how everything turned out for you and your family can only further reinforce her newfound desire to pursue FI so thanks for being a good role model :)

Whoohoo! Well done Mrs MF! I have had the husband on board for about a year now as well. He wasn’t a spendthrift by any means, but didn’t know what he was piling up all his cash in a savings account for. Now he also realizes it’s about freedom and we’re on a roll.

I am looking forward to inspiring blog posts of you guys traveling the globe.

Thanks for the comment, EW!

I am very much looking forward to writing about our time living and traveling abroad so it couldn’t come soon enough. Maybe we’ll stop by your neck of the woods at some point. We’ve been to Amsterdam a few times and I went on a business trip to Utrecht and both places were wonderful. One of my friends used to live in Maastricht and said it was beautiful there so that is definitely on our list of places to visit as well. Where exactly in the Netherlands are you located?

That is what couple to do each other. Help your better half change for the better. Women just love to shop. It’s one of their favorite things in the world. Well, good job to you mate.

“Help your better half change for the better” – I absolutely agree. She’s actually changed me for the better as well by making me less extreme with my savings. I now enjoy the present a bit more, rather than focusing solely on the future, and I don’t stress as much when I spend a bit of money on things that are important to me.

Thank you for this. I’m the frugal one in my relationship and it is my husband that is the more reluctant one. Luckily, he was always a saver before we married and earns a high income so his extravaganzas aren’t hurting us too badly, but he still has a higher lifestyle than I what I would like. Through talking to him about being free to travel, heck, even rent an apartment in Buenos Aires or Santiago, Chile while visas allow us (he is fully fluent in Spanish and wants more than anything to live in Latin America), it is giving him pause to think. Especially since our daughter is only 1 right now….we have years until we need to be “settled” down in one place for her sake. I keep trying, trying, trying to sell the dream instead of selling the miser lifestyle he thinks of. So far, it is getting me farther than anything. We are just a few years from complete retirement. There’s hope for anyone!

Thanks a lot for sharing your story, Elizabeth. I agree that selling the dream is the way to go because I can’t imagine trying to sell the miser lifestyle will get anyone very far.

Hopefully you succeed in convincing your husband and we can toast to your success over a drink in Argentina or Chile!

Found this post while reading thru MMM’s “Selling the Dream Pt. 2” post.

Kudos to Mrs. MF for a great write-up.

I have been enjoying your blog as well as MMM and Jim Collins.

The work you guys do is greatly appreciated as I am trying to emulate the FI and get my wife on board as well.

I will share this with her because I believe she will relate to this a little easier than me trying to explain my idea of ER.

Thanks again for all you guys do.

Hey Woodreaux, thanks a lot for the comment. I’m glad you enjoyed the post and I’m sure my wife will be happy to hear you enjoyed it as well.

I’d be interested to hear what your wife thinks about it after she reads it so please let me know!

Hi everyone, I’ve been contacted by a journalist who is interested in speaking with couples (age 30-55) who aren’t on the same financial page yet so if that’s the case for you and your significant other and you’d like to be featured in the article, please let me know!

I smiled as I read your wife’s profound and honest words.

I was on board with the ER journey a few months before my husband. In fact, he ‘bugged’ me quite a bit about my incessant reading of ER blogs (including yours). He lovingly called me an “information sponge”, but I continued to absorb everything I could. He isn’t a spendthrift, but the few things he enjoys he wants them to be ‘top-of-the-line’. I knew that shoving it down his throat would have the opposite desired effect, so I worked for a week, putting together a ‘presentation’ of sorts, to convince him.

One evening, after discussing our retirement investments, I just blurted out: “Did you know that if we double our annual contributions, we could quit our jobs in 8 years?”

Silence for a few seconds.

He shut his laptop. (That’s important…it meant I had his undivided attention.) ;-)

He said, “Seriously???”

That was all it took. No presentation, no manipulation. He saw the vision immediately. We started discussing what you’ve named the “Perfect Life”. Our relationship was already great before, but having this common goal that we’re striving towards together has been life-changing.

Everyone has to see the goal through their own lens for the value of it to be fully comprehended. So happy to hear that your wife came to see the vision for herself.

Great story, Laura! I’m really glad to hear you got your husband on board as well.

Now that you’re both fully committed, I bet it will take you less than 8 years and it will likely be a very enjoyable journey. Keep me updated on your progress every once in a while and good luck!

Laura was right! You are a freaking genius! I have only read four of your posts and I feel like I’m a decade behind. Of the four I’ve read, this is my favorite. I can relate. As for the rest, it will take a while to soak it all in.

It was awesome meeting you and your wife. It was time well spent and we both said we got more out of the evening talks than the convention. We hope to see you both again soon.

Haha, thanks a lot, Randy! Nice to see you over here in my little corner of the Internet.

It was great meeting you and Laura as well! Jill and I had a blast so we look forward to doing it all again next year. Speak to you again soon, hopefully!

As a couple, we are in full agreement with each other (and with you) about wanting to reach FI. We’re happy to do without some of our former consumerist impulses, and we are looking forward to reaching our own FI in a couple of years.

This guest post captures some of our own qualms about the RE part of FIRE (that is, early retirement). While we are very much on board with wanting financial independence, I doubt that we will retire as soon as possible. As a teacher (this is Julie), I find my job rewarding–when I’m not grading massive piles of papers and exams–that I do wonder whether I would give it up at the earliest opportunity. (Yes, I plan to tutor and volunteer once I do retire.)

So, this is just to say that we understand and sympathize with your wife’s perspective about work while being very glad for you both that you have greater agreement with each other about wanting to reach FI.

Thanks for sharing.

This is really encouraging to hear MF. We met a few years back at FinCon NOLA ( I was the photographer for the event), not sure if you remember me. I’ve always been a good saver and have had some weaknesses in my consumption habits over the years (re: motorcycles, photography), but starting last year I really took a hard look at what was making me happy in life and what wasn’t making me happy. I’m realizing more than ever that material possessions just don’t make me happy like they did in my youth and that life experiences and helping others is really what matters. It’s great to hear that your wife has come around on her own, and without your prodding. I’m sure having a FI blog surely helped a little ;). Anyways, if you guys are ever out in the Bay area, I’d love to have you over for dinner or show you around.

Thanks again for all you’ve done for the FI community. Always looking forward to what you are creating in your lab!

Of course I remember! How’ve you been?

You going to try to make it down to San Diego for FinCon this year? It’d be great to hang out again so hope you can make it. If not, you’re always welcome here in Scotland and I’ll definitely let you know next time I’m in the Bay area!

WOW! what an amazing transformation story, huge paradigm shift! thank you so much for sharing.

This May will be 15 years with my wife. She is almost there.

Cheers,

DFG

I’m glad you convinced Jill to publish this. I think I relate to her more than other bloggers. Recently I realized that we have achieved FI early than I expected we would. With this realization I’ve started reading more blogs and listening to podcasts about FIRE. I really do enjoy my job and if I quit today I would not be fulfilled. When Jill talks about what FI means to her I relate 100%. So I’m trying to work a little less and trying to introduce hobbies and activities in my life that I had been reluctant to bc I’m “too busy working”.

When you calculated how much you needed to be financially independent, did you set your financial goal to cover only your half of the expenses, or to cover your household’s entire expenses? I ask because I am in the same situation you were in: I am working towards FIRE (most likely retiring my 9-5 job), but my wife not so much as she enjoys working and doesn’t see herself retiring early.

$1.5m would comfortably cover our household expenses, but $0.7m would be enough to cover my half.

My conundrum is whether to set my target to the 1.5m, or the 0.7m.

(We have no kids, and I’m keeping that as a constant for the purpose of this question.)

Here are some of the considerations:

On one hand, as long as my wife continues to work, 0.7m would be enough, but if for some reason she were to become unable to work, we would no longer be FI. So my FI at 0.7m would be contingent on my wife keeping her job—not entirely “independent.”

As another consideration, she likes her occasional indulgence (overseas travel and staying in nice hotels etc.), and say the market is down and I were to use that as a reason to suggest against it, I’m afraid she could come to resent my retiring (had I continued to “work” money wouldn’t be an issue). She’s currently understanding of my FIRE endeavours, but I feel like I should have a cushion on top the 0.7m to prevent things like this when I actually retire.

For those reasons, I feel like I should (and as a responsible husband should) set the target closer to the $1.5 where our family finances would be secured.

Am I being too conservative/pessimistic? I’m very interested to hear what everyone thinks, and how those whose spouses are not on-board the FI train set their financial targets.

Thanks,

Taiji

Having set upon my path to FI about two years ago after coming across J Collins’ book and MMM’s blog, I thought I had read everything I needed to know about FIRE, but having just read through all of your blog posts (in 3 days!) I found there was so much new knowledge to be gained, especially on the mental side of FIRE. I’ve come out the other end motivated more than ever before to achieve FIRE, so thank you for all that you shared, and I will certainly be following your post-FIRE journey going forward.

MF was generous enough to respond via email, so I’m posting it here as reference for any future readers:

Thanks MF!

===========

My initial FI target was for just half of our expenses (since my wife planned to keep working).

That was a good decision because I was in a big hurry to achieve FI and that obviously made it possible to get there much more quickly.

I ended up working past that point though (it’s amazing how you don’t mind your job as much when you know you can quit whenever you want) and I also started bringing in unexpected side income so I have more than enough to cover all of our expenses but my wife is still working so that doesn’t really matter.

So I say you target half your expenses and then see how you feel when you get there. I imagine you won’t mind working a bit longer to get you both to FI (plus, the second half is much easier than the first because you have all that money earning its own money).

Good luck!

folks need to start doing fun stuff while still working.

to get some data points to what they like

nine years into retirement i still have no idea!

hard making new friends, folks to hang out with.

the mind part if f.i.r.e., i would like to see, explored more.

it is better to entice ,than to push.

Mrs. Mad FIentist, thank you for sharing.

So where are you now in terms of account setup? Still separate finances with a joint space for joint expenses?